Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

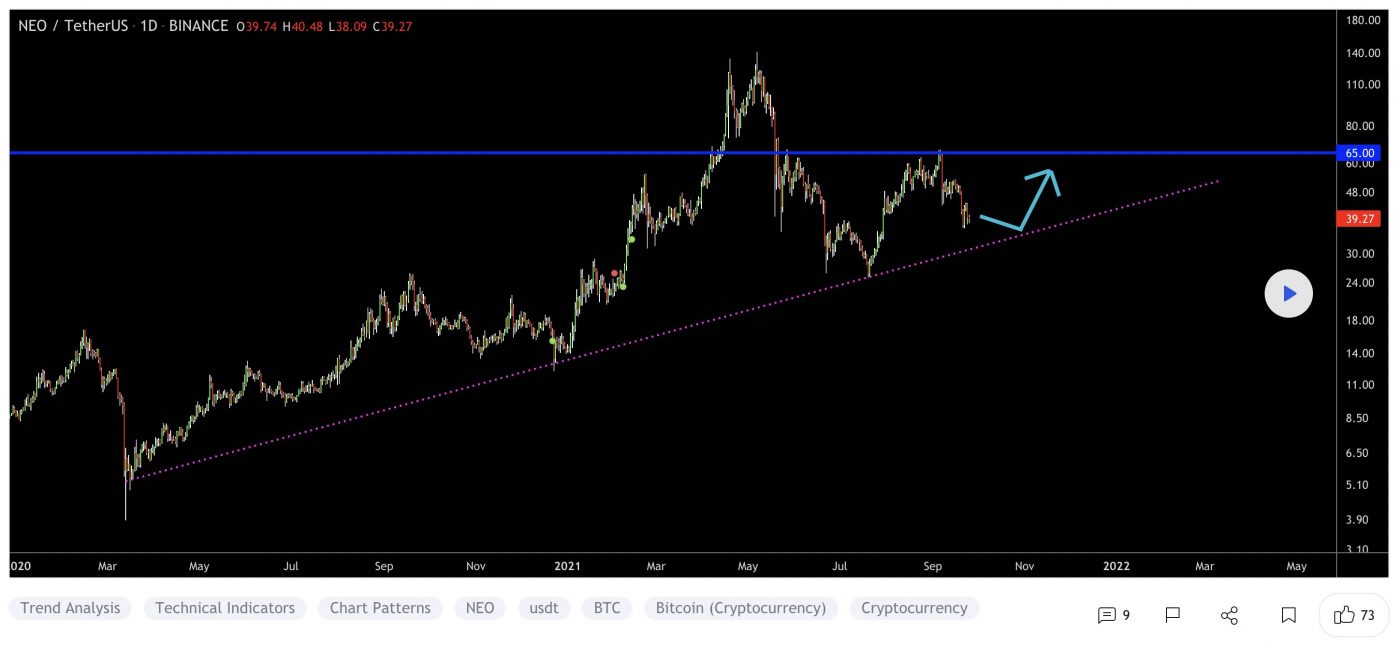

1. Neo (NEO)

NEO bills itself as a “rapidly growing and developing” ecosystem that has the goal of becoming the foundation for the next generation of the internet – a new economy where digitised payments, identities and assets come together. As well as creating a worldwide community of developers who create new infrastructure for the network and lower barriers to entry, the team behind this project operates an EcoBoost initiative that’s designed to encourage people to build decentralised apps and smart contracts on its blockchain.

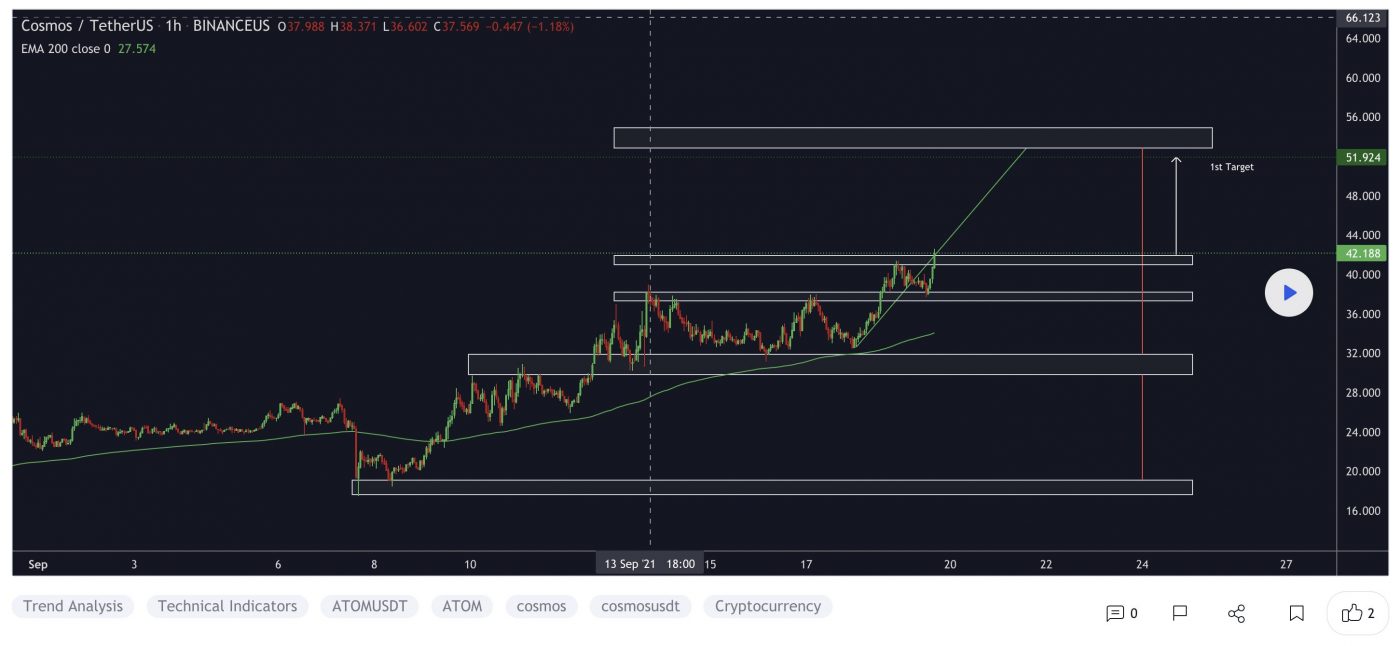

NEO Price Analysis

At the time of writing, NEO is ranked the 49th cryptocurrency globally and the current price is A$53.40. Let’s take a look at the chart below for price analysis:

After creating a second equal low in mid-July, NEO has rallied nearly 115% into resistance that starts near A$90.25.

Aggressive bulls looking for a continuation to the nearest cluster of relatively equal highs around A$57.33 might look for bids near A$50.86. More significant resistance rests above near A$66.15. A group of significant swing highs at A$70.19, A$74.55 and A$79.46 give possible targets if this resistance breaks.

A stop run on the recent low at A$48.00 into possible support beginning near A$45.13 might see stronger bidding. This area also has a confluence with the August monthly open.

A bearish market shift could reach the swing low at A$40.68 into possible support beginning near A$37.24.

2. Filecoin (FIL)

Filecoin FIL is a decentralised storage system that aims to “store humanity’s most important information”. The project was first described back in 2014 as an incentive layer for the Interplanetary File System (IPFS), a peer-to-peer storage network. Filecoin is an open protocol and backed by a blockchain that records commitments made by the network’s participants, with transactions made using FIL, the blockchain’s native currency. The blockchain is based on both proof-of-replication and proof-of-spacetime.

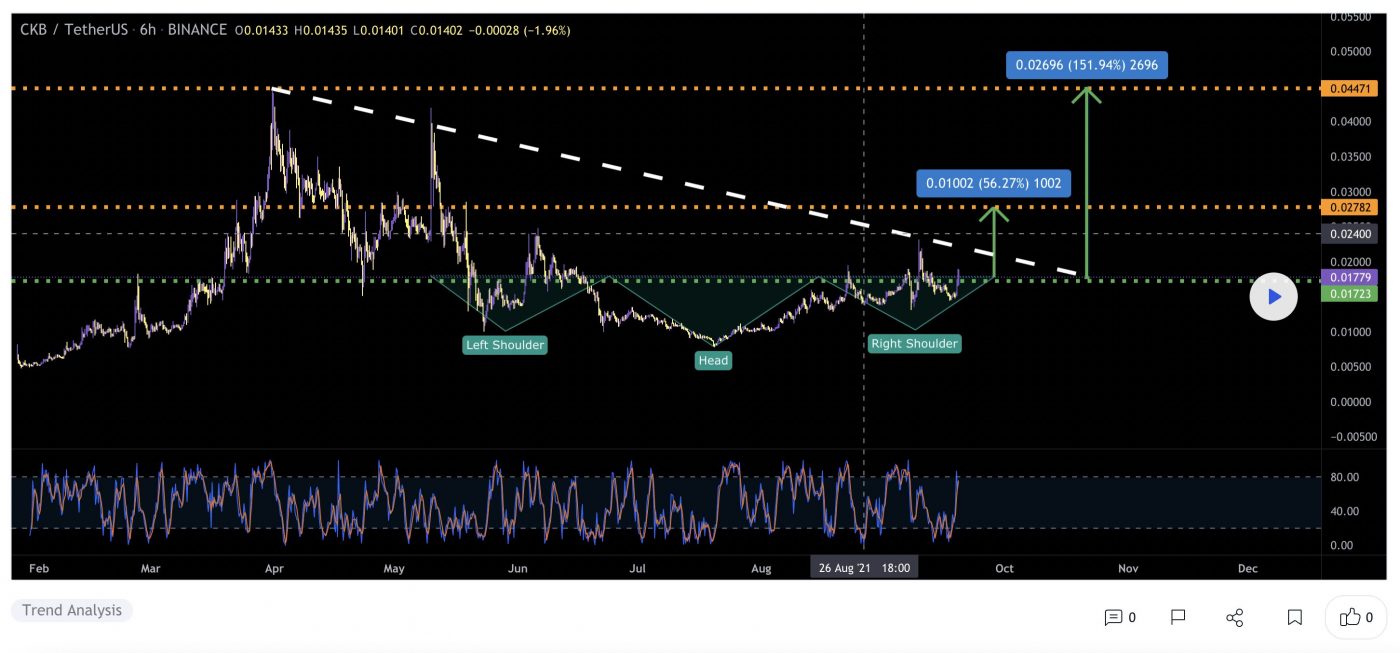

FIL Price Analysis

At the time of writing, FIL is ranked the 27th cryptocurrency globally and the current price is A$78.34. Let’s take a look at the chart below for price analysis:

After rallying over 150% from its July low, FIL is encountering resistance near A$152.88.

This resistance and the September monthly mid at A$118.35 currently have the price trapped. The swing high and resistance near A$107.22 provide a likely target before any major bearish market shift, with continuation through this resistance possibly reaching for short stops and resistance near A$134.67.

The daily gap at A$72.38 could provide support, while the area beginning near A$69.86 could see more substantial interest from the bulls. A longer-term bearish shift in the marketplace will likely reach the relatively equal lows near A$65.29, possibly finding a floor at support beginning near A$60.93.

3. Avalanche (AVAX)

Avalanche AVAX is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is blazingly fast, low-cost, and green. Any smart contract-enabled application can outperform its competition on Avalanche. AVAX is the native token of Avalanche. It is a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche.

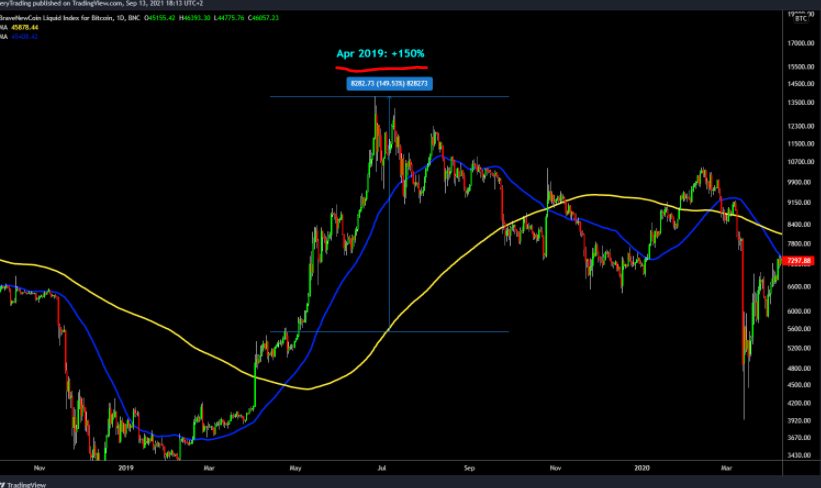

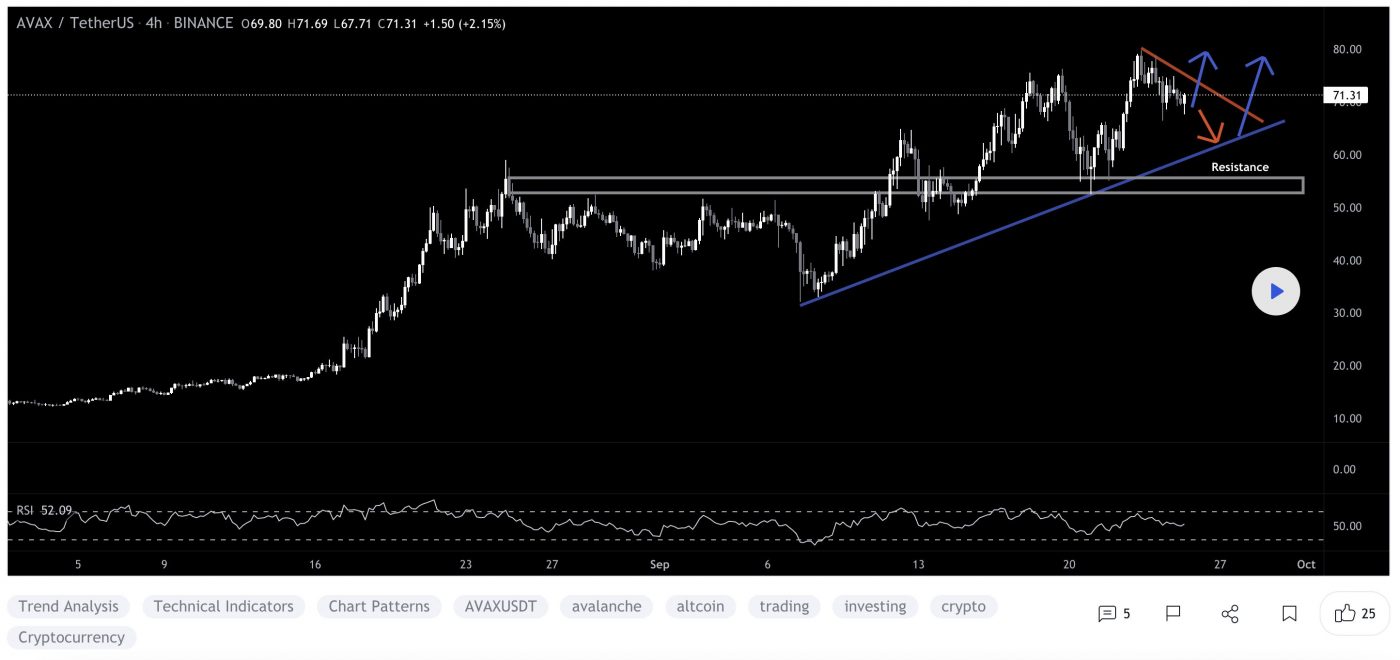

AVAX Price Analysis

At the time of writing, AVAX is ranked the 11th cryptocurrency globally and the current price is A$96.98. Let’s take a look at the chart below for price analysis:

AVAX continued its rally through the daily gap between A$99.45 and A$97.25, turning this region into an area of possible support.

However, a stop run under the relatively equal lows at A$94.34 could form a wick below this level, potentially reaching an untapped daily gap beginning near A$87.14.

Resistance starting at $104.50 has seen significant profit-taking, shown by the long upper wicks on the daily candles. A break of this resistance may reach the next significant swing high at A$110.89, continue into probable resistance just above, and possibly set new all-time highs at A$122.56.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.