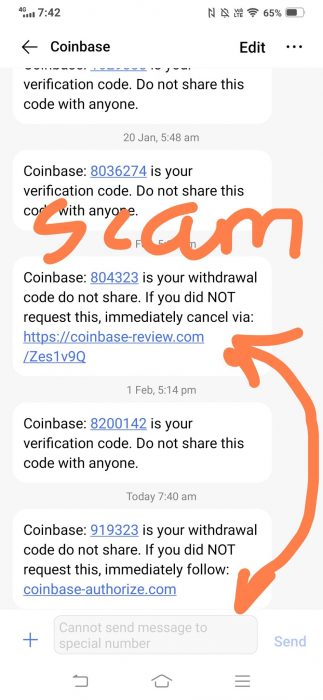

There crypto-scam occurred this month, but this time it did not involve a shady project that ran away with investors’ funds, rather an Instagram influencer who scammed his followers out of $ 2.5 million through a Bitcoin scheme.

Jebara Igbara went by the name of Jay Mazini on its Instagram, known for buying Bitcoin using his account. Igbara used his 1 million followers to make a profit of 2.5 million through a Bitcoin scheme, by tricking followers to send him Bitcoin to his wallet in exchange for fiat, but never paid.

Igbara Could Face More Than 20 Years in Jail

His followers filed a complaint to the Brooklyn Federal Court. One user sent Igbara over 5000 BTC on January 7, which is now worth over AU$ 340 million, never paying back. The U.S. Department of Justice is now charging Igbara with wire fraud, which could give him a sentence of up to 20 years in jail.

“As we allege, Igbara’s social media persona served as a backdrop for enticing victims to sell him their Bitcoin at attractive, but inflated, values. A behind-the-scenes look, however, revealed things aren’t always as they seem. There was nothing philanthropic about the Bitcoin transactions Igbara engaged in with his victims.”

—stated FBI Assistant Director-in-Charge William Sweeney [on the court document].

Igbara is now detained in New York, waiting for his trial. His Instagram account was deleted on Thursday.

Another scam worth noting is TurtleDex, a so-called “DeFi storage protocol” that performed an exit scam on its users, scamming its investors out of the same amount as Igbara. $2.5 million were drained out liquidity pools, and communications channels, including TurtleDex’ official website were deleted afterwards.