Over the past week alone, bitcoin is up over 34 percent, surging past the US$55,000 mark. After a lacklustre September (jokingly referred to as “Downtember”), October (or “Uptober”) has kicked off with a bang suggesting we may be in for an exciting Q4.

2021 – A Topsy Turvy Year

Everyone knows Bitcoin is volatile, but 2021 has been noticeably so, particularly in light of the endless attacks on the network. These ranged from China banning crypto (again) and shutting down miners to Elon Musk triggered sell-offs in the wake of his “environmental concerns“.

Following a strong Q1 providing a return of 102 percent, Q2 proved to be bitcoin’s worst in over eight years, delivering 40 percent. Q3 brought bitcoin back into positive territory, with the digital asset recording a 24 percent return over the period. After reaching an important technical milestone last month (the “Golden Cross“), there are signs that Q4 may prove to be bitcoin’s best in 2021.

Three Reasons Q4 Is Looking Good

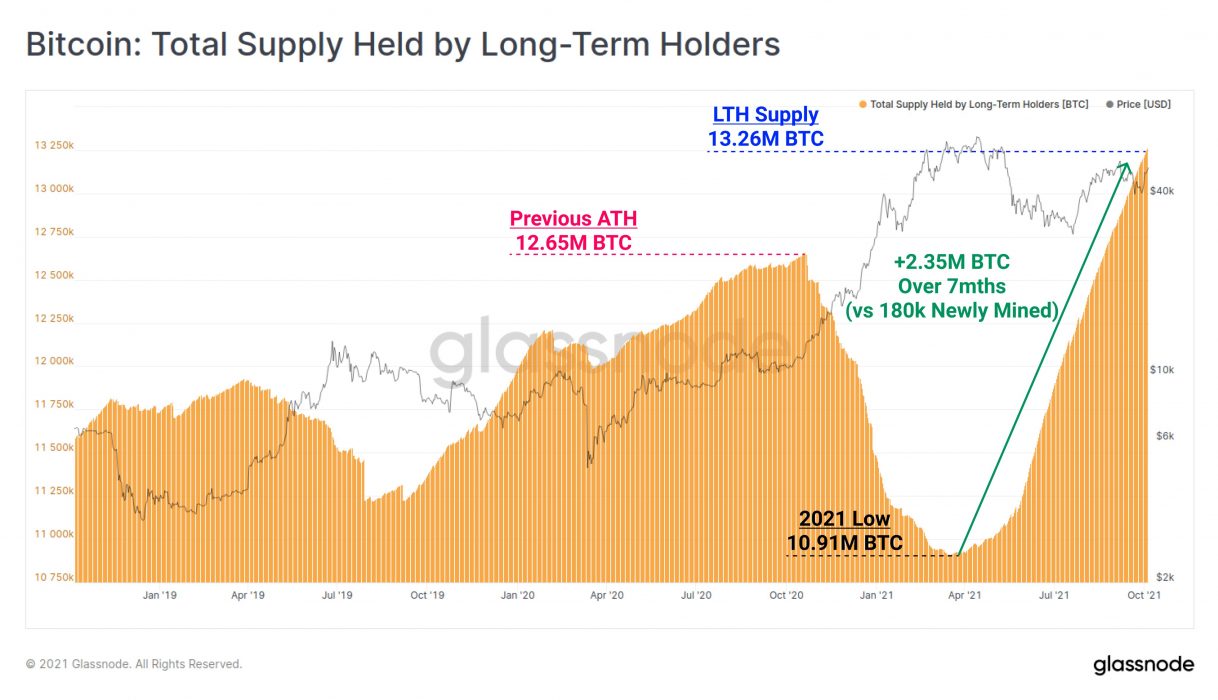

Reason One: HODLers Are Accumulating

One of the main signals of a bull market is accumulation by long-term holders (HODLers). According to Glassnode, HODLers have added 2.35 million BTC to their stacks since supply bottomed out in March. Since then only 180,000 BTC have been mined, meaning HODLers accumulated 13x more coins than were produced via fresh issuance over the past seven months.

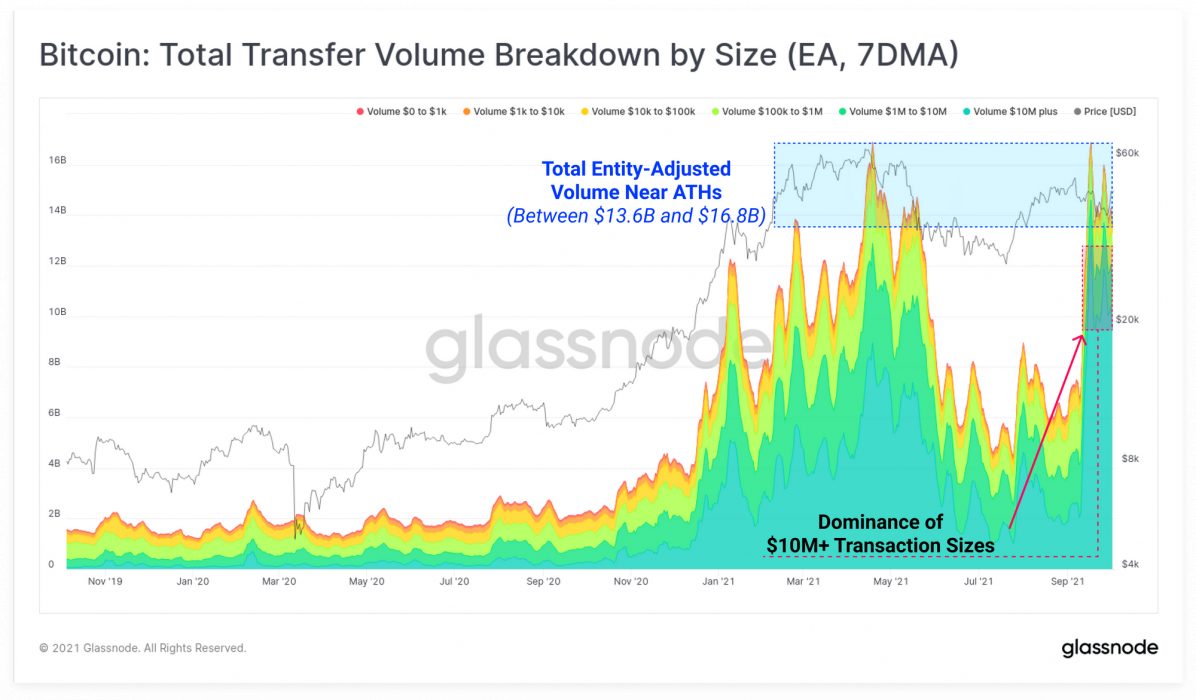

Reason Two: On-Chain Volume Dominated By Large Transactions

According to Glassnode:

The rising dominance of large transaction sizes hints to the increased maturation of Bitcoin as a macro-scale asset with increasing interest from high-net-worth individuals, trading desks, and institutions.

Glassnode

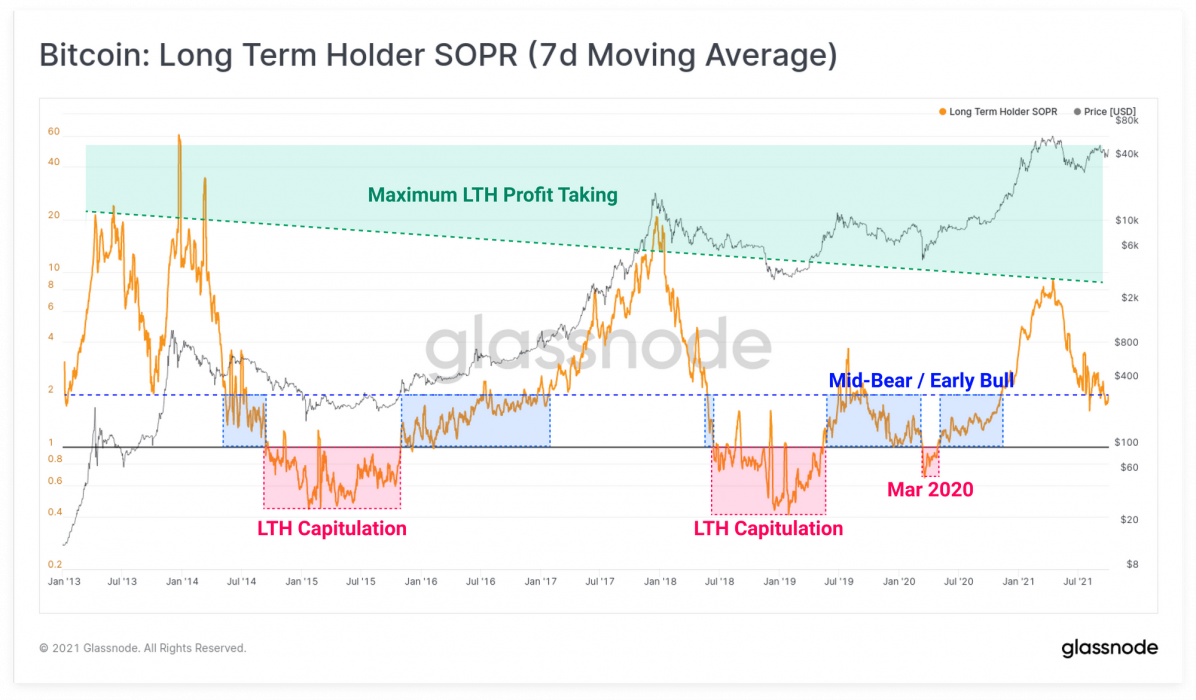

Reason Three: SOPR is Flashing End of a Bear/Start of a Bull Market

In Glassnode speak, the LTH-SOPR (long-term holder, spent output profit ratio) refers to the degree of profit realised on chain. Glassnode notes that as a longer-term cyclical metric, the “LTH-SOPR usually trades in this range during late stage bear markets, and early stage bull markets. This is a result of lengthy sideways price action which compresses profit multiples, even for longer-term investors.”

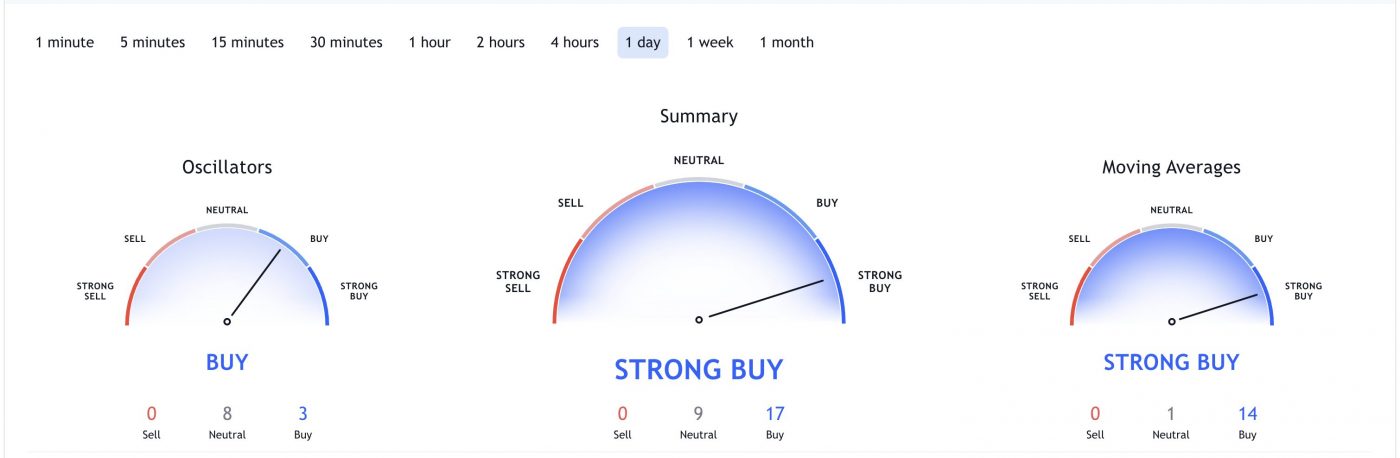

Outside of on-chain analysis, the futures and options markets are currently showing that traders are no longer in fear mode and have shifted bullish.

Despite having the validity of his model challenged this year, Plan B remains confident of his end-of-year US$135,000 bitcoin prediction made in late June:

Just last week, derivative markets gave bitcoin a 3.2 percent chance of reaching US$100,000 before year end.

Between technical, fundamental, on-chain and stock-to-flow analysis, time alone will tell which is more accurate in determining how bitcoin performs in Q4. Chances are bitcoin will do what bitcoin does – whatever it wants.