Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ripple (XRP)

Ripple XRP is the currency that runs on a digital payment platform known as RippleNet, on top of a distributed ledger database called XRP Ledger. While RippleNet is run by a company called Ripple, the XRP Ledger is open-source and not based on a blockchain, but rather the aforementioned distributed ledger database.

XRP Price Analysis

At the time of writing, XRP is ranked the 6th cryptocurrency globally and the current price is US$0.3754. Let’s take a look at the chart below for price analysis:

XRP printed some gains during Q1 and Q2 after moving sideways for the past few weeks. The price is in a downtrend, with the 9, 18 and 40 EMAs providing resistance on each attempt to rally.

However, bulls are showing some interest at the 73% retracement, near $0.3610. If this level breaks, a move into possible support – just below the lows near $0.3245 – seems likely.

If the price does rally through the swing high at $0.3955 – perhaps triggered by a sudden surge in Bitcoin – bulls might find some resistance at the 61.8% retracement level near $0.4250.

Overlapping swing highs and lows near $0.4526 may provide the next target, where bears immediately forced the price down in late December.

More bullish market conditions could shift targets to up near the midpoint of Q1’s consolidation, around $0.5132, where higher timeframes show an inefficiently traded zone.

2. Chiliz (CHZ)

Chiliz CHZ is the leading digital currency for sports and entertainment, powering the world’s first blockchain-based fan engagement and rewards platform, Socios.com. Here, fans can purchase and trade branded fan tokens as well as having the ability to participate, influence, and vote in club-focused surveys and polls. Founded in Malta in 2018, the company states its vision is to bridge the gap between active and passive fans, providing millions of sports fanatics with a fan token that acts as a tokenised share of influence.

CHZ Price Analysis

At the time of writing, CHZ is ranked the 60th cryptocurrency globally and the current price is US$0.1423. Let’s take a look at the chart below for price analysis:

CHZ‘s stunning rally to $0.1650 plummeted over 23% last week to sweep consolidation lows at $0.1055. This could set the stage for a new bullish cycle to begin.

The price is currently balancing around the monthly open. A quick stop run into support beginning near $0.1420 could set the stage for a move into the daily gap beginning near $0.1705, potentially reaching resistance near $0.1837.

A sweep of the highs near $0.1958, followed by a sharp sell-off, hints that bulls are preparing to run the swing high near $0.2147. This run could find the next resistance around $0.2346 in the candle wick that created the monthly high. If the market remains bullish, the price will likely reach into possible resistance near $0.2528.

3. Omg Network (OMG)

Omg Network OMG, formerly known as OmiseGo, is a non-custodial, layer-2 scaling solution built for the Ethereum blockchain. As an Ethereum scaling solution, OMG Network is designed to allow users to transfer ETH and ERC20 tokens significantly faster and more cheaply than when transacting directly on the Ethereum network. The network is powered by the OMG utility token, which can be used as one of the payment methods for fees on the OMG Network, and will eventually be stackable – helping to secure the network in return for rewards.

OMG Price Analysis

At the time of writing, OMG is ranked the 110th cryptocurrency globally and the current price is US$2.21. Let’s take a look at the chart below for price analysis:

OMG‘s 37% drop has filled the June monthly gap twice as the price consolidated between $1.82 and $2.40.

The price’s current region, between $2.20 and $2.35 and just under the monthly open, could continue to give support. If this area holds, the cluster of relatively equal range highs up to $2.60 is a likely target.

An animated move through these highs could reach up to the daily gap beginning at $2.85. The area between $2.96 and $3.10 provides a likely cap for a move into this zone.

A drop lower could be a run-on stop under $2.00 and find support near $1.94. If this level is lost, the swing low at $1.85 is a likely target, with $1.79 possibly giving support.

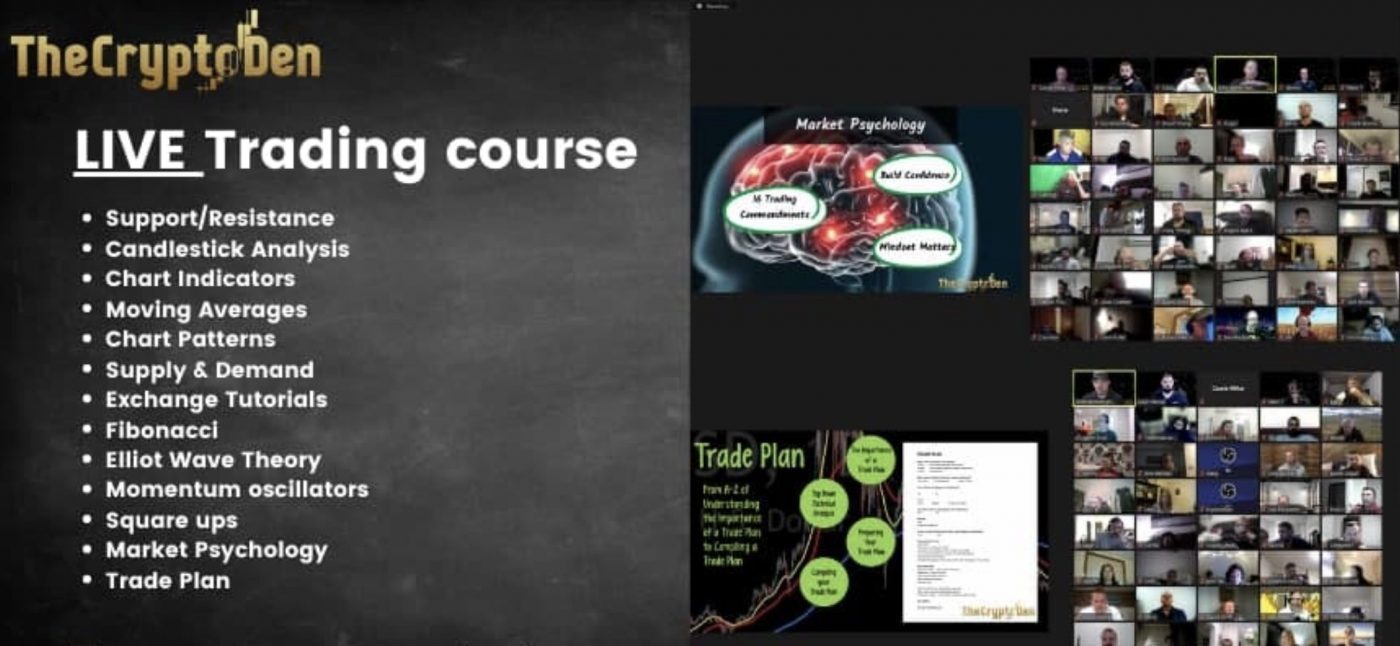

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.