A South Korean investor who claims to have lost US$2.4 million in the Terra ecosystem collapse earlier this month has been arrested after knocking on Terraform Labs founder Do Kwon’s door and attempting to speak to him about the loss.

Despite not technically trespassing on Kwon’s property, the investor is believed to have broken South Korean law by trying to approach Kwon and will likely face a fine.

Lack of Public Statements Prompted Personal Visit

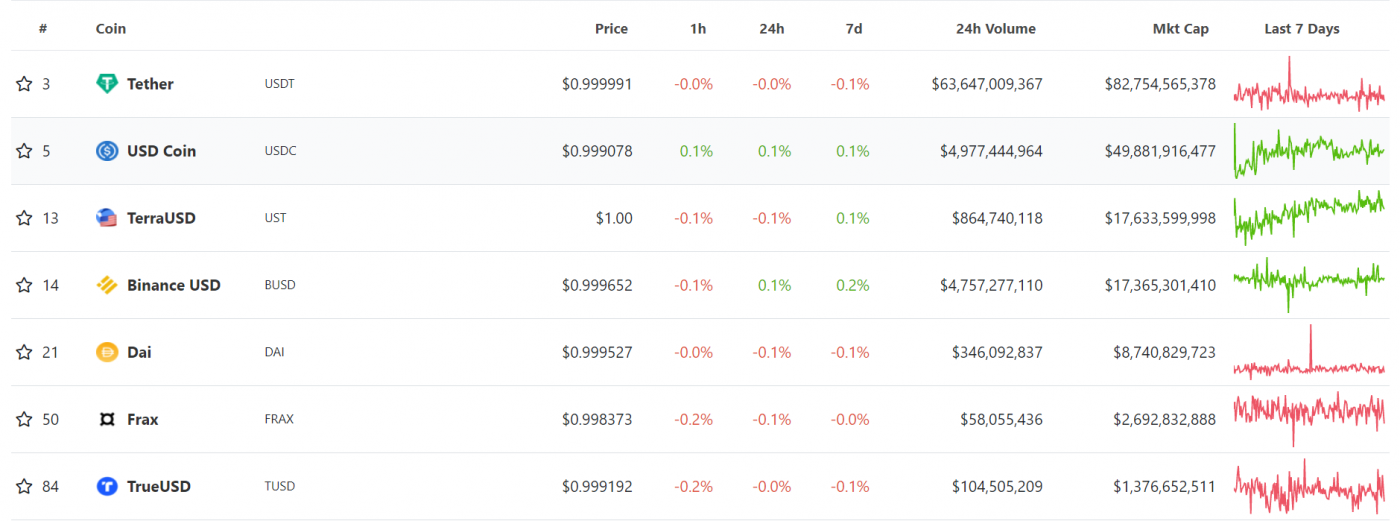

The investor, a social media personality known as ‘Chancers’, says he was distressed after suddenly losing three billion won (US$2.4 million) in the catastrophic collapse of Terra, after the Terra-based stablecoin UST lost its peg to the US dollar.

I felt like I was going to die. I lost a lot of money in a short period of time. Around $2.4m of my cryptocurrency was wiped out.

Chancers, aggrieved LUNA investor

This combined with virtual silence from anyone involved with Terra regarding the state of the network drove Chancers to attempt to speak with Do Kwon directly.

After finding Kwon’s address online, Chancers travelled across Seoul to confront him in person, while live-streaming to about 100 viewers. Explaining the intention of his visit, Chancers said: “I wanted to ask him about his plans for LUNA; I suffered a huge loss and wanted to talk to him directly.”

Wife Calls Police, Investor Turns Himself In

When Chancers arrived at Kwon’s property, he was greeted by Kwon’s wife who said Kwon wasn’t home and called the police.

The following day Chancers found out police were searching for him and on May 13 he turned himself in to the local station. Despite the fact he didn’t trespass on or damage any property, Chancers now expects to be charged and faces a fine and a criminal record.

“It’s so hard,” Chancers lamented. “I lost a lot of money and now I’m being investigated by the police. I originally served as a civil servant in Korea. But if I am convicted of this case, I may not be able to return to the civil service again.”

Other affected LUNA investors rallied to support Chancers on Twitter, and at least one of them offered some sage advice – albeit in hindsight:

In welcome news, South Korean authorities are also investigating the collapse of Terra to see if any crimes were committed in the lead-up, something many investors will be very interested to know.