The Australian Securities and Investments Commission (ASIC) has cautioned new and young investors about the risks of taking advice from social media and finfluencers.

So-called “finfluencers” have been circulating on YouTube and social media platforms Instagram and TikTok claiming they can “help you on your journey to financial freedom” while technically “not giving financial advice”.

While social media can be okay as a means of getting background information … relying on it comes with a degree of risk […] Advice may not be licensed and you may get information on something that is inaccurate.

Somer Taylor, senior manager of retail complex products and investor protection, ASIC

Last month, ASIC chairman Joe Longo told a parliamentary committee hearing that social media influencers giving financial advice was an “area of big concern” for the agency.

Young People and Newcomers Are Most Vulnerable

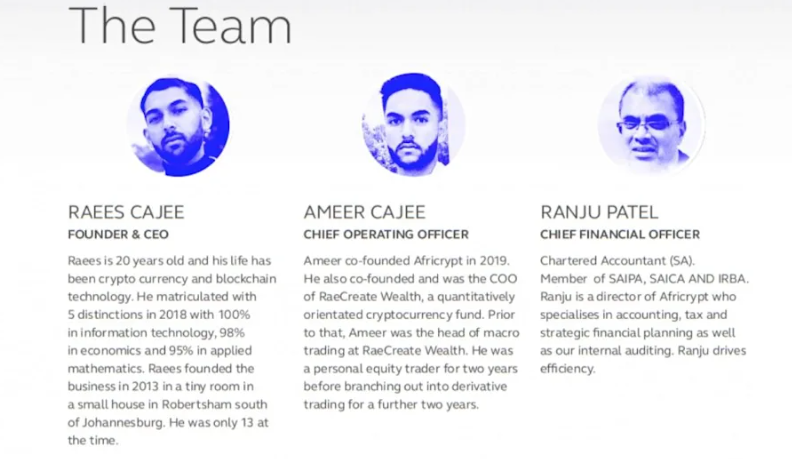

A large number of millennials and generation Zs have turned to investing in cryptocurrencies and equities to generate wealth. And since investing in crypto has so few barriers, people can easily buy in. For first-time investors with some computer savvy and extra cash, it might seem like quite the opportunity.

[New market entrants] have been engaged in short-term speculation rather than long-term wealth creation.

ASX

In 2020, more than 435,000 investors placed their first trade on the ASX, with almost half of these investors aged between 25 and 39, and 18 percent under 25. These under-40s are recognised as a tech-savvy age group. However, in this age of information overload, it can be difficult to know who and what to trust.

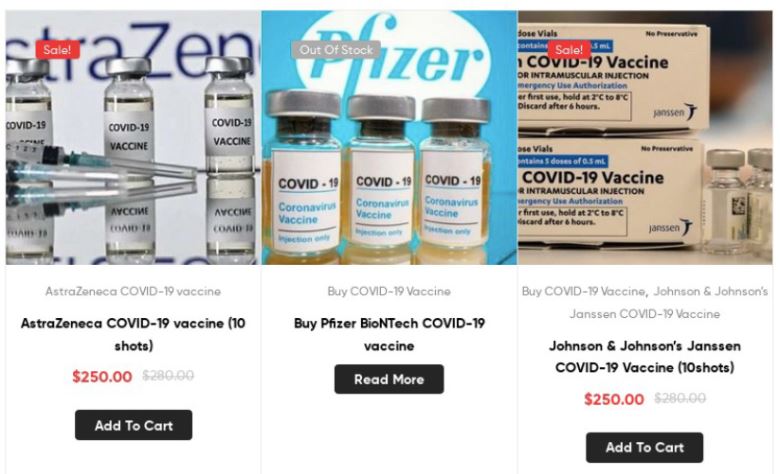

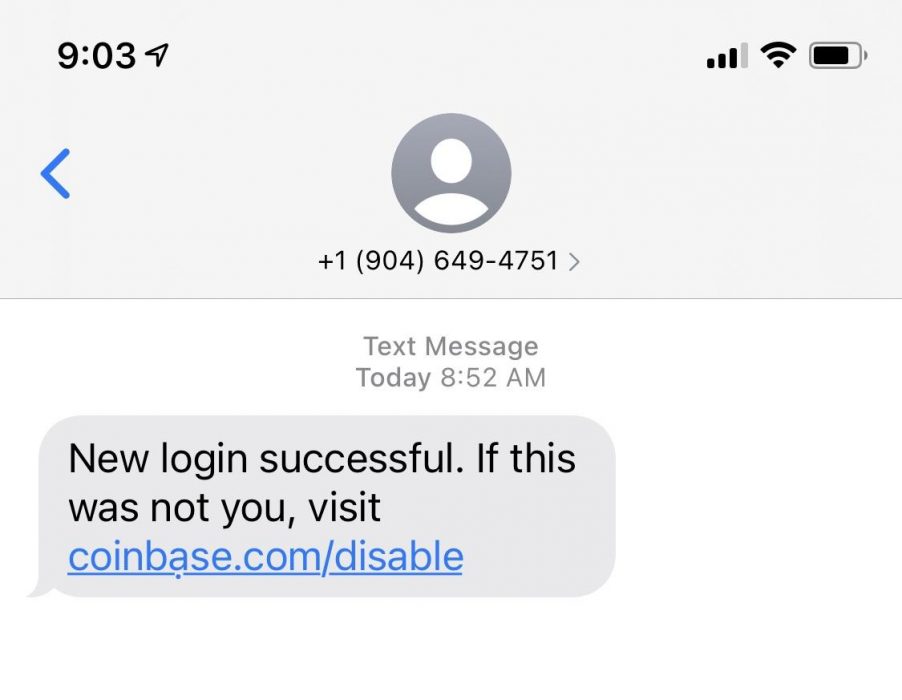

There have been instances of Instagram influencers orchestrating their own scams, stealing from the followers they were supposedly helping. An influencer might be paid to promote a certain product or idea, manipulating assets or even markets, pumping and dumping assets for individual gain. There have been many examples of investors getting scammed, even by semi-reputable e-sports influencers.

Australians lost millions to bitcoin scams in 2020, and following a recent report from the Australian Competition and Consumer Commission (ACCC), the amount of money lost to scams involving bitcoin since the start of this year already equals the entire losses of 2020.

Most people don’t understand cryptocurrency; they just hear the buzz around it … and they need to do their research.

Delia Rickard, deputy chair, ACCC

Pump and dump activity has long been a problem in the local share market as well as the crypto market. Somer Taylor, ASIC’s senior manager of retail complex products and investor protection, says she has witnessed a sharp increase during the pandemic with a wave of new participants entering the market.

International Finfluencers Not Subject to Australian Laws

In Australia, anyone giving financial advice must have an Australian Financial Services Licence (AFSL). However, the finfluencers with the biggest social media followings are from overseas and not subject to Australian laws. The ASX has warned investors to vet their sources of information before acting on it.

With TikTok’s #moneytok getting more than 7.6 billion page views and #stocktok 1.3 billion, there is an overabundance of finance-related information being shared. Many companies even collaborate with influencers on marketing campaigns.

It’s unfortunate that many companies are being led to believe that building ‘advocacy’ with these types of finfluencers is the right way to engage with investors.

Sarah Lenard, managing partner, strategic consultancy Advisir

Some think they can give financial advice as long as they add the disclaimer “this isn’t financial advice”. But the penalty for giving unlicensed advice in Australia is up to five years’ imprisonment and/or a fine of up to $133,200 for an individual and 10 times that for businesses.