Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Burger Swap (BURGER)

BurgerSwap BURGER is one of the first democratised, decentralised automated market makers (AMMs) on the Binance Smart Chain (BSC). It was built without the control of any centralised authorities through the use of smart contracts. BURGER token staking allows any user to create proposals and influence the adjustment of transaction fees, block rewards, and other system parameters of the Burger Swap exchange via voting.

BURGER Price Analysis

At the time of writing, BURGER is ranked the 470th cryptocurrency globally and the current price is US$1.56. Let’s take a look at the chart below for price analysis:

After a 45% retracement from its June highs, BURGER found a temporary low near $1.45. A recent move above $1.70 could be the first sign of a bullish shift but could also be a stop run before the next drop lower.

If the market adopts a more bullish tone, the price could run through the most recent swing high. If this bounce occurs, it would likely find some resistance near $1.93, possibly reaching up to $2.10.

However, a move below the closest support near $1.40 makes stop runs on the swing lows near $1.35 and $1.26 likely. A confluence of several levels near $1.15 could provide a temporary bounce. Still, a sustained bullish market will likely target $2.00 and even $2.07.

2. Quantum (QTUM)

Quantum QTUM is a proof-of-stake (PoS) smart contract open-source blockchain platform and value transfer protocol, aiming to bring together the strengths of Bitcoin and Ethereum in one chain. QTUM is built on Bitcoin’s UTXO transaction model, with the added functionality of smart contract execution and DApps. Recently, the platform added support for DeFi applications.

QTUM Price Analysis

At the time of writing, QTUM is ranked the 99th cryptocurrency globally and the current price is US$4.02. Let’s take a look at the chart below for price analysis:

QTUM retraced 70% from its Q2 highs before forming a new low near a cluster of older relatively equal lows in late June.

Last week’s sharp rally reached probable resistance near $4.67. This level is near the 61.8% and 78.6% retracements of the last significant move upward.

Possible support rests just below the monthly open, near $3.80. This area saw significant consolidation in late July. It remains to be seen whether this is a run on bears’ stops before a more substantial move down, or a bullish shift in market structure that could lead to a more significant rally.

With the overall market being bearish and significant numbers of equal lows enticing bears below, traders may want to watch possible support near $3.65. This area is inefficiently traded and borders the last accumulation before Q1’s stunning rally.

Suppose this is the start of a more significant rally. In which case bulls might target $4.38, where higher timeframes show an inefficiently traded area near multiple bearish rejections during December 2021. A powerful bullish swing could reach up to $5.20, where early December saw inefficient trading and the bulk of Q3 2021’s trading took place.

3. Algorand (ALGO)

The Algorand ALGO blockchain is a permissionless, pure proof-of-stake blockchain protocol. Unlike proof-of-work (PoW) blockchains, where the root block must be validated by randomly selected validators (using computing power), in the pure proof-of-stake approach all of the validators are known to one another and only have to agree on the next block in order to create a new block. Algorand was invented to speed up transactions and improve efficiency in response to the slow transaction times of Bitcoin and other blockchains.

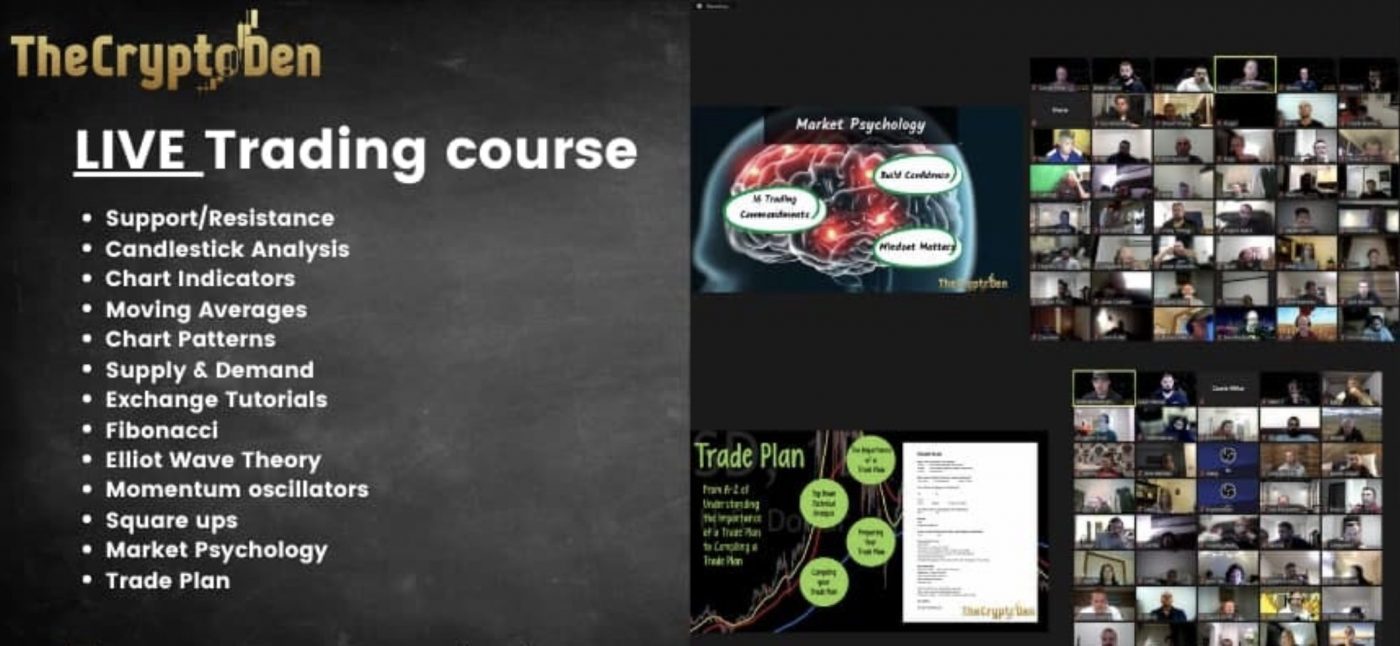

ALGO Price Analysis

At the time of writing, ALGO is ranked the 30th cryptocurrency globally and the current price is US$0.3545. Let’s take a look at the chart below for price analysis:

After creating a second equal low during last month, ALGO gained nearly 20% into resistance that starts near $0.4022.

Swing traders looking for a continuation to the nearest cluster of relatively equal highs around $0.4712 might look for bids near $0.5326. More significant resistance rests above, near $0.5925. A group of significant swing highs at $0.6310 and $0.6518 provide possible targets if this resistance breaks.

A stop run on the recent low at $0.3071 into possible support beginning near $0.2430 might see stronger bidding. This area also has a confluence with the recent monthly lows.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.