Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polkadot (DOT)

Polkadot DOT is an open-source sharding multichain protocol that facilitates the cross-chain transfer of any data or asset types, not just tokens, thereby making a wide range of blockchains interoperable with each other. Polkadot’s native DOT token serves three clear purposes: providing network governance and operations, and creating parachains (parallel chains) by bonding. This interoperability seeks to establish a fully decentralised and private web, controlled by its users, and simplify the creation of new applications, institutions and services.

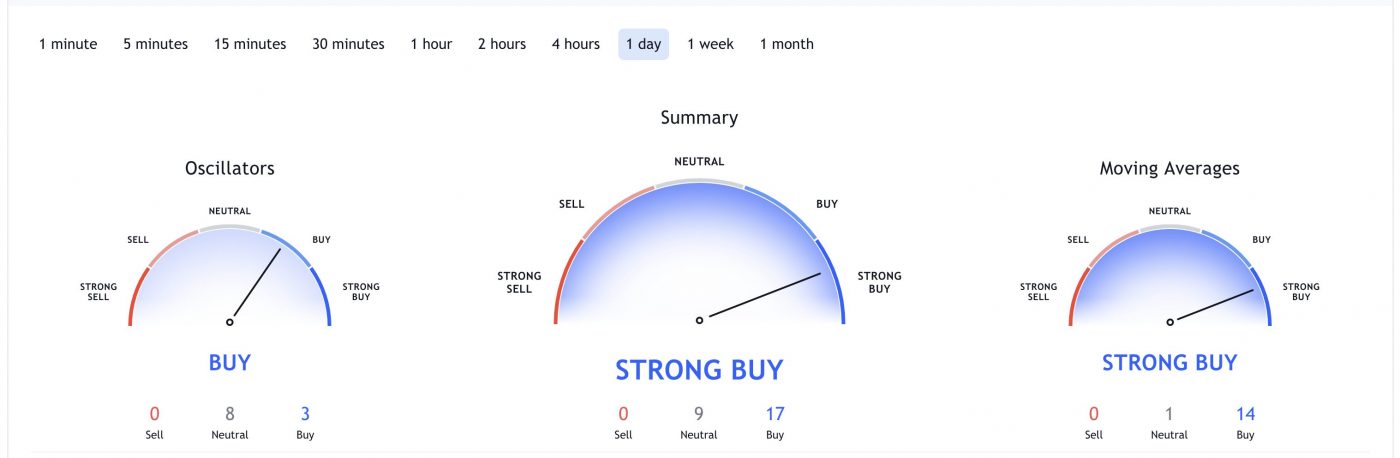

DOT Price Analysis

At the time of writing, DOT is ranked the 8th cryptocurrency globally and the current price is A$34.97. Let’s take a look at the chart below for price analysis:

DOT‘s nearly 87% retracement from its early May high found a low near A$20.65 in late June before July’s bullish trend began.

The price is currently approaching resistance at a swing high near A$36.89. If this level breaks, bulls might target the swing highs near A$38.52, A$39.80, and potentially up to A$41.68. Resistance near A$43.05 and A$45.21 could cap this move.

If the market remains bullish for the near term, bulls might buy at A$33.06. However, a stop run into A$31.77 could offer a higher probability entry. A steeper drop could reach below the swing low into possible support near A$28.75.

2. Cardano (ADA)

Cardano ADA is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals”, helping to create a society that is more secure, transparent and fair.

Cardano is used by agricultural companies to track fresh produce from field to fork, while other products built on the platform allow educational credentials to be stored in a tamper-proof way, and retailers to clamp down on counterfeit goods.

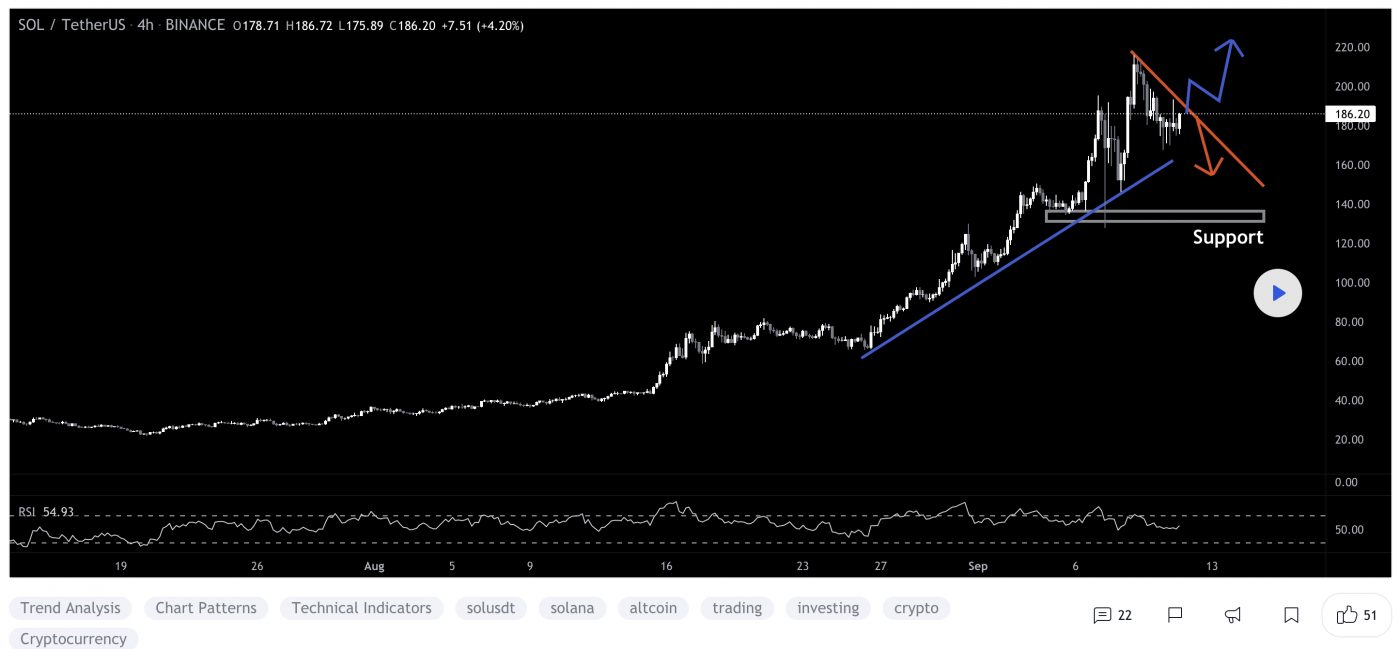

ADA Price Analysis

At the time of writing, ADA is ranked the 3rd cryptocurrency globally and the current price is A$3.36. Let’s take a look at the chart below for price analysis:

ADA‘s chart paints a different picture than many other altcoins, with August’s high leading to a massive range after setting a low near A$1.90 in July.

The nearly 85% spike within two weeks at the beginning of August makes immediate bids questionable. However, the price may be finding support near A$3.21 and possibly near A$3.14. Since the price swept the impulse’s high at A$3.05, bulls might be waiting to enter near the swing low and gap near A$2.93, or slightly lower near A$2.87.

Little resistance lies overhead, although some might exist between A$3.42 and approximately A$3.48, just above the current price. A sweep and rejection of the high near A$3.57 would make most areas of possible support highly suspect and could mark the end of the bullish trend.

3. Decentraland (MANA)

Decentraland MANA defines itself as a virtual reality platform powered by the Ethereum blockchain that allows users to create, experience, and monetise content and applications. In this virtual world, users purchase plots of land that they can later navigate, build upon and monetise.

Decentraland uses two tokens: MANA and LAND. MANA is an ERC-20 token that must be burned to acquire non-fungible ERC-721 LAND tokens. MANA tokens can also be used to pay for a range of avatars, wearables, names and more on the Decentraland marketplace.

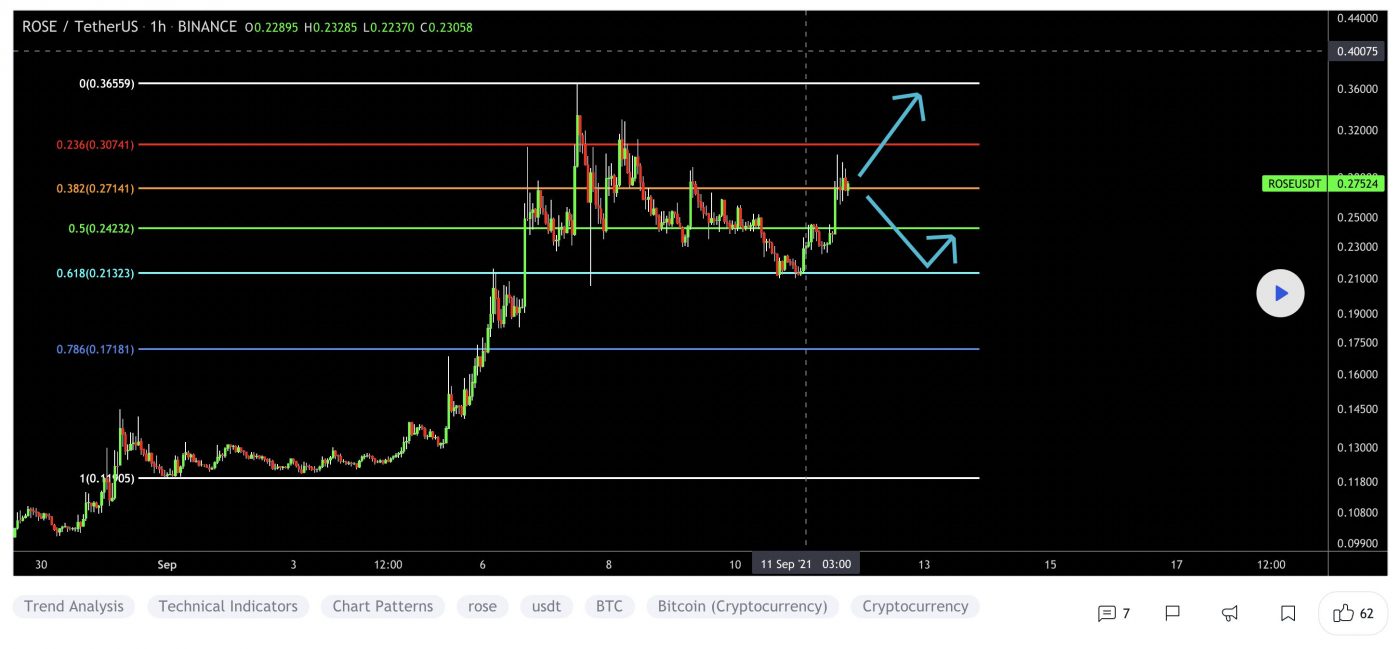

MANA Price Analysis

At the time of writing, MANA is ranked the 77th cryptocurrency globally and the current price is A$1.16. Let’s take a look at the chart below for price analysis:

Like many other altcoins, MANA set a high in early May before retracing 83% to the low at A$0.8539 in July.

Price broke through resistance near A$1.24, which may mark an area of possible support on a retracement. If this support fails, bulls might also step in near A$1.12. However, a drop this far increases the chances of a stop run to A$1.03 and possibly into support near A$0.9562. For now, continuing bullish market conditions could help A$1.00 become support.

The swing high around A$1.25 gives bulls a reasonable first target, with A$1.31 also likely to draw the price upward. Higher-timeframe resistance beginning near A$1.33 or A$1.35 could cap the move or trigger consolidations. If bullish market conditions continue, bulls might test probable resistance near A$1.40.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.