Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Binance Coin (BNB)

Binance BNB is the biggest cryptocurrency exchange globally, based on daily trading volume. Binance aims to bring cryptocurrency exchanges to the forefront of world financial activity. Aside from being the largest cryptocurrency exchange, Binance has launched a whole ecosystem of functionalities for its users. The Binance network includes the Binance Chain, Binance Smart Chain, Binance Academy, Trust Wallet and Research projects, which all employ the powers of blockchain technology to bring new-age finance to the world. Binance Coin is an integral part of the successful functioning of many of the Binance sub-projects.

BNB Price Analysis

At the time of writing, BNB is ranked the 4th cryptocurrency globally and the current price is US$383.55. Let’s take a look at the chart below for price analysis:

After a 25% decline during February, BNB has ranged between $360 and $410. The recent price recovery was approaching probable resistance near $408 but could be aiming for stops above the relatively equal highs near $420. Continuation of the trend could target the daily gap near $435.

Aggressive bulls might add to positions near $395 and $387. Price action near $375 may be more likely to provide support – if it gets there – during any retracements.

Relatively equal lows clustered around $369 seem likely to be swept if the bearish trend resumes. If this move occurs, the price might find support at the significant higher-timeframe level near $360.

2. Ripple (XRP)

Ripple XRP is the currency that runs on a digital payment platform called RippleNet, on top of a distributed ledger database called XRP Ledger. While RippleNet is run by a company called Ripple, the XRP Ledger is open-source and not based on a blockchain, but rather the previously mentioned distributed ledger database.

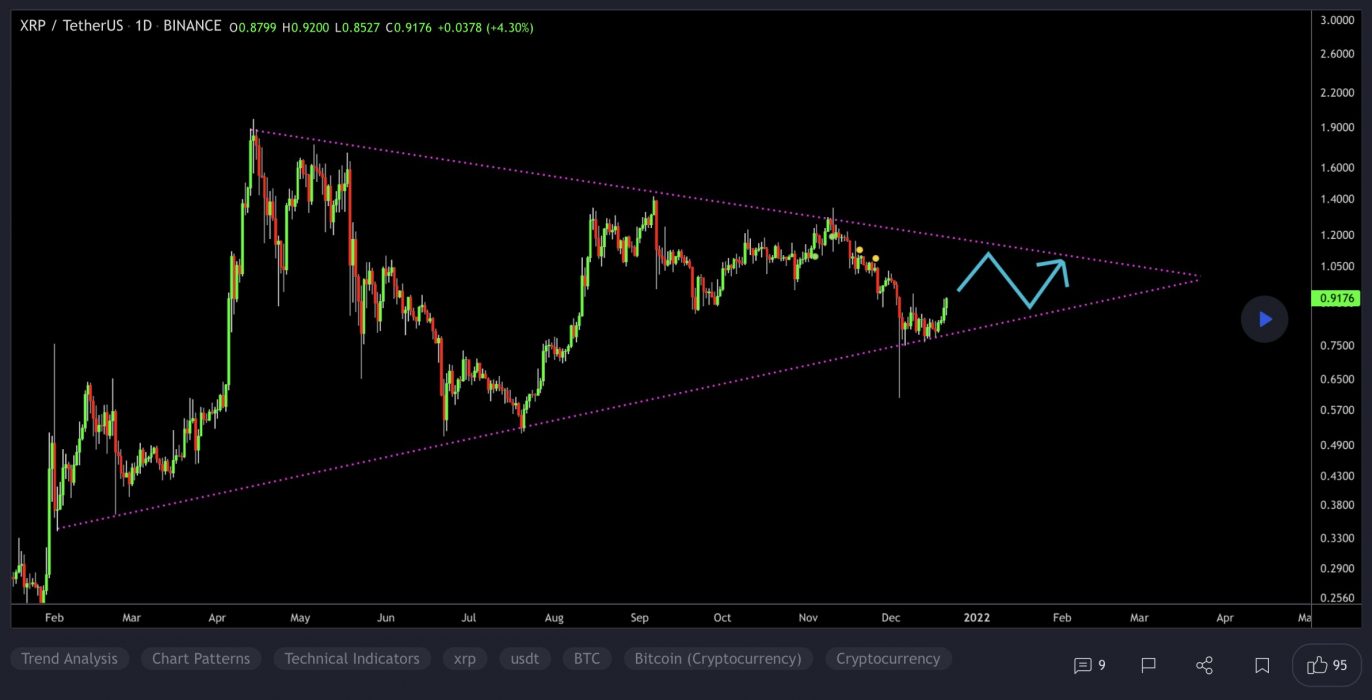

XRP Price Analysis

At the time of writing, XRP is ranked the 6th cryptocurrency globally and the current price is US$0.7402. Let’s take a look at the chart below for price analysis:

XRP printed some gains during last week before moving sideways for the rest of the month.

The price was in a downtrend, with the 9, 18 and 40 EMAs providing resistance on each attempt to rally. However, bulls are showing some interest at the 71.6% retracement, near $0.7472. If this level breaks, a move into possible support – just below the lows near $0.6952 – seems likely.

If the price does rally through the swing high at $0.8055 – perhaps triggered by a sudden surge in Bitcoin – bulls might find some resistance at the 61.8% retracement level near $0.8450.

Overlapping swing highs and lows near $0.8946 might provide the next target, where bears immediately forced the price down in late December.

More bullish market conditions could shift targets up near the midpoint of Q3’s consolidation, near $0.9517, where higher timeframes show an inefficiently traded zone.

3. Chiliz (CHZ)

Chiliz CHZ is the leading digital currency for sports and entertainment, powering the world’s first blockchain-based fan engagement and rewards platform, Socios.com. Here, fans can purchase and trade branded fan tokens as well as having the ability to participate, influence, and vote in club-focused surveys and polls. Founded in Malta in 2018, the company’s vision is to bridge the gap between active and passive fans, providing millions of sports fanatics with a fan token that acts as a tokenised share of influence.

CHZ Price Analysis

At the time of writing, CHZ is ranked the 68th cryptocurrency globally and the current price is US$0.1766. Let’s take a look at the chart below for price analysis:

CHZ‘s stunning rally to $0.3150 plummeted over 70% during January to sweep consolidation lows at $0.1655. This could set the stage for a new bullish cycle to begin.

The price is currently balancing around the monthly open. A quick stop run into support beginning near $0.1732 could set the stage for a move into the daily gap beginning near $0.1685, potentially reaching resistance near $0.1934.

A sweep of the highs near $0.2132, followed by a sharp sell-off, could hint that bulls are preparing to run the swing high near $0.2247. This run could find the next resistance around $0.2436 in the candle wick that created the monthly high. If the market remains bullish, the price will likely reach into possible resistance near $0.2618.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.