The cryptocurrency Waves just went up over 134% in the past couple of weeks. Let’s take a quick look at WAVES, price analysis and possible reasons for the recent breakout.

What is Waves?

Waves is an open blockchain protocol and development toolset for Web 3.0 applications allowing anyone to build their Blockchain decentralized apps (dapps).

Waves Price Analysis

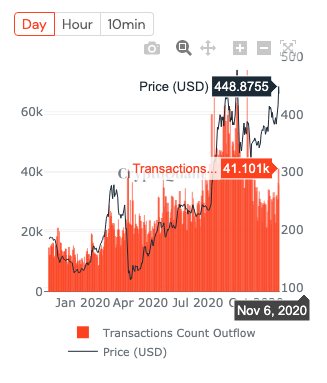

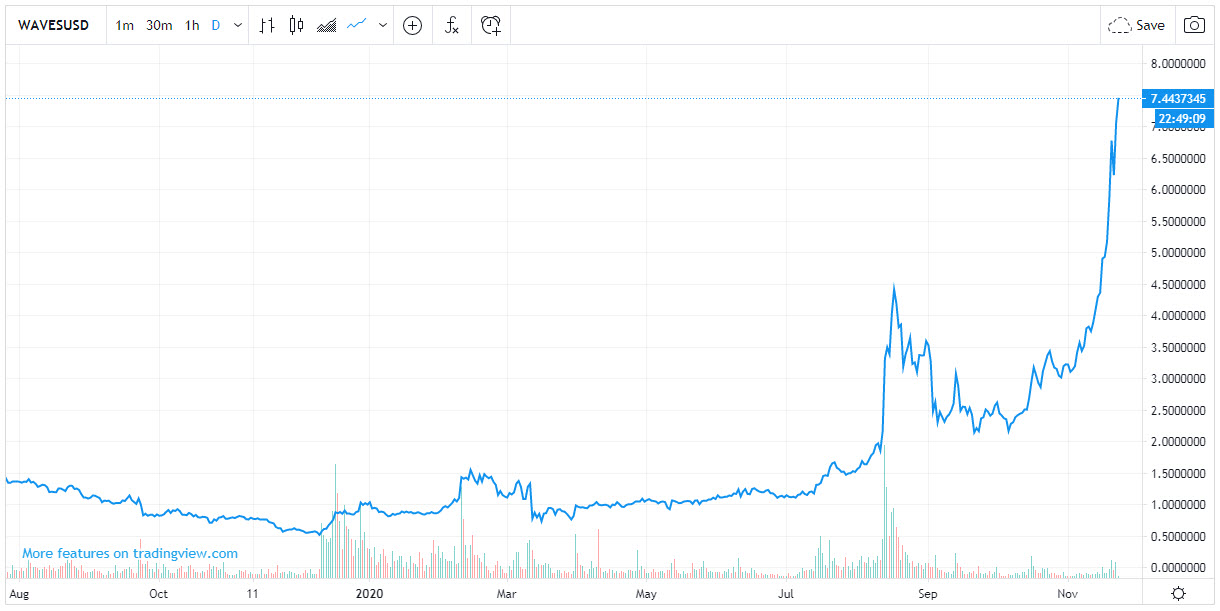

At the time of writing, WAVES is ranked the 32nd cryptocurrency globally and the current price is $10.21 AUD. This is a +134% increase since 05 November 2020 (17 days ago) as shown in the chart below.

If we zoom out and take a look at the price over the past year or so, we can see the recent breakout more clearly, the line is almost vertical which is insane.

So Why did WAVES breakout?

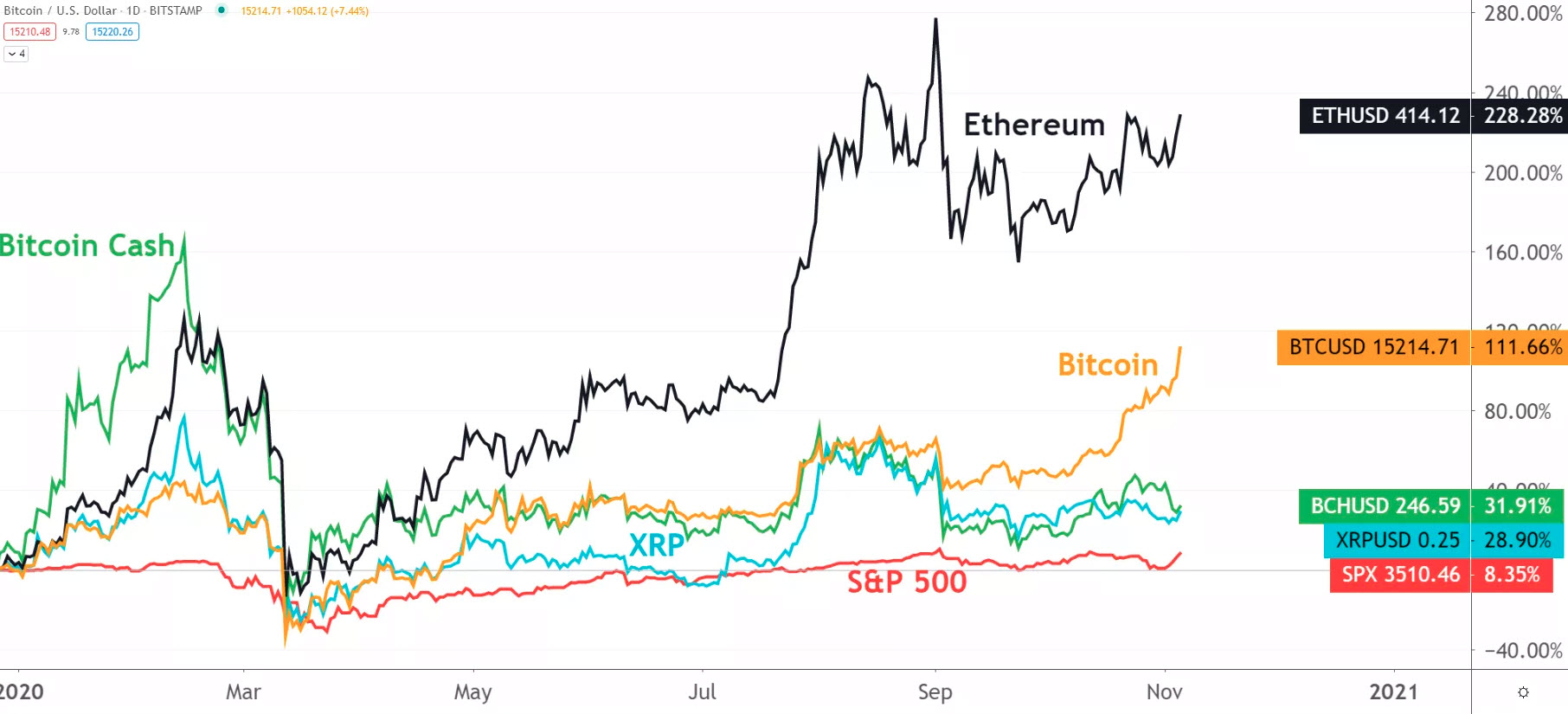

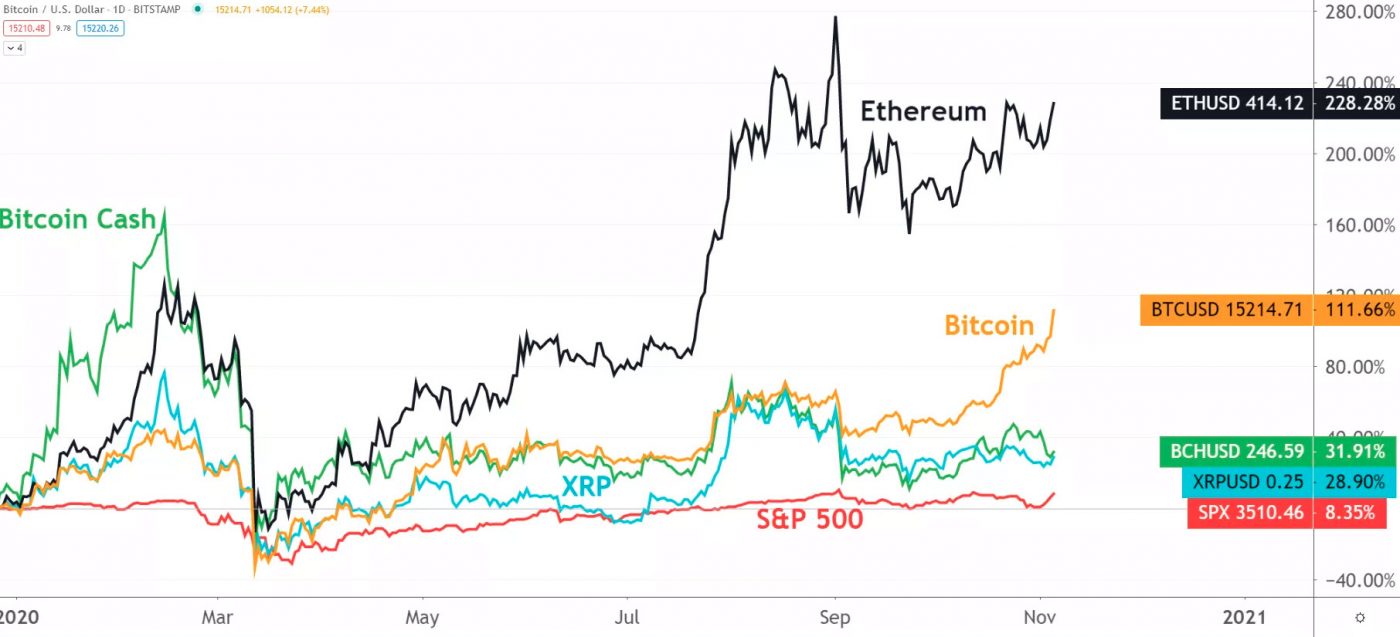

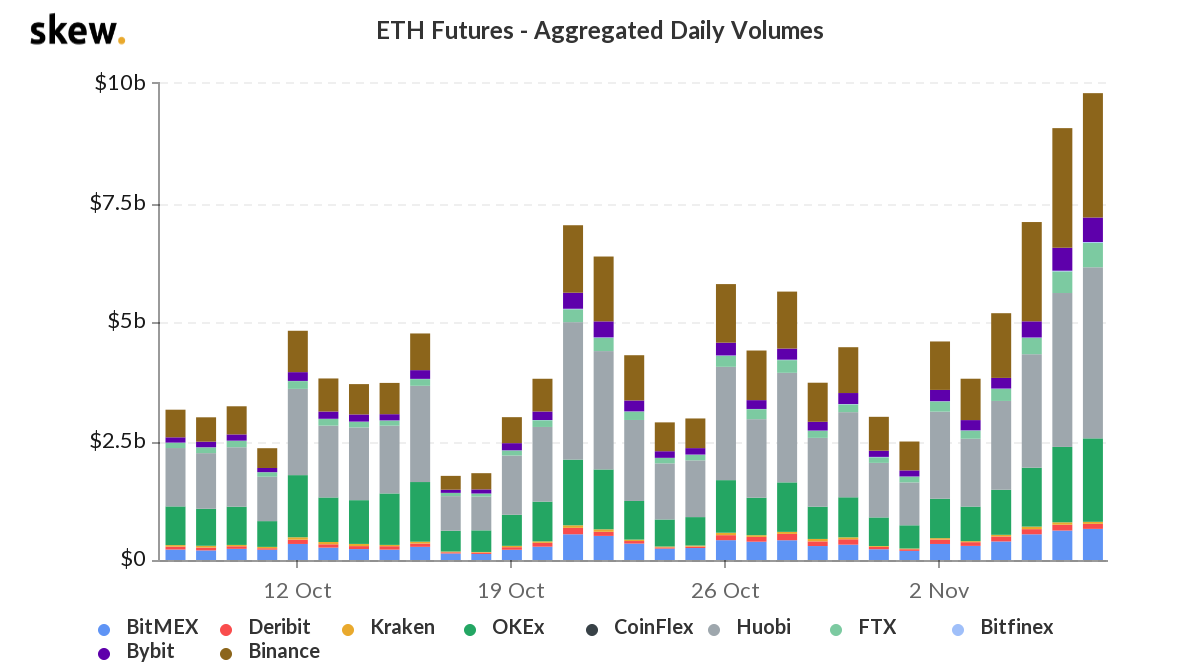

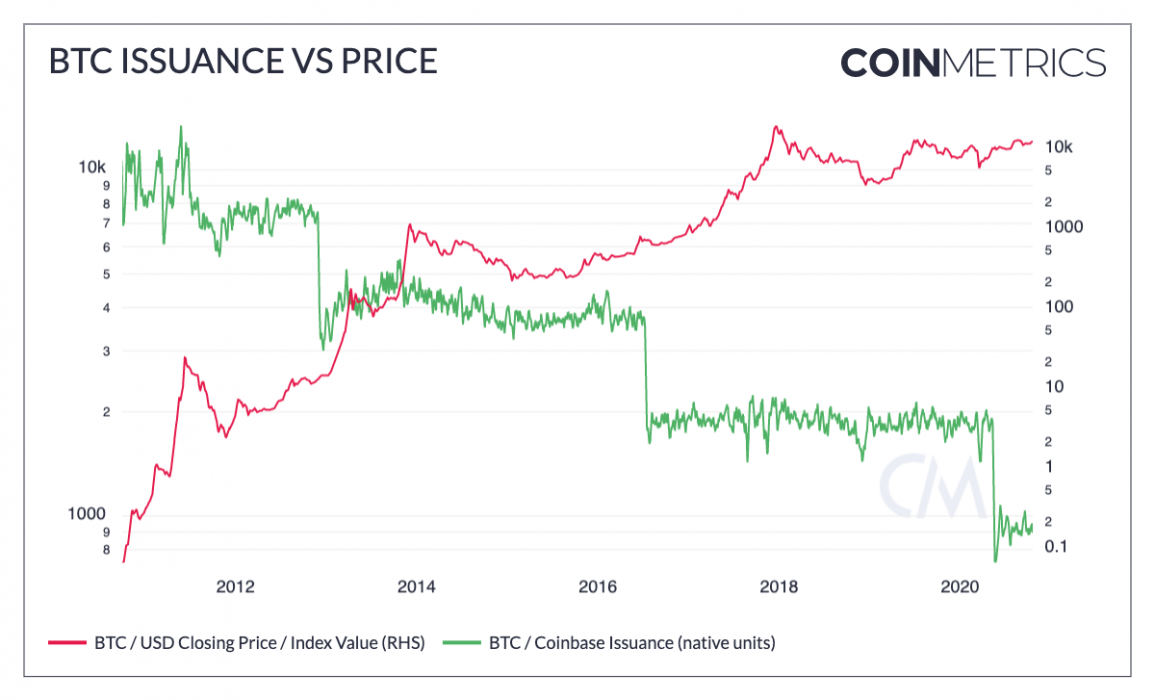

The recent rise in Bitcoin over 100% since the halvening in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. It could also be contributed to some of the recent events where the WAVES project has made some partnerships and sidechain developments.

Recent WAVES News & Events:

- 03 Nov 2020 – IOST connects Gravity Network to foster cross-chain functionality

- 18 Nov 2020 – Waves Enterprise releases blockchain voting platform to the public

- 21 Nov 2020 – OKExChain partners with Waves protocol

- 31 Dec 2020 – Enterprise projects can buy WAVES & VST

- Q4 2020 – Waves Enterprise and Waves Platform Sidechains

The breakout started around 5th Nov, just 2 days after the news first surfaced on medium about the Blockchain IOST network is connecting the Gravity Network to support Cross-chain Functionality with Waves, Ethereum, and Tron.

The partnership with OKExChain announcement is pretty big news for the Waves protocol with regards to developing Distributed Ledger Tech (DLT) technology so this may have had an impact recently to keep the breakout going.

Where to Buy or Trade WAVES?

WAVES has highest liquidity on Binance Exchange so that would help for trading WAVES/USDT or WAVES/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.