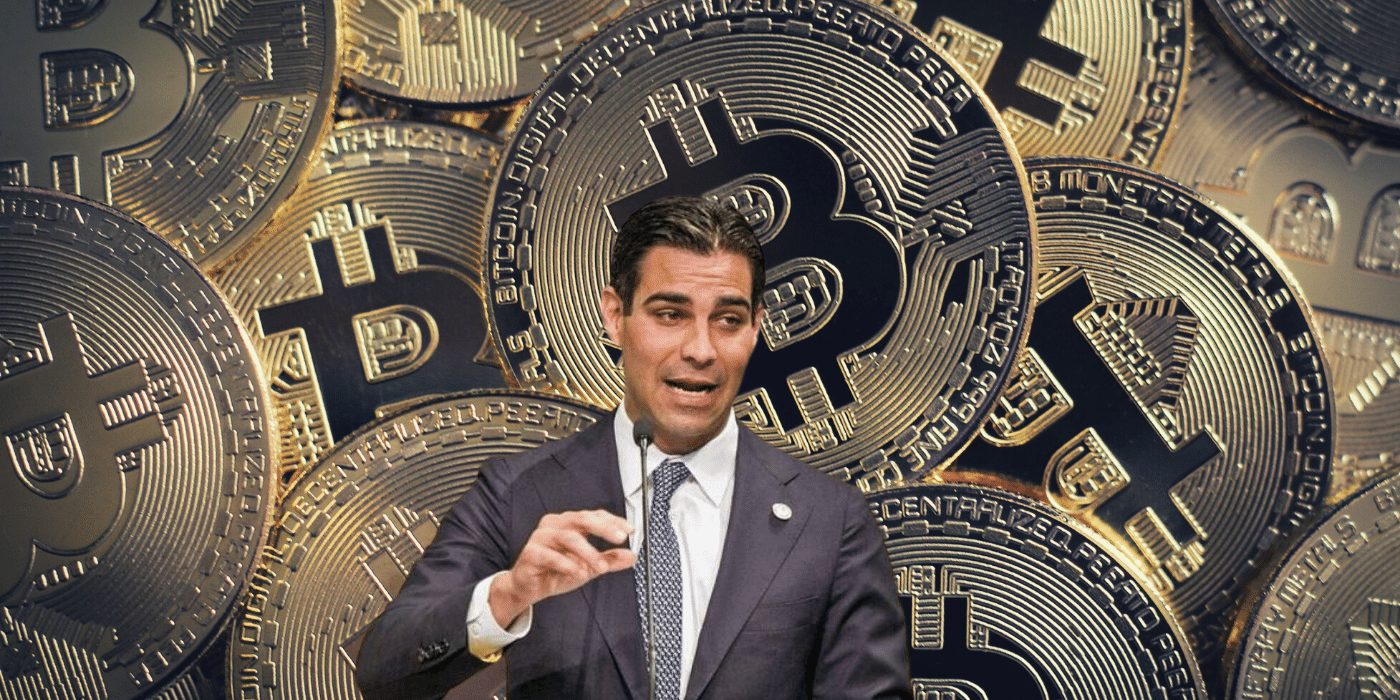

Miami Mayor Francis Suarez, who earlier this month announced he would be taking his salary in bitcoin, has continued his push to make the Floridan city one of the most crypto-friendly in the world. This week, he announced that eligible Miami residents would qualify for a bitcoin dividend in exchange for staking their MiamiCoin.

MiamiCoin – Reducing the Tax Burden

MiamiCoin is the city’s token that residents hold or trade. The underlying protocol generates revenue for the city when residents mine tokens. Those running the software receive 70 percent of the coins they mint and 30 percent is returned to the municipality in a city wallet.

This project has proved to be an economic windfall for Miami, generating over US$21 million since its launch in September. On an annualised basis, that equates to US$400 million in tax revenue, or approximately 20 percent of current annual tax receipts. Suarez has suggested that over the long run, this project could completely eliminate the need for taxes, describing the move as “revolutionary”.

I do see very quickly a world where the satoshi system is what is used to make payments … We need for people to understand that … yes, we want you to hold bitcoin but we also want to increase the utility of bitcoin.

Francis Suarez, Miami Mayor

From the outset, Mayor Suarez stated his intention to reduce the tax burden on Miami and thus far his bold experiment appears to be paying off.

Earning BTC on MiamiCoin

On November 11, Suarez announced that eligible residents would soon be able to generate a bitcoin yield from staking the city’s MiamiCoin. In order to qualify, residents would be required to acquire a wallet, register for the dividend and pass a straightforward verification process. Thereafter, the proceeds from staking their MiamiCoin would be paid, in bitcoin, into their registered wallet.

We’re going to be the first city in America to give a bitcoin yield as a dividend directly to its residents.

Francis Suarez, Miami Mayor

One of the challenges Suarez noted was determining who would qualify for a wallet:

Is it going to be, for example, taxpayers? Is it going to be people that vote in the city? People that have a city address? That’s going to be a challenge.

Francis Suarez, Miami Mayor

Miami is making moves in the crypto space and Mayor Suarez is its chief conductor. While his bitcoin yield program still has a few outstanding issues to iron out, one thing that isn’t in doubt is Suarez’s commitment to attracting crypto capital and talent from around the country.

No doubt, other cities will be watching closely. If Miami’s move proves successful, don’t be surprised to see a bunch of cities follow suit.