Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. SKALE Network (SKL)

Skale SKL is described as an elastic network designed to bring scalability to Ethereum. As well as boosting transaction capacity, the decentralised project aims to reduce latency and ensure that payments can be made as cheaply as possible. SKALE Network is geared towards improving both the security and decentralisation of Ethereum-based apps. Token holders on the network are incentivised and earn rewards by helping to improve the scalability and security of the platform by serving as validators.

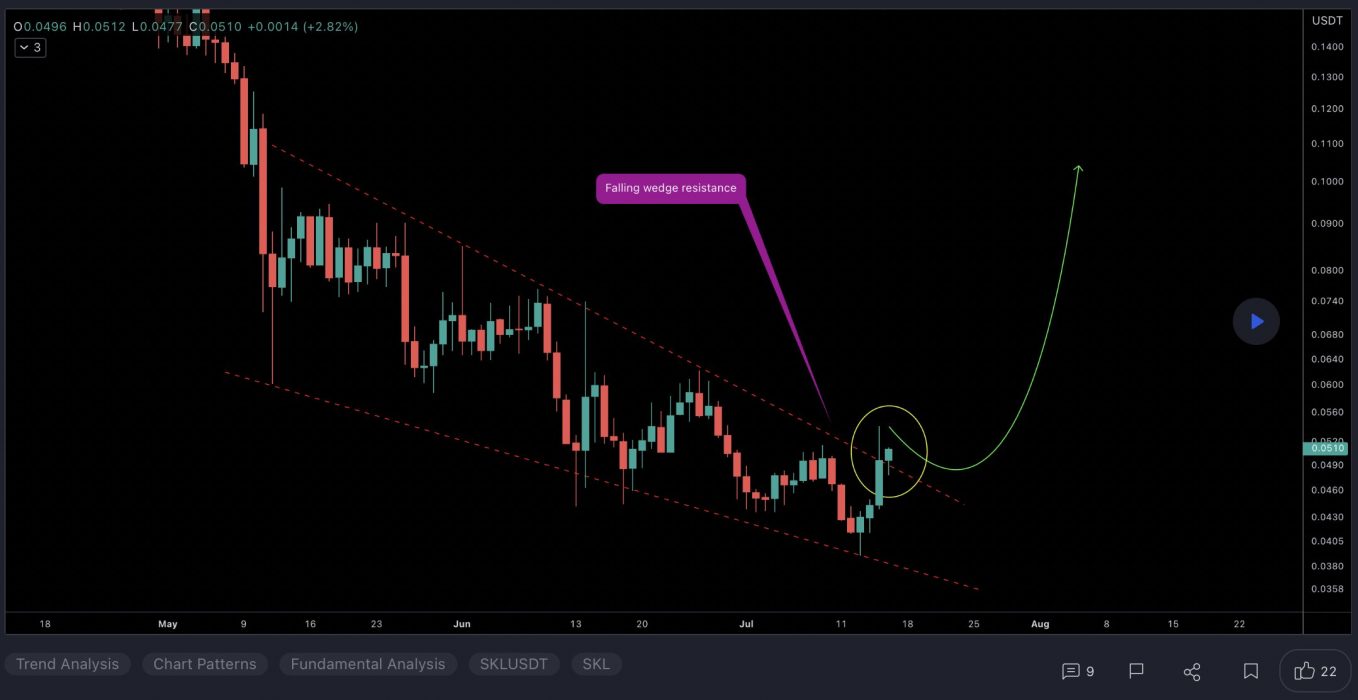

SKL Price Analysis

At the time of writing, SKL is ranked the 140th cryptocurrency globally and the current price is US$0.05502. Let’s take a look at the chart below for price analysis:

Since the beginning of Q2, SKL has been in a gentle downtrend. The future likely holds more stop runs and erratic volatility until the chart forms more substantial high-timeframe levels.

A retracement might uncover support near $0.04920, which is the daily high of the last swing low. The high of the wick beginning near $0.04571 may also provide support. However, bulls will likely remain wary of the current downtrend, making the low at $0.04230 the probable next bearish target.

Just above, the daily gap beginning near $0.06088 may provide resistance to bulls, possibly marking a future range high. A push through this level is likely to target the swing high near $0.06493 – perhaps running to probable resistance near $0.07044. Strength above this level may signal the start of a bullish trend, encouraging bulls to “buy the dip”.

2. Algorand (ALGO)

The Algorand ALGO blockchain is a permissionless, pure proof-of-stake blockchain protocol. Unlike proof-of-work (PoW) blockchains, where the root block must be validated by randomly selected validators (using computing power), in the pure proof-of-stake approach all of the validators are known to one another and only have to agree on the next block in order to create a new block. Algorand was invented to speed up transactions and improve efficiency in response to the slow transaction times of Bitcoin and other blockchains.

ALGO Price Analysis

At the time of writing, ALGO is ranked the 30th cryptocurrency globally and the current price is US$0.3411. Let’s take a look at the chart below for price analysis:

After creating a second equal low during last month, ALGO gained nearly 25% into resistance that starts near $0.4322.

Swing traders looking for a continuation to the nearest cluster of relatively equal highs around $0.5012 might look for bids near $0.5536. More significant resistance rests above, near $0.6025. A group of significant swing highs at $0.6410 and $0.6618 provide possible targets if this resistance breaks.

A stop run on the recent low at $0.2835 into possible support beginning near $0.2530 might see stronger bidding. This area also has a confluence with the recent monthly lows.

3. THORChain (RUNE)

ThorChain RUNE is a decentralised liquidity protocol that allows users to easily exchange cryptocurrency assets across a range of networks without losing full custody of their assets in the process. The native utility token of the THORChain platform is RUNE. This is used as the base currency in the THORChain ecosystem and is also used for platform governance and security as part of THORChain’s Sybil resistance mechanisms – since THORChain nodes must commit a minimum of 1 million RUNE to participate in its rotating consensus process.

RUNE Price Analysis

At the time of writing, RUNE is ranked the 53rd cryptocurrency globally and the current price is US$2.88. Let’s take a look at the chart below for price analysis:

RUNE has dropped 85% from its early Q2 high. It’s currently breaking down from its consolidation range formed in May and early June.

The price might find its closest resistance in an inefficiently traded area on the daily chart between $2.99 and $3.10. This level has confluence with the past week’s swing high.

The price may be forming a triple-sweep (three lower lows) before returning into its consolidation range. If so, an inefficiently traded area near $3.25 could provide another resistance. This level also shows distribution on the weekly chart near the 18 EMA.

A more extended rally could reach an inefficiently traded area on the monthly chart between $3.42 and $3.90. Yet this is less likely to happen soon, given the current bearish market conditions.

Below, $2.65 could offer support. This level is an area of inefficient trading below a daily swing low from June. It also shows accumulation on the weekly.

The following daily swing low, near $2.35, could offer the next bearish target. This level shows inefficient trading on the daily and weekly charts.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.