As prices in the real-life property market surge out of control, some Australians are settling for the next best thing – buying virtual properties.

Those who cannot afford to get into the actual property market purchased digital real estate to the tune of A$59 million in April alone, despite a 35.3 percent first-quarter drop in the Everyrealm Metaverse Index, which tracks virtual property across 14 different metaverses.

Many of Australia’s most prestigious addresses and landmarks have gone on the market at rock-bottom prices. Right now, 47 Aussie addresses are listed for sale in one virtual marketplace where people can “buy” property, or rather NFTs based on the real world.

Buy an Icon for Just Four Figures

Iconic Australian properties such as the Melbourne Cricket Ground have sold for as little as A$6078.90. While that sounds ridiculously cheap by the standards of tangible property, owners won’t actually own the real deal.

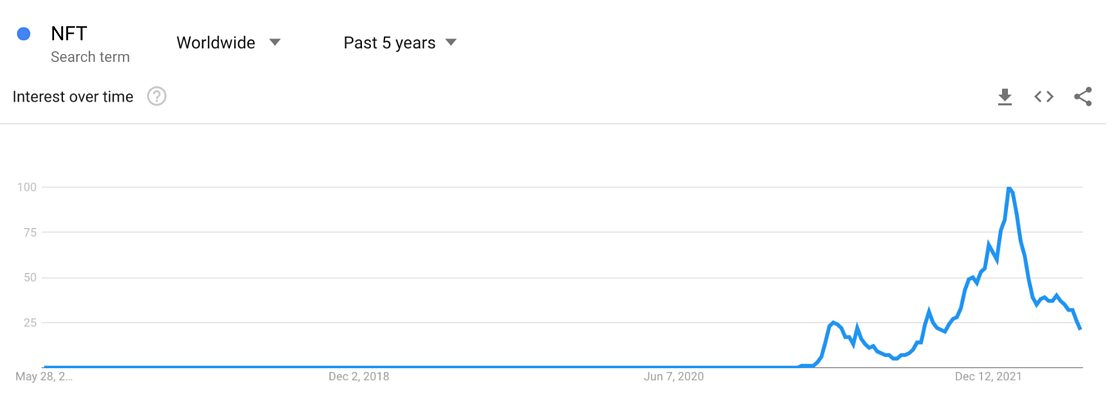

Virtual land deals are becoming an increasingly frequent occurrence with companies such as McDonald’s setting up shop in the metaverse. NFT community the Bored Ape Yacht Club is also set to start selling large quantities of virtual land.

Royalties to be Earned, Money to be Lost

Dr Simone Brott, senior lecturer in architecture at the Queensland University of Technology and author of the book Digital Monuments, says that new platforms selling virtual land are popping up every day. As she notes, “When you buy a virtual piece of real estate, you’re buying an asset just as if you were buying a bricks and mortar building. If that asset appreciates, you can sell it for a profit.”

Brott also notes that, unlike real world property where you can only make a profit once, when you sell a real estate NFT to a second buyer who then sells it to a third, depending on how the deal was set up you might end up earning royalties each time the NFT changes hands.

There are pros and cons to the craze, warns Dr Brott. “It’s seen as a risky investment but also provides early entry and significant market opportunity.” She adds:

The metaverse is simply the next iteration of social media. But unlike Facebook, which is owned by a CEO, the metaverse is owned collectively by those who own the real estate.

Dr Simone Brott, senior lecturer in architecture, Queensland University of Technology

Canstar personal finance writer Nicola Field confirms that some virtual property owners have made big gains. “But, as is often the case with anything crypto-related, it’s a fair bet plenty have also lost money on virtual property.”