Despite its ongoing legal complications, Ripple (XRP) has big plans for its immediate future. Facing SEC allegations that it raised over 1 billion dollars through the sale of unregistered ongoing digital asset securities, the price of Ripple has fluctuated wildly as the merit of the case is assessed by the investment community.

According to the SEC, other financial entities such as Ethereum (ETH) and Bitcoin (BTC) do not qualify as a security as they are sufficiently decentralised. The SEC only regulates securities and not currencies or commodities, so the definition is all important.

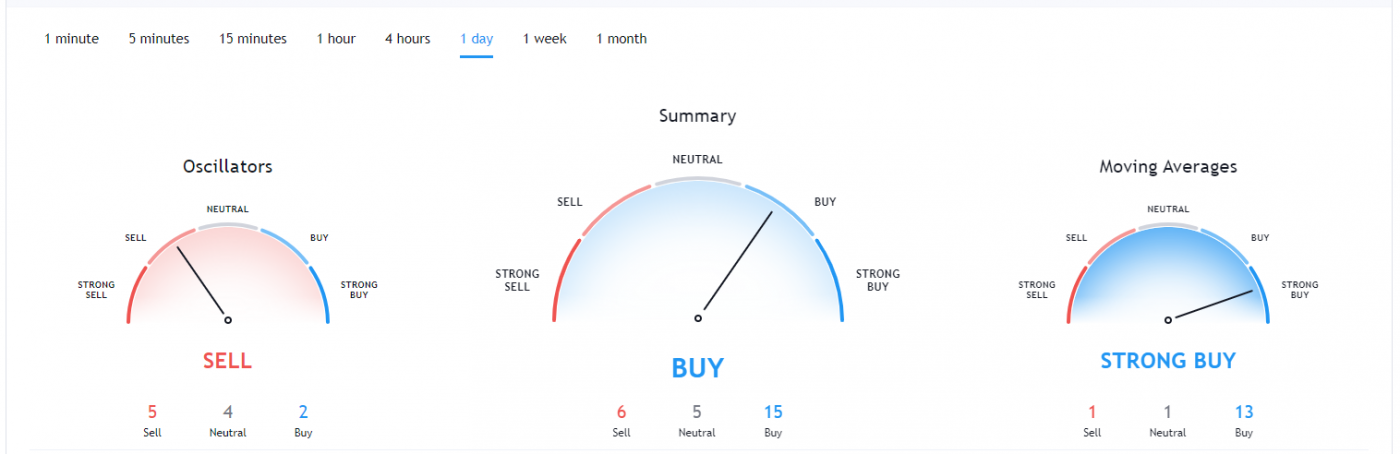

Ripple CEO Brad Garlinghouse is confident his company would be “on the leading” side of the impending crypto IPO boom during the Davos conference in January 2020. The market seems to agree with a bullish Ripple assessment, as evidenced by its strong recent growth.

Ripple’s legal team continues to insist that it falls outside of the SEC’s charter and that the Federal case is “dead wrong.” With a strong legal defence team that is well resourced and funded, the market is betting that Ripple will prevail. The management team is then determined to press ahead with a public offering that will raise its profile and a significant pool of funds.

The Coinbase IPO demonstrated the depth of investor appetite for exposure to the growing crypto sector, and Ripple seems determined to tap into this bullish sentiment.

Jackson Byrne – Guest Writer