As the crypto industry continues to boom in Australia, investors and some members of the Senate are pushing for a more regulated environment. With current regulation setting the bar a little low, it could pose possible risks to investors and businesses alike.

On August 6, some of the largest crypto exchanges in Australia including Blockchain Australia, Independent Reserve, Kraken, Swyftx and various asset managers made an appeal to the Committee on Australia as a Technology and Financial Centre. They asked for minimum operating standards to be implemented to protect investors, with the ultimate aim of aligning consumer protection and industry growth.

While Australia is in a good position to participate in the global development of digital assets, a team of legal experts has highlighted current gaps in the framework that leave consumers exposed.

The Need For Regulation

Currently, the only cryptocurrency licence that exists in Australia is administered by AUSTRAC and is focused on identifying tax evaders and money laundering. With a lack of rules and entities to enforce them, individuals and businesses in the crypto space are at risk.

According to Adrian Przelozny, founder of crypto exchange Independent Reserve, there are no rules, external audits or IT security standards for the community to follow. “This is ridiculous and needs to change to protect consumers,” he says. “How can we hold A$1 billion worth of client assets without having to prove to an auditor these assets exist?”

There also are no rules that prescribe how assets should be stored. Consumers are just hoping custodians are following a procedure that keeps their assets from being lost, but there’s no regulator that ensures this actually happens.

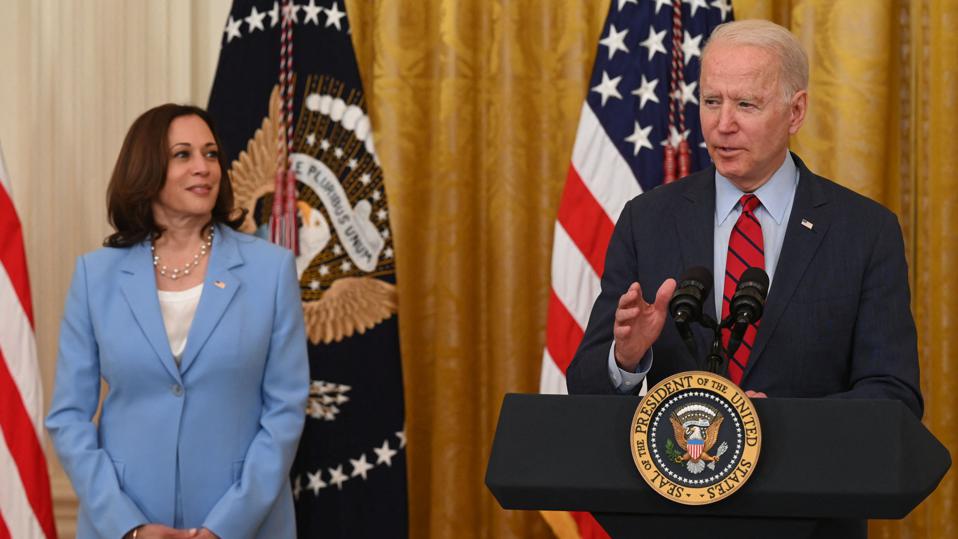

Adrian Przelozny, founder, Independent Reserve

The Consequences of Regulatory Uncertainty

The lack of regulation in Australia is leading Aussie investors to engage in international crypto trading, which could be unsafe. Regulators and enforcers ensure that investors are protected by regularly verifying that exchanges comply with all required security protocols.

Crypto businesses are scared to move forward and create new products. In the murky regulatory state crypto is in now, if a business spends time and money creating a new financial product, it may be a futile exercise or one that has consequences for new investors, such as last month’s changes to leverage trading by major crypto exchanges to protect new investors.

Australia needs to follow in the footsteps of Singapore, Hong Kong, Europe and the US, all of which have successfully regulated digital financial products. In recent months, Australian crypto companies have been urging regulators to provide some regulatory clarity.

The Aussie Commitment to Crypto

Generally speaking, Australia is quite progressive in its regulatory approach towards cryptocurrencies compared to other countries.

Australia needs to prepare for the future of finance. We believe prioritising digital financial legislation will have a significant longer-term impact across our entire economy.

Caroline Bowler, chief executive, BTC Markets

For now, the Australian Securities and Investments Commission (ASIC) has released a report detailing the current regulations around crypto trading. The challenge for investors is that the ASX and ASIC have been reluctant to allow exchange-traded funds linked to bitcoin to be listed, which could lead to investors buying BTC and other crypto elsewhere.