Media Release – 15 February 2021 – New Australian data from TradingView, the social charting network for investors and traders and among the 100 most visited websites in the world, reveals data about Australians’ fast-growing interest in the cryptocurrency market.

Bitcoin, most popular asset

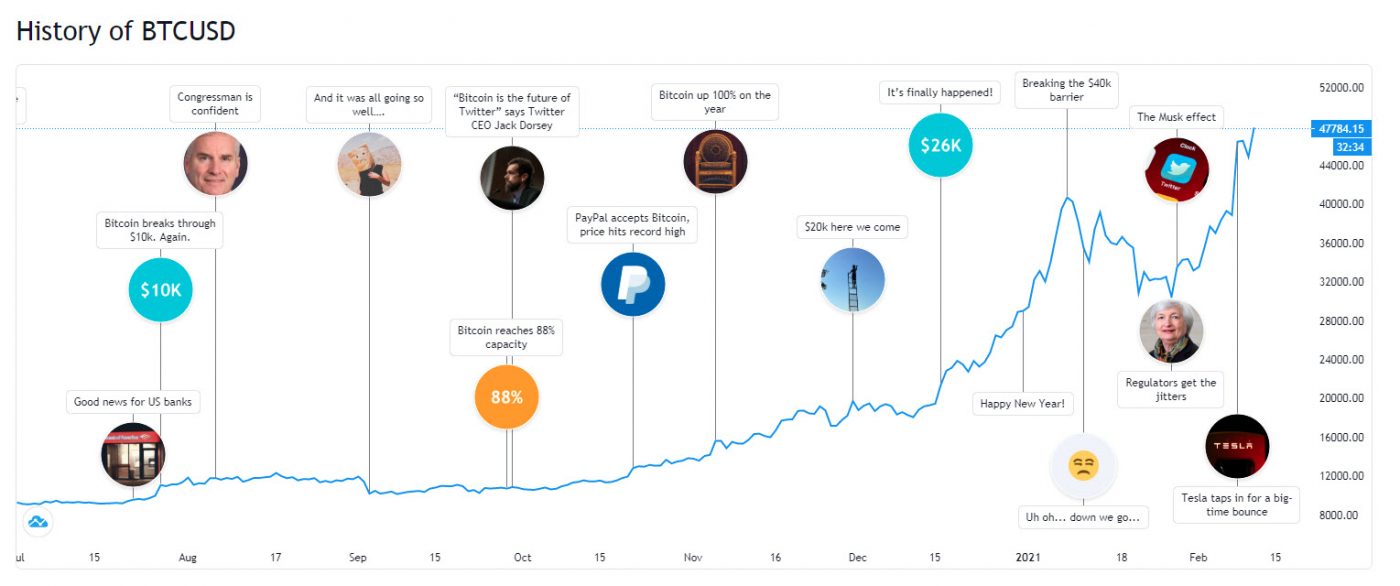

Between July 2020 and January 2021, the volume of unique searches for cryptocurrencies on TradingView grew from 17,044 to 39,477—an increase of 132%.

Looking at individual assets for the month of January, bitcoin topped the rankings for the most popular asset on TradingView in Australia by a landslide, with 25,931 unique searches, ahead of forex page AUD/USD (11,767) and Tesla (10,808).

In terms of page views overall, bitcoin was the third most popular asset between last July and January 2021 in Australia, with 2.6 million total views, closely behind forex symbols AUD/USD and EURUSD (both 2.9 million).

The rise of altcoins

In January 2021 only, cryptocurrency pages on TradingView received 7.6 million views, and 29 million views between July and January. New South Wales users are leading the pack, generating 31% of this traffic, ahead of Victoria (25%), and Queensland (21%).

Ether (ETHUSD), the cryptocurrency built on top of the open source Ethereum blockchain, has also received significant interest from Aussie traders, having been viewed 553,352 times in January 2021 from 16,581 unique users. Interestingly, the altcoin has received more attention than other popular assets such as Apple (AAPL – 7,121 users), Gold (GOLD – 5,233 users), and GBP/USD (8,298 users).

Ripple (XRP) also became more popular than the aforementioned assets by capturing the attention of 8,330 unique Australian users. This growing popularity of altcoins is testament that the cryptocurrency trend is not only about bitcoin. In fact, when looking at the top 30 cryptocurrencies on TradingView, bitcoin represents only 20% of total views, and 19% of unique users in the last seven months, and when considering all the cryptocurrencies only 9% of total views.

Despite this sharp increase in interest in the past few months, it is worth noting that Australia ranks 91st in a list of 230 countries and territories TradingView operates in, in terms of proportion of views to cryptocurrency pages vs total views on the platform.

Quote from Glenn Leese, Director of Growth, TradingView

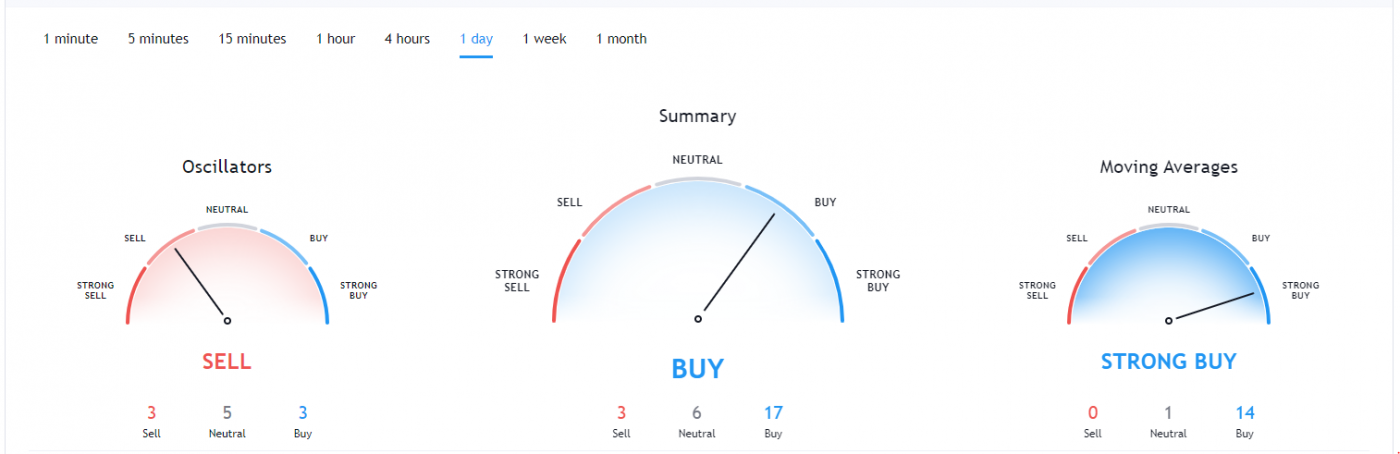

“These figures are aligned with the bullish attitude toward cryptocurrencies we’ve seen globally in recent months, with credibility of the asset compounded by institutional backing and elevated interest from established companies. This is a trend we’re likely to see continue here in the local market, with some traditional financial advisors now recommending that bitcoin be part of investment portfolios.

Additionally, the increased awareness of decentralised projects, like Ethereum and Ripple, are fuelling the uptake in altcoin adoption. It’s also suggestive of where the priorities of Aussie traders’ lie and a key indicator that confidence in cryptocurrencies as a whole is at an all-time high.

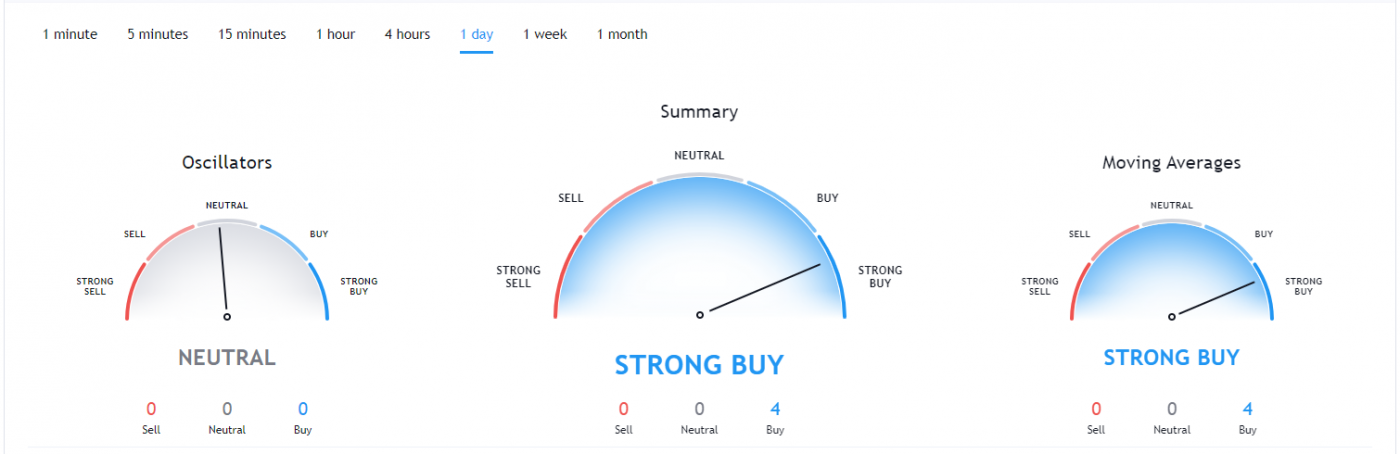

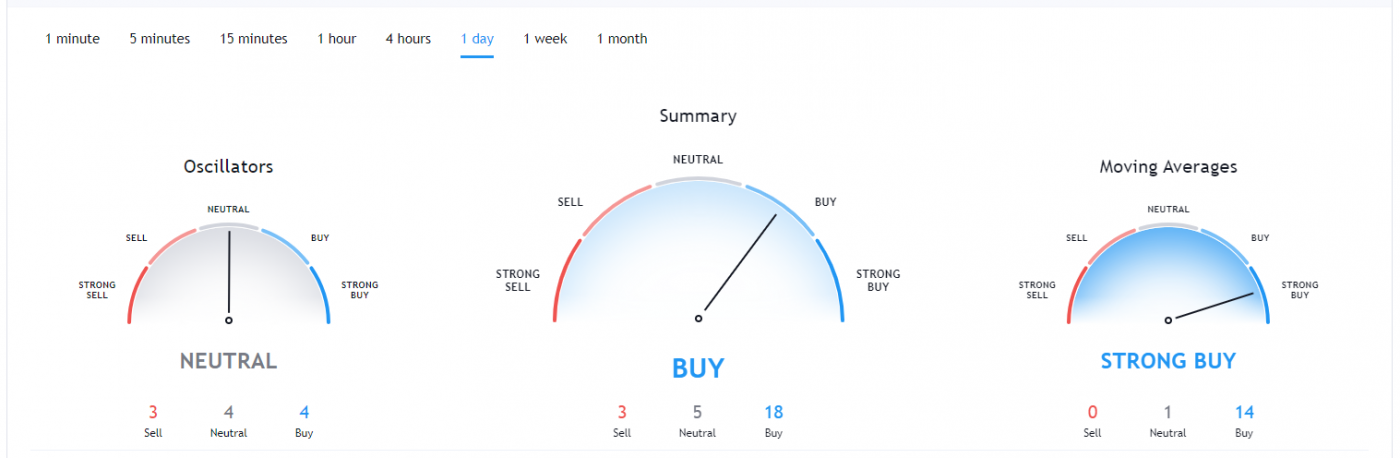

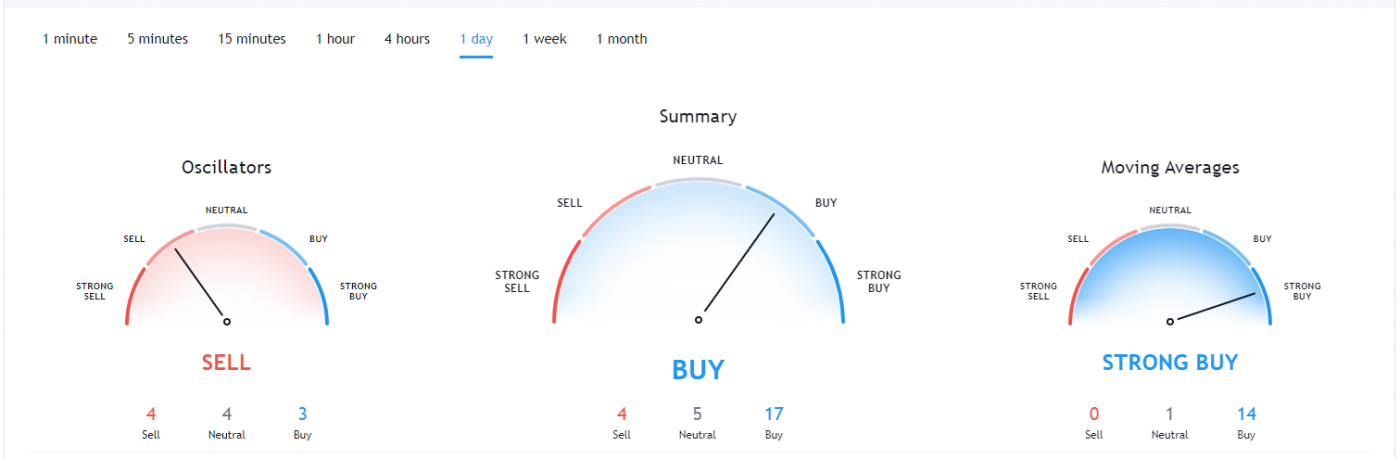

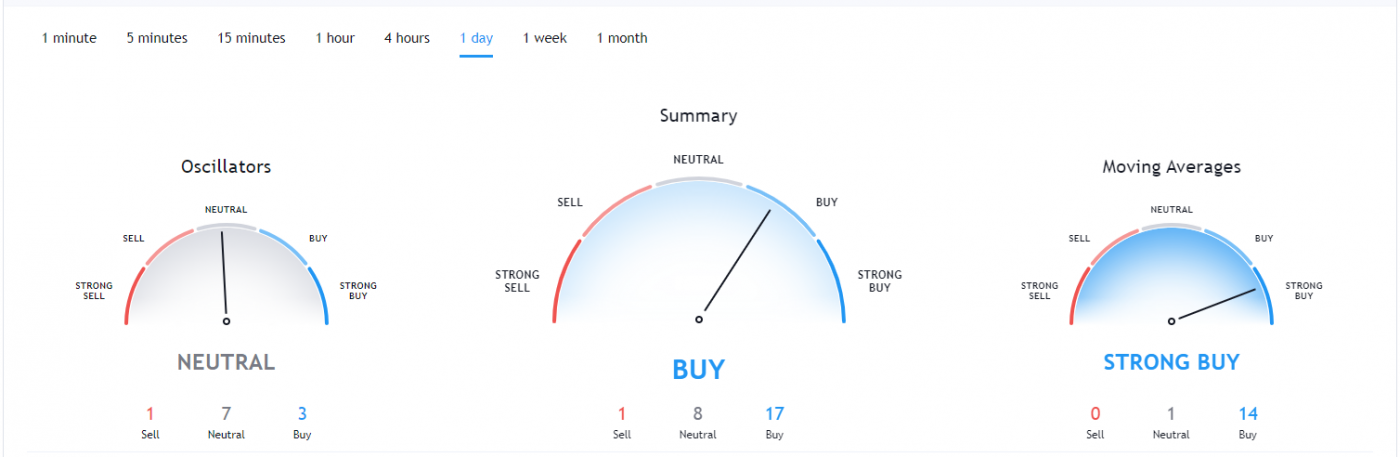

However, when choosing to invest in cryptocurrencies, it’s important that traders base their decisions on technical and fundamental data rather than on word of mouth. There has never been a more crucial time to do your own research and look before you leap.”

Methodology

All data was extracted from the TradingView platform, looking at Australian users’ activity between July 2020 and January 2021, which includes 230,000 registered users in February 2021, and 2.25 million unique visits from Australia in 2020.

About TradingView

TradingView is the world’s most popular network of traders and investors – powered by real-time data and market-leading analysis software. Use its platform to follow global assets, find trading ideas, chat with others, spot trends, and place trades directly with brokers. Have a look by visiting www.tradingview.com or downloading the free TradingView mobile apps for iOS and Android. For your website or business, visit www.tradingview.com/widget.