After the launch of Coin98 Farming Pool, C98 took a strong breakout with +95% gains in a single day. Let’s take a quick look at C98, price analysis, and possible reasons for the recent breakout.

What is Coin98?

Coin98 is a decentralised finance (DeFi) solution that allows users access to cross-chain swaps, staking, and yield farming. The Coin98 exchange describes itself as a multi-chain liquidity aggregator that supports assets across a variety of blockchains, including but not limited to Ethereum, Binance Smart Chain, Solana, and Tron. Coin98 also has a wallet among its offerings, which supports more than 20 networks on both its mobile and desktop platforms.

C98 Price Analysis

At the time of writing, C98 is ranked 214th cryptocurrency globally and the current price is A$7.95. Have a look at the chart below for price analysis.

After looking at the above 4-Hour candle chart, we can clearly see that C98 was trading inside the rising wedge pattern on the C98/USDT pair. The first resistance was on the A$4.89 price level, which C98 broke with a strong bullish trend buying volume and is now heading towards the recent high prices at A$8.63. Seeing many Altcoins are holding a strong position this week after the recent bitcoin price recovery, C98 may continue to increase in the uptrend if traders keep buying with high volume.

“The Rising Wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. As a reversal pattern, the rising wedge will slope up and with the prevailing trend.”

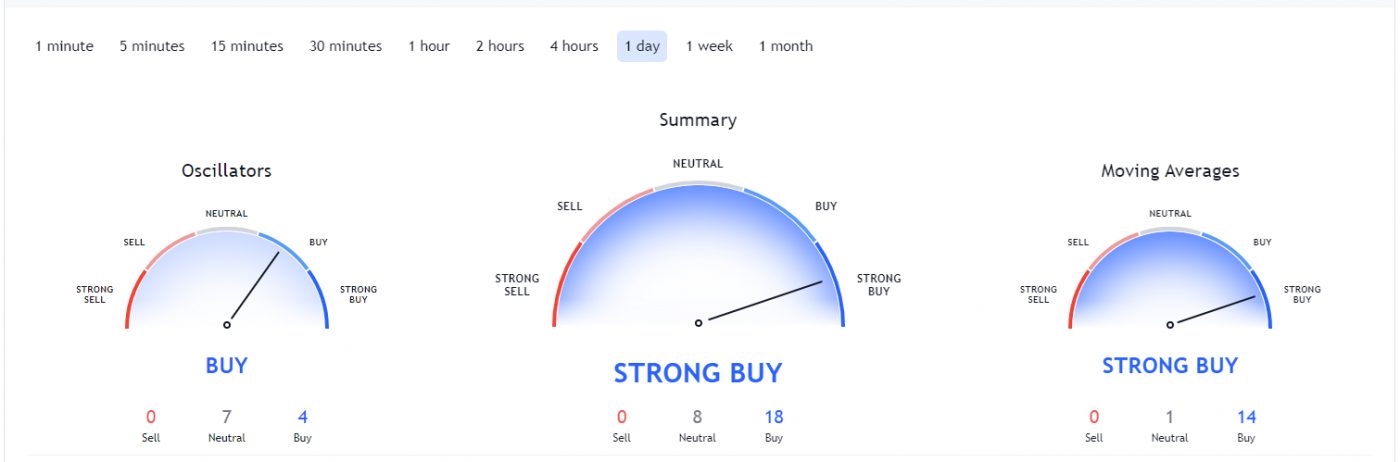

What Do the Technical Indicators Say?

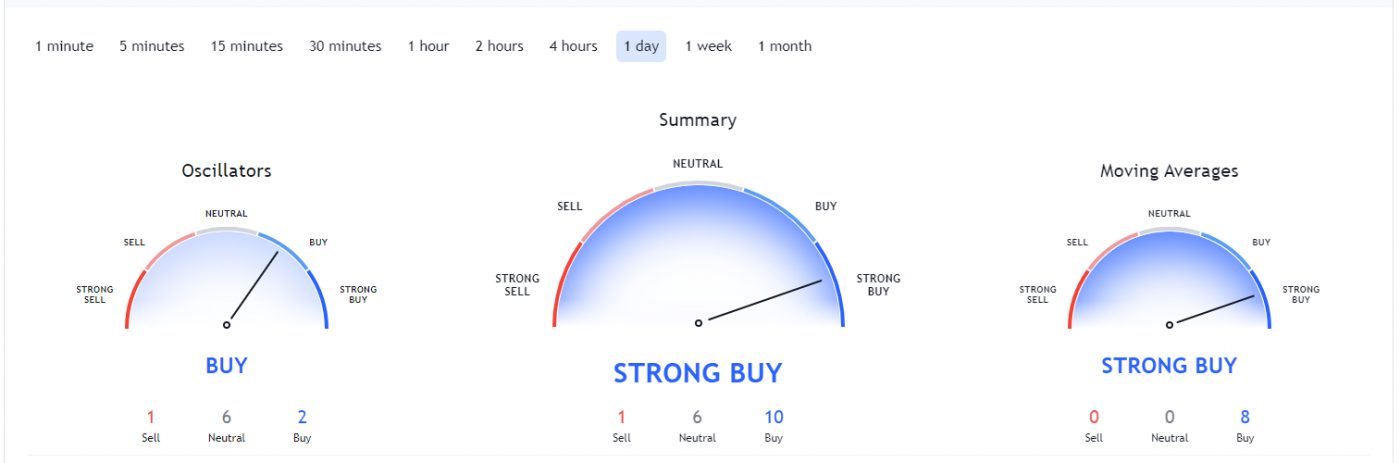

The Coin98 TradingView indicators (on the 1 day) mainly indicate C98 as a strong buy, except the Oscillators which indicate C98 as a Buy.

So Why Did Coin98 Breakout?

After the C98 opening at Binance Launchpad, mostly ICOs pump after going live on exchange for trade and general market sentiment seems to suggest cryptos are hopefully turning back bull run season after recent massive price corrections. The suggested start of the Altcoins season could have contributed to the recent breakout. It could also be attributed to some recent news of MoonFarm announcing that C98 Farming Pool has officially launched.

Where to Buy or Trade Coin98?

Coin98 has the highest liquidity on Binance Exchange so that would help for trading C98/BTC, C98/BUSD or C98/USDT pairs. However, you can also buy C98 from different exchanges listed on Coinmarketcap.