With a market capitalisation of US$3.2 million, Monero (XMR) is the world’s largest privacy token, more than double that of its closest rival, Zcash (ZEC). However, as the protocol’s biggest mining pool, MineXMR, approached 50 percent of the hashrate, critics raised serious alarm bells.

Risks of Concentrated Hashpower

Within proof-of-work blockchains such as Monero, the most valid and obvious concern relating to a mining pool’s disproportionate hash power is the theoretical risk of a “51 percent attack”.

In short, this is when a group controls more than 50 percent of a blockchain’s hash power. If successful, the group could then block new transactions from being confirmed, as well as change the ordering of new transactions. In addition, it may also be possible to effectively rewrite parts of the blockchain by reversing transactions. This fundamentally undermines the “double spend problem” that blockchains are supposed to solve. In that sense, the attackers can spend tokens, erase the transaction and then once again spend the tokens.

Aside from “51 percent attacks”, the other concern is that it undermines decentralisation, one of the other core premises of blockchains:

Monero Community Calls for Boycott

Across Twitter and Reddit, Monero supporters were vocal in their call for miners in the MineXMR pool to leave without delay:

As one Reddit user put it, MineXMR was just under 96 percent of the way to achieving the majority of hashrate:

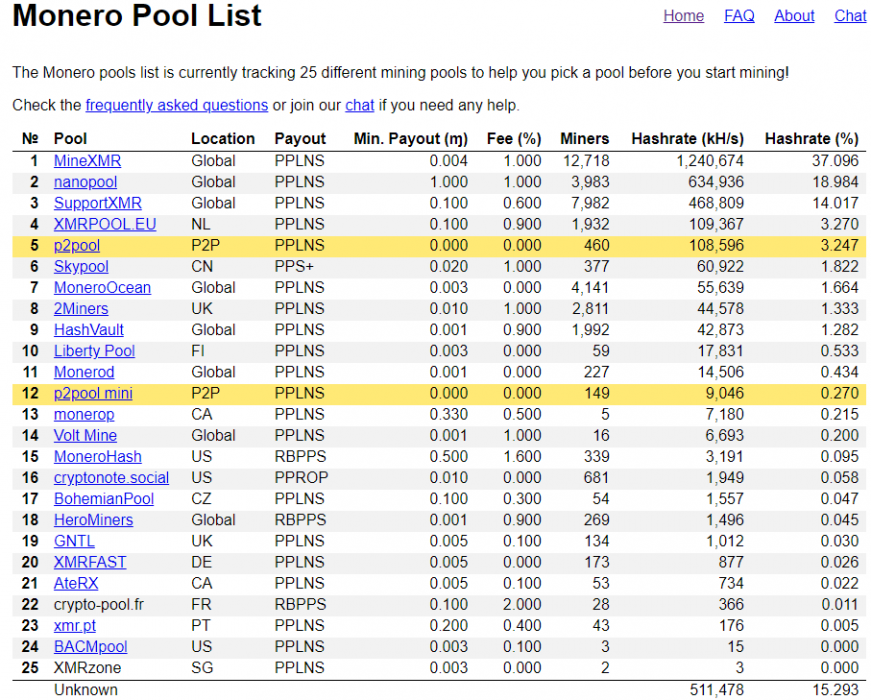

It would appear as if the calls to leave MineXMR have been somewhat heeded. Within 24 hours, the MineXMR pool went from 48 percent of the hashrate, down to 37 percent. Notwithstanding, its hashrate remains more than double the next largest pool, nanopool, at 22 percent.

It’s been a tough past year for Monero, as lead maintainer “Fluffy Pony” was arrested, not to mention the token’s recent alert that its multi-sig wallet code had been compromised.

While the Monero community and holders are no doubt pleased that some miners have abandoned MineXMR, it remains to be seen whether long term, the miners are truly committed to decentralisation, or whether their own interests ultimately trump those of its holders.