Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ellipsis (EPS)

Ellipsis EPS finance is an exchange for stablecoins on the Binance Smart Chain. It allows for stablecoins swap with very low slippage and minimal fees. EPS is a Revenue Earning token where token stakers will earn fees from the Ellipsis protocol. EPS is the native token on the platform that provides value for LPs and token holders.

EPS Price Analysis

At the time of writing, EPS is ranked the 379th cryptocurrency globally and the current price is A$0.7646. Let’s take a look at the chart below for price analysis:

July has been an exceptionally volatile month for EPS. The price climbed nearly 285%, retraced over 135%, then bounced 88% into resistance beginning near A$0.9255.

This weekend filled a gap from A$0.6841 to A$0.7256, which may provide support again. A sweep through this level to tag Sunday’s swing low is likely to test probable support near A$0.6624.

A more substantial move down could reach support at A$0.6283 and possibly touch the gap near A$0.5689.

The price is testing fresh resistance at A$0.8263, making the swing high at A$0.8544 a likely target. A break of this level might continue to the swing high at A$0.9621 before continuing into price discovery.

2. Bzx Protocol (BZRX)

The Bzx protocol BZRX is an Ethereum-based decentralised platform built for DeFi lending and margin and leverage trading that differentiates itself from competitors through a smart contract-powered token system. Bzx’s trading front-end Fulcrum allows users to trade and/or lend crypto assets through tokenised loans (iTokens) and tokenized positions (pTokens). Torque serves as bZx’s lending front-end web interface, allowing users to borrow funds for any purpose at a fixed interest rate.

BZRX Price Analysis

At the time of writing, BZRX is ranked the 388th cryptocurrency globally and the current price is A$0.3257. Let’s take a look at the chart below for price analysis:

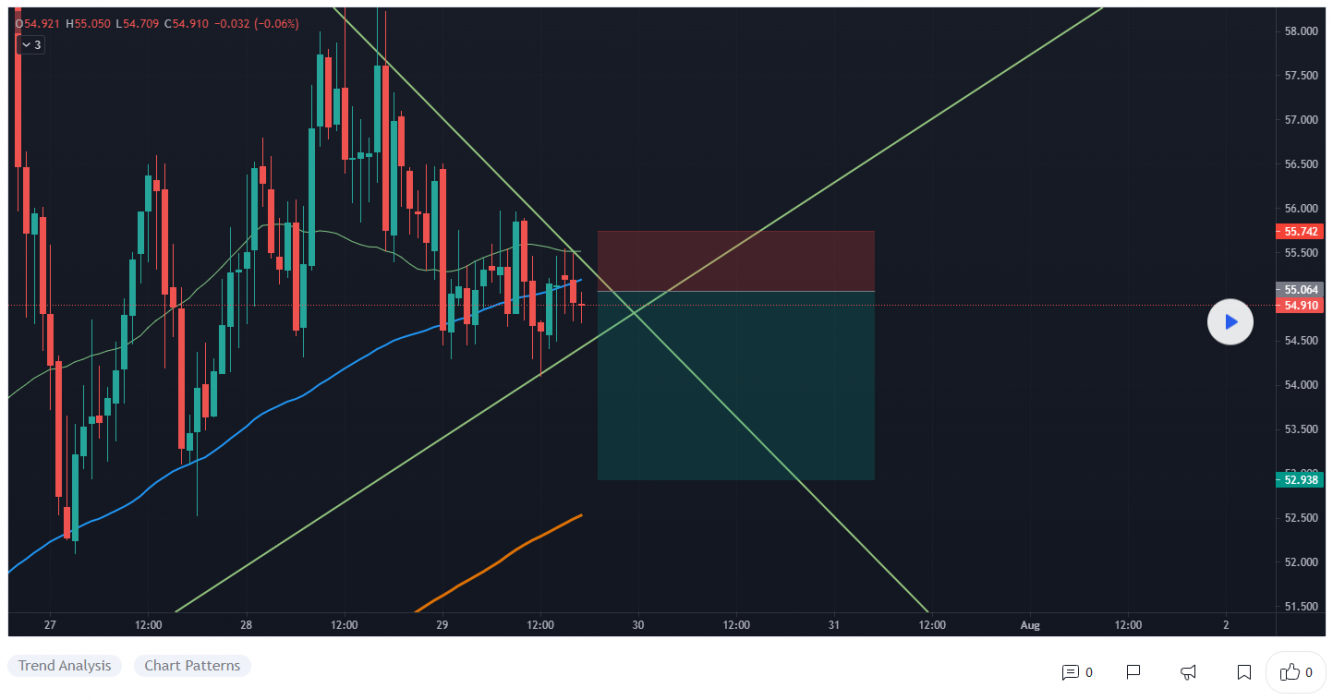

BZRX bulls enjoyed nearly 145% returns during March, with the Q2 retracing almost 85% beginning a consolidation from Q3 between resistance near A$0.3544 and the low around A$0.2357.

A stop run into support beginning near A$0.1932 is likely to precede any significant move upward. This stop run could easily reach the consolidation high near A$0.1766, giving bulls a better entry.

A more significant shift in the market could reach probable support at the daily gap near A$0.1652, giving bulls a favorable risk-reward entry to target the last high at A$0.3685, A$0.4187, and A$0.4698.

3. Alpha Finance Lab (ALPHA)

Alpha Finance Lab ALPHA is a cross-chain DeFi platform that looks to bring alpha to users across a variety of different blockchains, including Binance Smart Chain (BSC) and Ethereum. ALPHA is the native utility token of the platform. Token holders can earn a share of network fees by staking ALPHA tokens to cover any default loans. Other use cases for the token include liquidity mining and governance voting.

ALPHA Price Analysis

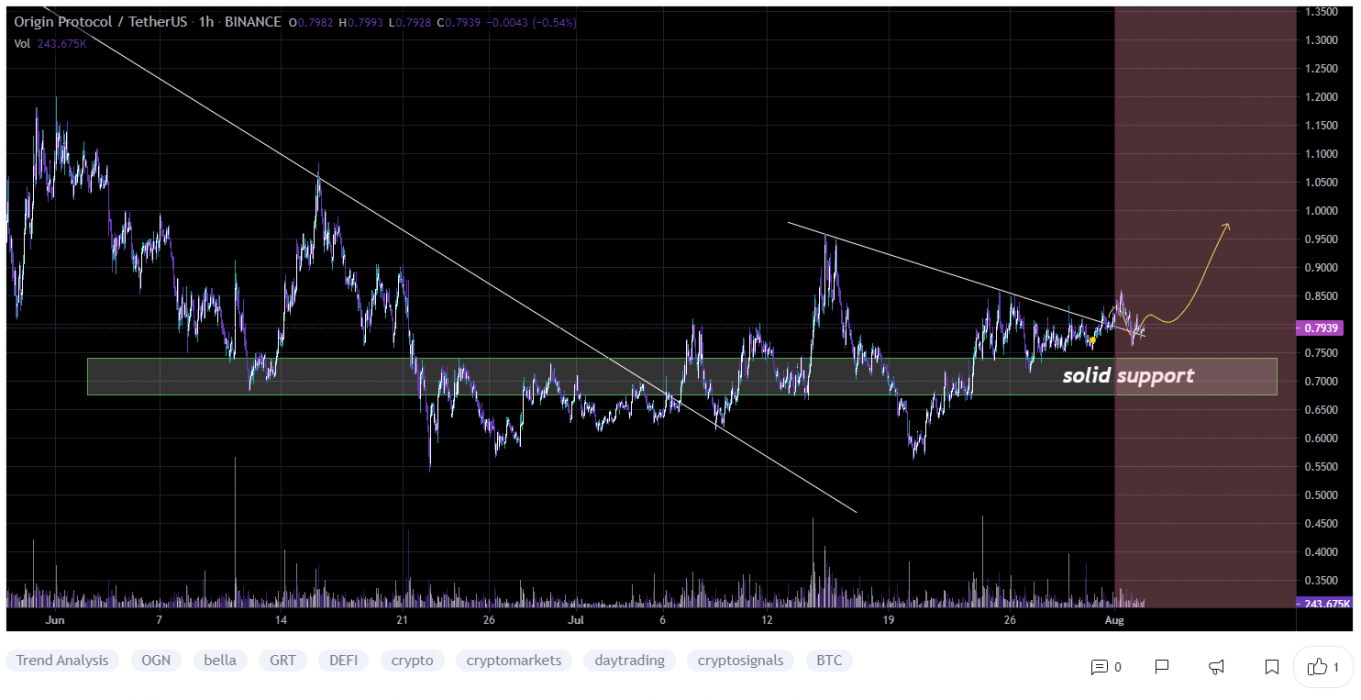

At the time of writing, ALPHA is ranked the 155th cryptocurrency globally and the current price is A$0.882. Let’s take a look at the chart below for price analysis:

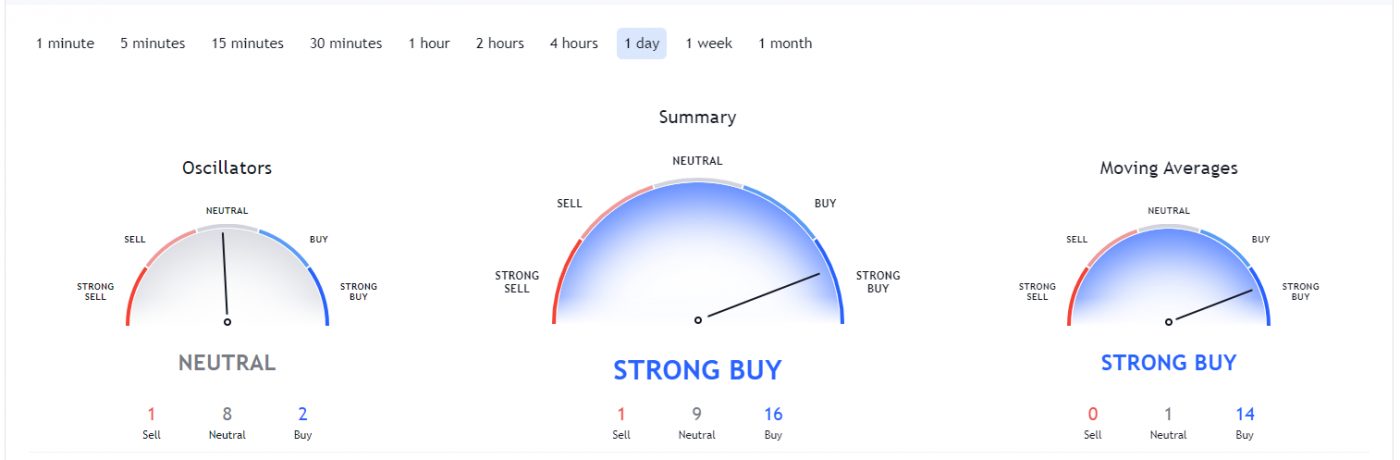

ALPHA printed reasonable returns during June and July, soaring over 129% before dropping to sweep the local lows and fill the daily gap near A$0.7285.

This gap could continue to provide support, but a decline to the gap over the consolidation near A$0.6438 provides a more favourable entry.

A daily close-through resistance at A$0.9641 and A$0.9912 points to the A$1.15 swing high as the next primary target and may turn the current resistance to support.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. However, you can also buy these coins from different exchanges listed on Coinmarketcap.