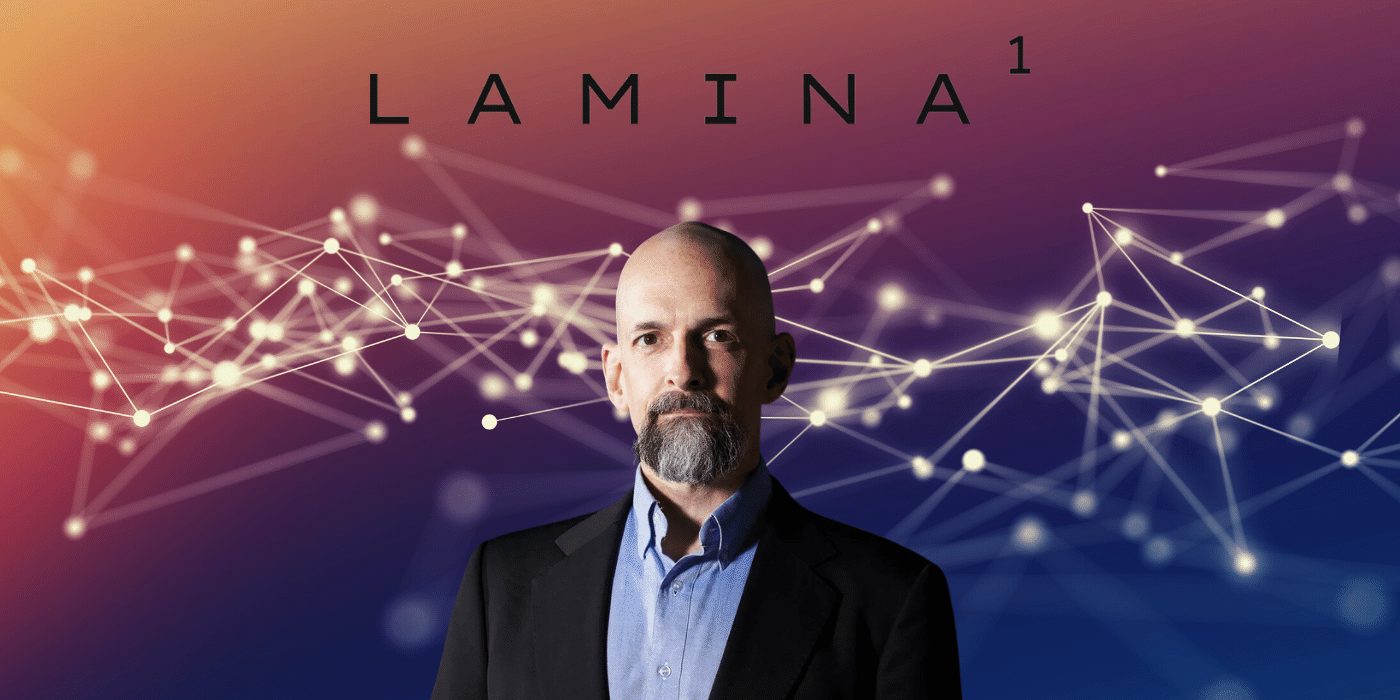

Thirty years ago, American cyberpunk science-fiction author Neal Stephenson conceived the term “metaverse” in his 1992 bestseller Snow Crash. Now he’s bringing the concept to life.

Stephenson and crypto trailblazer Peter Vessenes, original convenor of the Bitcoin Foundation, this week announced the joint creation of their metaverse-specific blockchain, Lamina1, with Vessenes named as CEO and Stephenson chairman of the project:

Testnet, Betanet Set for Later This Year

The testnet and betanet of Lamina1 are scheduled to be launched later this year, with the pair’s ultimate goal to create a fully immersive 3D open metaverse directly inspired by Stephenson’s novel.

The “provably carbon-negative” Lamina1 chain will offer high transaction volume and an economic design with new incentive mechanisms to help create what its architects describe as thriving, vibrant economies for creators and entrepreneurs.

Vessenes says the first iteration of the blockchain will be “somewhere between a friendly fork and partnership” of Avalanche, though nothing is set in stone as yet.

We Just Want to ‘Build Cool Stuff’

“When I look at the things that have made the top chains work, it’s really just how successful they’ve been at getting their communities all the resources they need, and just helping them succeed,” Vessenes adds. “What we’re wanting to do is bring in very, very high-quality IP partners, enterprise partners, help everybody meet each other and just build cool stuff.”

Financial backers of the project already named include Ethereum co-founder Joseph Lubin, PSL co-founder Geoff Entress, Bloq chairman Matthew Roszak, Transparent Systems president Patrick Murck and blockchain pioneer David Johnston.

The Multi-Trillion-Dollar Frontier

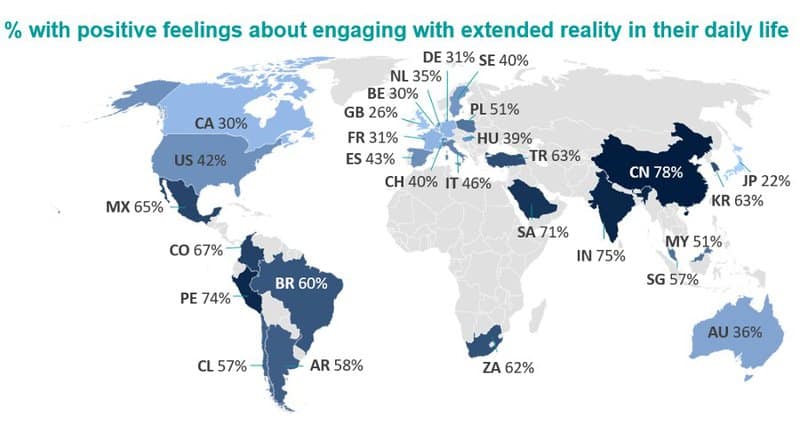

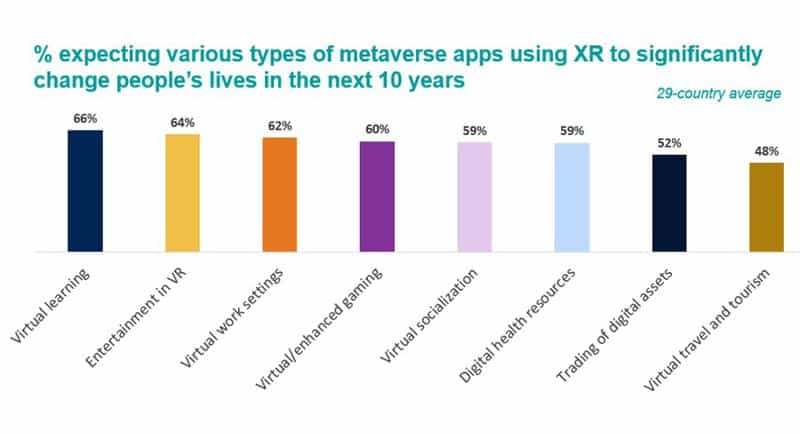

Last month, an Analysis Group report estimated that the metaverse could make a US$3 trillion GDP contribution in its first decade. Goldman Sachs is even more bullish, predicting as much as US$8 trillion in potential earnings. And JPMorgan – another global investment bank – believes the metaverse is likely to infiltrate every sector in coming years, having entered the Web3 space with its own virtual Decentraland lounge in February.

Of course, such continued exponential growth is only likely if the industry reaches its expected potential.