Let’s take a closer look at this week’s altcoins showing breakout signals. We’ll dive into the trading charts and provide some analysis to help you.

1. Celer Network (CELR)

The Celer Network (CELR) is a smartly designed layer-2 scaling solution that provides off-chain transactions handling. The Celer platform offers fast, simple and secure off-chain transactions for both payments and smart contracts. The project was among the first to be developed using the Substrate framework and is part of the Polkadot ecosystem. As to the overall goal of the network, its founders envisioned unleashing the full potential of blockchain and revolutionising Dapps with more efficient and productive outputs.

CELR Price Analysis

At the time of writing, CELR is ranked the 174th cryptocurrency globally and the current price is A$0.03565. Let’s take a look at the chart below for price analysis:

After retracing nearly 80 percent from its highs, CELR wicked into the monthly gap beginning near A$0.02814. This wick formed the bottom of the current range.

The price shows no apparent signs of a longer-term reversal, which may mean that the closest resistance near A$0.04012 will continue to suppress the price. However, some support could be found near the monthly open, possibly giving bulls footing for a stop run through the swing high at A$0.04296.

This move could continue into resistance near A$0.04731 and spike through the relatively equal highs near A$0.05047. A break of the next swing high near A$0.05631 is likely to find resistance once it reaches A$0.05733. If this move occurs, it may suggest a longer-term reversal.

A retest of possible support near A$0.03142 could provide an entry for a short-term trade. However, there is a higher probability for more substantial support near A$00.01715 after a run on the lows at A$0.02810 and A$0.01715.

2. Fetch.ai (FET)

Fetch.ai is a platform that aims to connect Internet of Things (IoT) devices and algorithms to enable collective learning. It was launched in 2017 by a team based in Cambridge, UK. Fetch.ai is built on a high-throughput sharded ledger and offers smart contract capabilities to deploy machine learning and artificial intelligence solutions for decentralised problem-solving.

These open-source tools are designed to help users create ecosystem infrastructure and deploy commercial models.

FET Price Analysis

At the time of writing, FET is ranked the 156th cryptocurrency globally and the current price is A$0.3367. Let’s take a look at the chart below for price analysis:

FET has dropped nearly 82 percent from its highs, with the current low’s wick on June 22 taking stops below two major swing lows.

The resulting bounce found resistance near A$0.3764, which could continue to cap upward movement. If the price finds support in the current region near A$0.3536, it could continue to resistance near A$0.4183. A more substantial move might run stops above the swing high near A$0.4536 into resistance near A$0.4718.

A break below the monthly open is likely to target buy stops near A$0.2710, an area that could provide some support. A move below this level could target below the swing low at A$0.2169, possibly reaching the gap beginning near A$0.1700.

3. Swipe (SXP)

Swipe is a platform that looks to form a bridge between the fiat and cryptocurrency worlds with its three main existing products: the Swipe multi-asset mobile wallet, the Swipe cryptocurrency-funded debit card, and the Swipe Token (SXP).

This ecosystem is powered by the Swipe Token (SXP), which functions as the fuel for the Swipe Network, and is used for paying transaction fees. Holders of SXP tokens are eligible for exclusive discounts on the Swipe app and the token can be used for making fiat payments with the Swipe debit card.

SXP Price Analysis

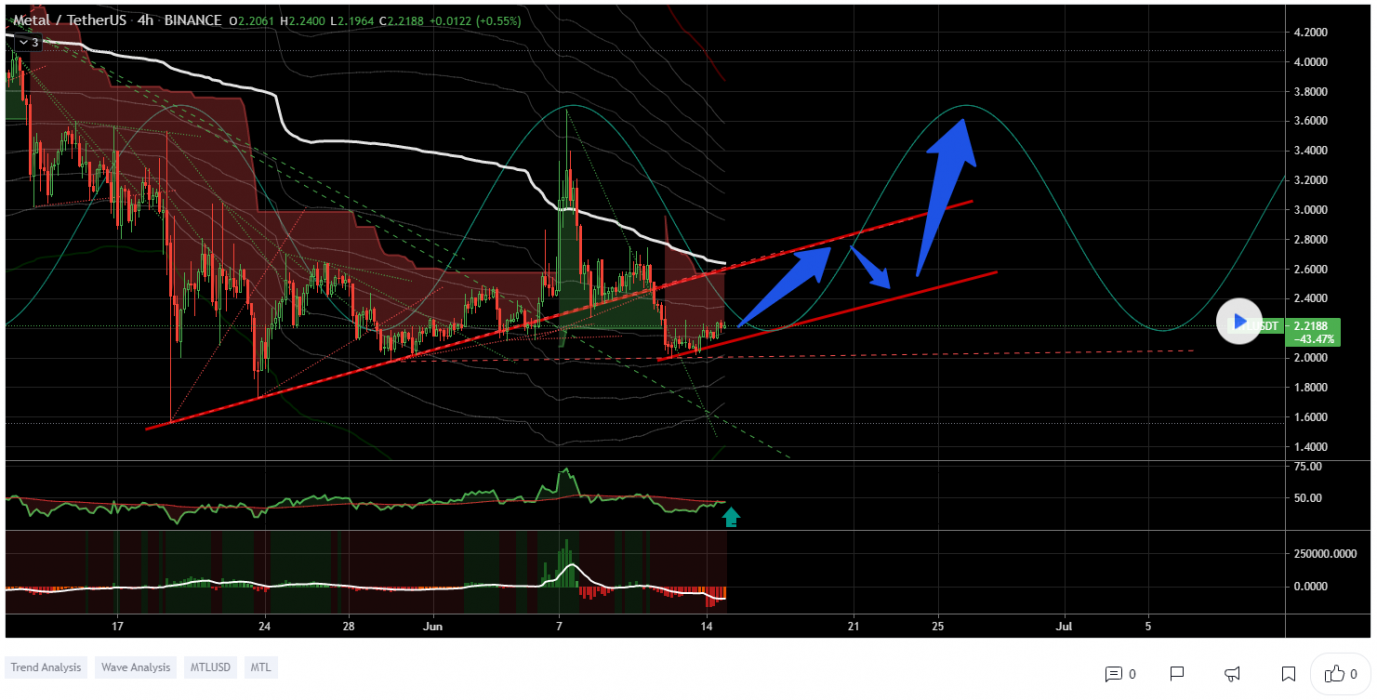

At the time of writing, SXP is ranked the 158th cryptocurrency globally and the current price is A$2.59. Let’s take a look at the chart below for price analysis:

SXP’s 77 percent drop has filled the February monthly gap twice as the price consolidates between A$1.78 and A$3.31.

Price’s current region, between A$2.69 and A$2.50 and just under the monthly open, could continue to give support. If this area continues to hold, the cluster of relatively equal range highs up to A$3.31 is a likely target.

An animated move through these highs could reach up to the daily gap beginning at A$3.69. The area between A$4.26 and A$4.07 provides a likely cap for a move into this zone.

A drop lower could be a run-on stop under A$2.38 and find support near A$2.24. If this level is lost, the swing low at A$1.78 is a likely target, with A$1.60 possibly giving support.

Where to Buy or Trade Altcoins?

These three Altcoins have the high liquidity on Binance Exchange, so that could help with trading on USDT or BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.