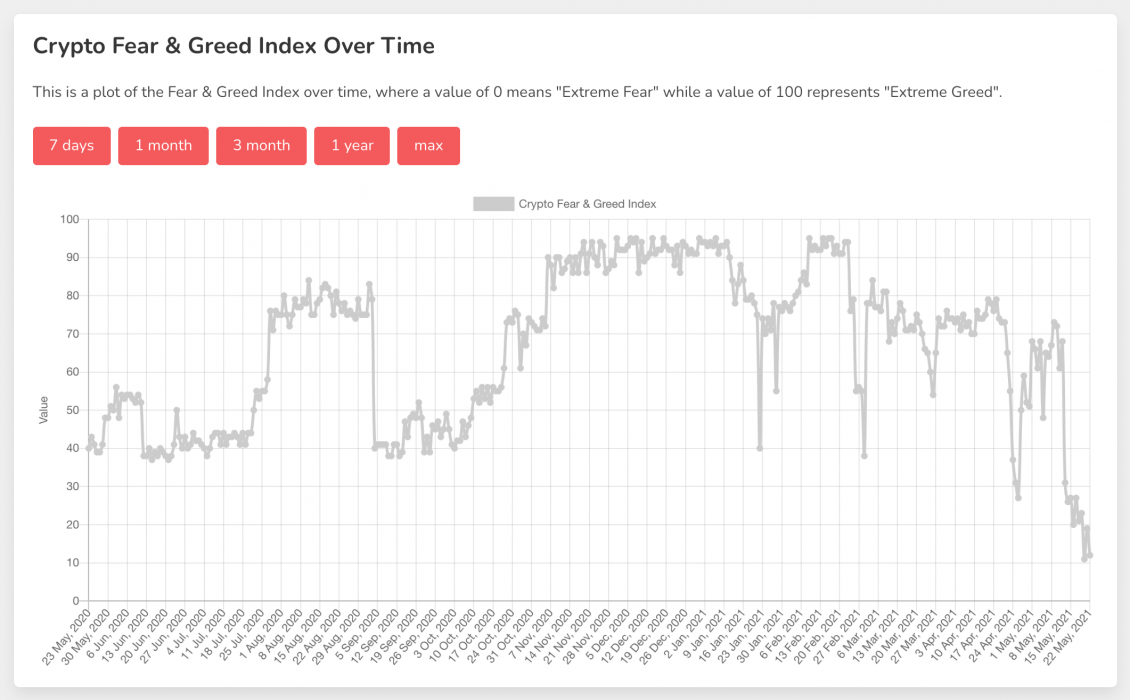

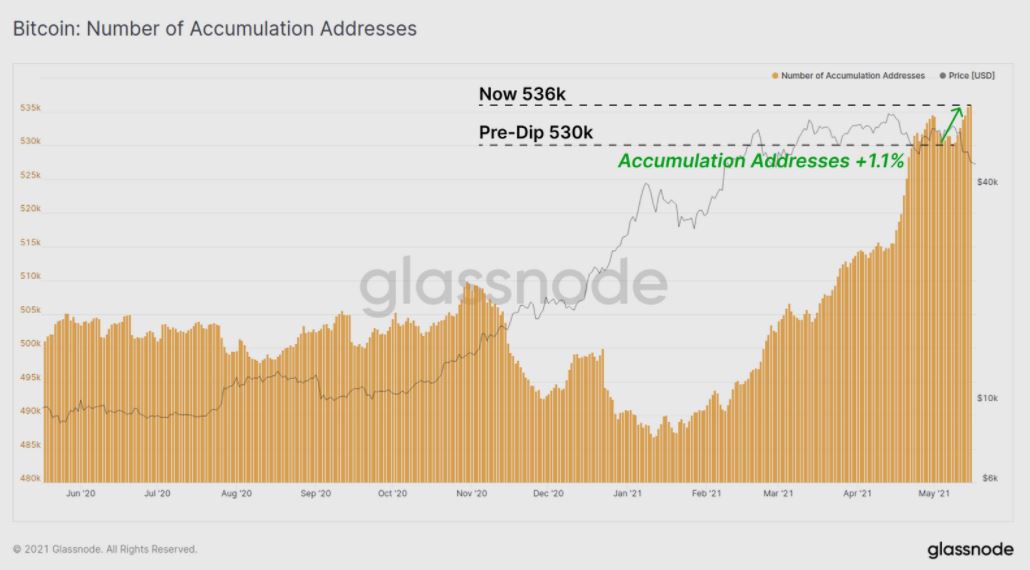

May has been definitely one of the craziest and most volatile months for the crypto market so far in 2021.

There are several possible reasons why the market has shaken so much. The previous bull run attracted new traders and investors entering the crypto world, sometimes without any proper training and buying at the top of the market.

With so much happening, some crypto traders have taken their stories to Reddit, especially sharing their frustrations and to blow off some steam.

Some Lost Everything

Some traders were hit hard by the crypto crash — seeing even 50% of their portfolio vanished, losing life savings, the chance to pay their houses, car, or even rent.

One user shared his story on how he and his wife lost 50% in their total investments, and now they can’t buy a car and their dreams of being homeowners will be put on hold — and to complete the picture, they have a baby incoming.

However, despite the adversity, they still don’t plan to sell.

She was upset, but she said we shouldn’t sell for a loss, and just to keep holding for the next few years and act as if the money doesn’t exist. […] Remember, if you do all the investing, that means you did all the losing. Don’t deny this.

A Reddit user

Some are Staying Optimistic

One trader said the crypto crash came amid an already rough month for him. Despite the adversity, he incited everyone in the community to not let themselves go in a downward spiral if they’re going through a similar situation. “Remember to consider the good things in life first before dwelling on depressing news and events”, he said.

Excited for crypto to change the world for the better, just going to take a little bit longer than we want but the good things always take patience and especially this year, I am trying to be as patient as any sane person in these tumultuous times.

A Reddit user

Some traders believe the current situation is an opportunity for everyone that wants to join the crypto space but thought they were already too late. One user bought ETH when it was priced around $120 USD. However, he emphasised the difficulty of buying the dip especially when there’s a lot of FUD (Fear, Uncertainty, Doubt) going on and the markets are in red, adding “it takes courage to buy dips”.

The thing I’m trying to say is that it’s impossible to time the market, but don’t call people who buy at dips ‘lucky’. It takes courage to buy at long time lows, not knowing if the market is going to back up. It’s much easier in hindsight, during a bull run. Remember this.

A Reddit user