Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Basic Attention Token (BAT)

Basic Attention Token BAT is the token that powers a new blockchain-based digital advertising platform designed to fairly reward users for their attention while providing advertisers with a better return on their ad spend. The Basic Attention Token itself is the unit of reward in this advertising ecosystem and is exchanged between advertisers, publishers and users. Advertisers pay for their advertising campaigns in BAT tokens. Out of this budget, a small portion is distributed to advertisers, while 70% is distributed to users – whereas the intermediaries that typically drive up advertising costs are cut out of the equation to improve cost-efficiency.

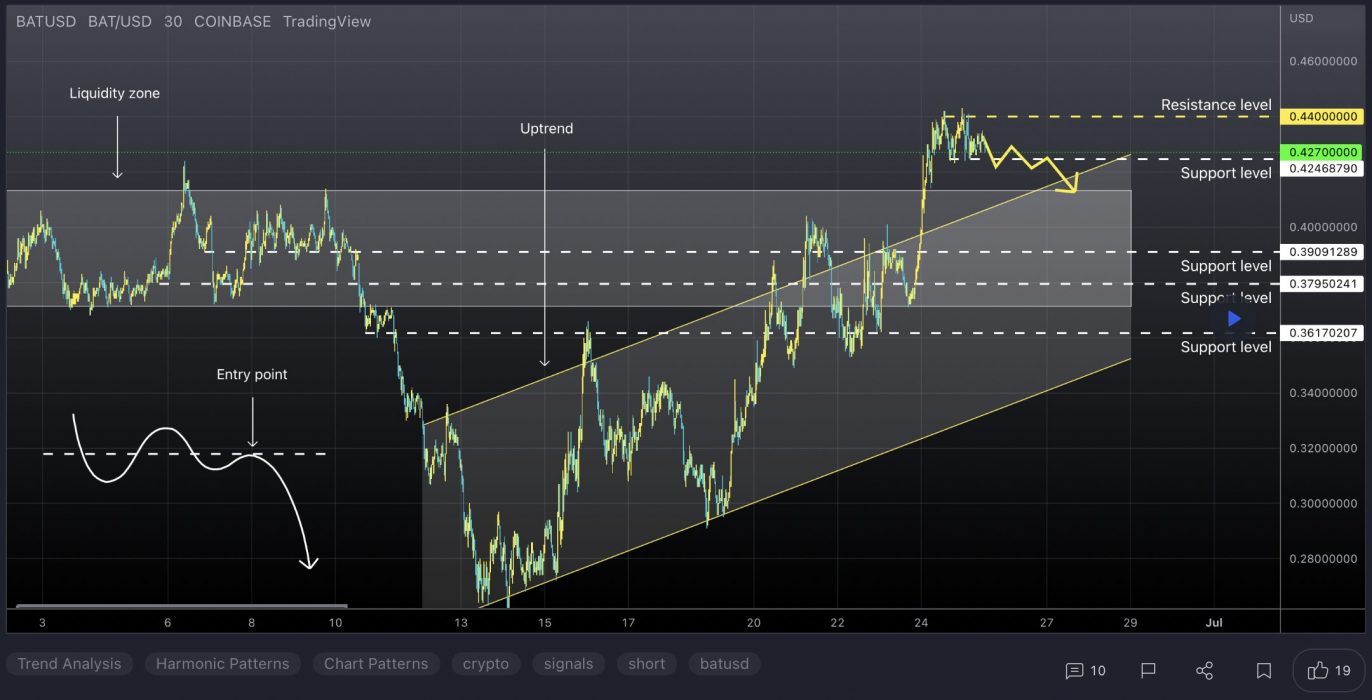

BAT Price Analysis

At the time of writing, BAT is ranked the 68th cryptocurrency globally and the current price is US$0.4032. Let’s take a look at the chart below for price analysis:

BAT has dropped nearly 70% from its Q2 2022 high and 82% from its November 2021 all-time high.

Support might have formed last week from $0.3834 to $0.3565 and should hold if bulls are ready for a bounce. This zone overlaps with an inefficiently traded area on the weekly chart from $0.3763 to $0.3294.

If this level breaks, bears might target an inefficiently traded area on the monthly chart from $0.3047 to $0.2732. Below this level, $0.2545 to $0.2380 could provide support after a run on bulls’ stops under the Q4 2020 lows into an area of significant accumulation.

The closest resistance begins near $0.4583. This level has confluence with the 9 EMA and a brief consolidation before May 11’s spike downward.

A more significant rally might find resistance near $0.5140. This level is inefficiently traded and has confluence with the lows of last summer’s accumulation and the 18 EMA.

If the market becomes more bullish, $0.6146 may provide the next resistance. This level is slightly above the May monthly open, overlaps with multiple old lows and aligns with the 40 EMA.

2. Orion Protocol (ORN)

Orion ORN aims to solve the difficulties in performing profitable transactions associated with the lack of liquidity on the majority of crypto exchanges. This is the case for both centralised and decentralised exchanges. Orion’s solution to this is to aggregate exchanges’ order books into one simple-to-use-and-understand terminal. The Orion Protocol’s goal is to help users get the best returns out of their investments while also lowering the risks associated with using multiple exchanges.

ORN Price Analysis

At the time of writing, ORN is ranked the 397th cryptocurrency globally and the current price is US$1.30. Let’s take a look at the chart below for price analysis:

After a 75% retracement from its April highs, ORN found a temporary low near $1.20. A recent move above $1.49 could be the first sign of a bullish shift – but could also signal a stop run before the next drop lower.

If the market adopts a more bullish tone, the price could run through the most recent swing high. If this bounce occurs, it would likely find some resistance near $1.63, possibly reaching up to $1.85.

However, a move below the closest support near $1.25 makes stop runs on the swing lows near $1.21 and $1.18 likely. A confluence of several levels near $1.16 could provide a temporary bounce. Still, a sustained bearish market will likely target $1.12 and even $1.00.

3. Zilliqa (ZIL)

Zilliqa ZIL is a public, permissionless blockchain designed to offer high throughput with the ability to complete thousands of transactions per second. It seeks to solve the issue of blockchain scalability and speed by employing sharding as a second-layer scaling solution. The platform is home to many decentralised applications, and it also allows for staking and yield farming. The native utility token of Zilliqa, ZIL, is used to process transactions on the network and execute smart contracts.

ZIL Price Analysis

At the time of writing, ZIL is ranked the 67th cryptocurrency globally and the current price is US$0.04687. Let’s take a look at the chart below for price analysis:

ZIL‘s 85% drop found a low near $0.03368 before closing over a weekly high around $0.04682. This daily close over the high could signal a shift in market structure that might reach probable resistance near $0.06032.

A sustained bullish move may target the swing high at $0.05860. If this stop run occurs, a run beyond the high into probable resistance near $0.06384 and $0.06645 is possible.

Bulls could buy a retracement to possible support near $0.04258, just above the weekly open. A bearish turn in the marketplace may propel the price toward possible support near $0.03926.

However, relatively equal lows near $0.03714 and $0.03524 provide an attractive target for bears if the market resumes its bearish trend. A run on these lows might find support between $0.03315 and $0.03069.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.