For today’s trading news, we’re looking at three altcoins that might breakout by showing bullish trends in the charts.

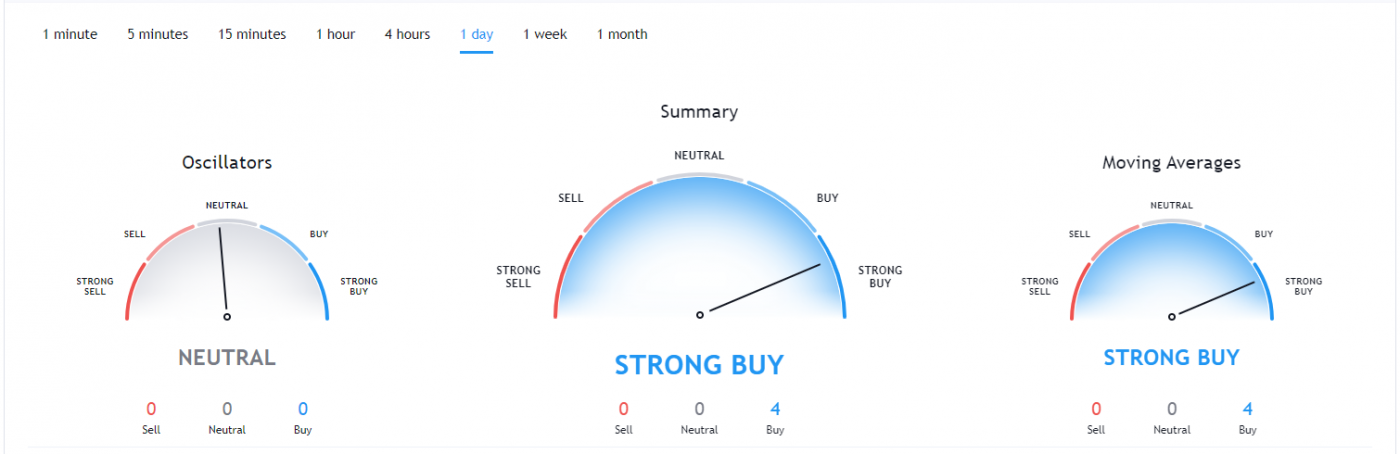

1. LISK (LSK)

Lisk (LSK), founded in early 2016 by Max Kordek and Oliver Beddows and headquartered in Zug, Switzerland, is a blockchain application platform that seeks to make blockchain technology more accessible to the masses. Lisk focuses on user experience, developer support, and in-depth documentation. Lisk’s SDK kit is written in JavaScript so as to allow developers to easily build blockchain applications on the Lisk blockchain and even deploy their own sidechain linked to the Lisk network. The open-source Lisk blockchain platform is powered by Lisk (LSK) tokens and operates under the Delegated Proof of Stake (DPoS) consensus model to allow for its network to be secured by democratically elected delegates.

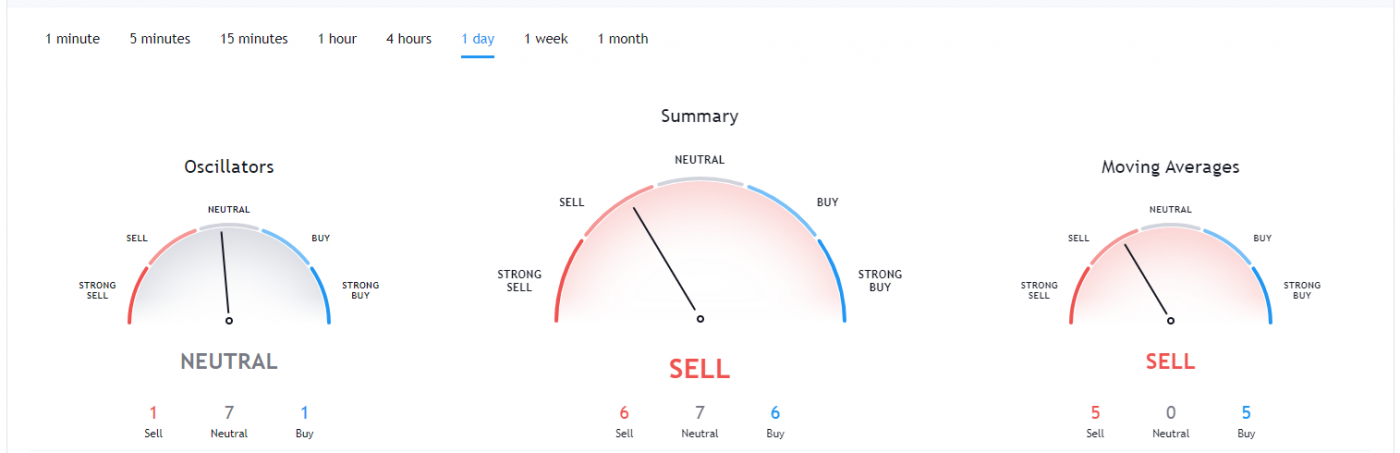

LISK Price Analysis

At the time of writing, LSK is ranked 86th cryptocurrency globally and the current price is $1.50 AUD. Let’s take a look at the chart below for price analysis.

After a November rally, LSK dropped to support near the 70.5% retracement during December. Currently, the price is accumulating at a significant monthly level after running stops near the weekly support at $1.34 AUD.

A Q1 2021 Altcoins season could make the current region an excellent entry opportunity for bulls, with any quick drops to the supports near $1.34 AUD and $1.27 AUD giving even higher risk-reward entries.

The relatively equal highs on the daily chart near $1.65 AUD provide a highly probable first target. If the price breaks the December monthly open, the relatively equal highs near $1.90 AUD provide the next target.

The swing high at $1.76 AUD provides a third target for an extended rally, although some resistance starting at $1.74 AUD could slow down bulls before reaching the fourth target near $2.35 AUD.

2. Tezos (XTZ)

Tezos is a blockchain network that’s based on smart contracts, in a way that’s not too dissimilar to Ethereum. However, there’s a big difference: Tezos aims to offer infrastructure that is more advanced — meaning it can evolve and improve over time without there ever being a danger of a hard fork. This is something that both Bitcoin and Ethereum have suffered since they were created. People who hold XTZ can vote on proposals for protocol upgrades that have been put forward by Tezos developers.

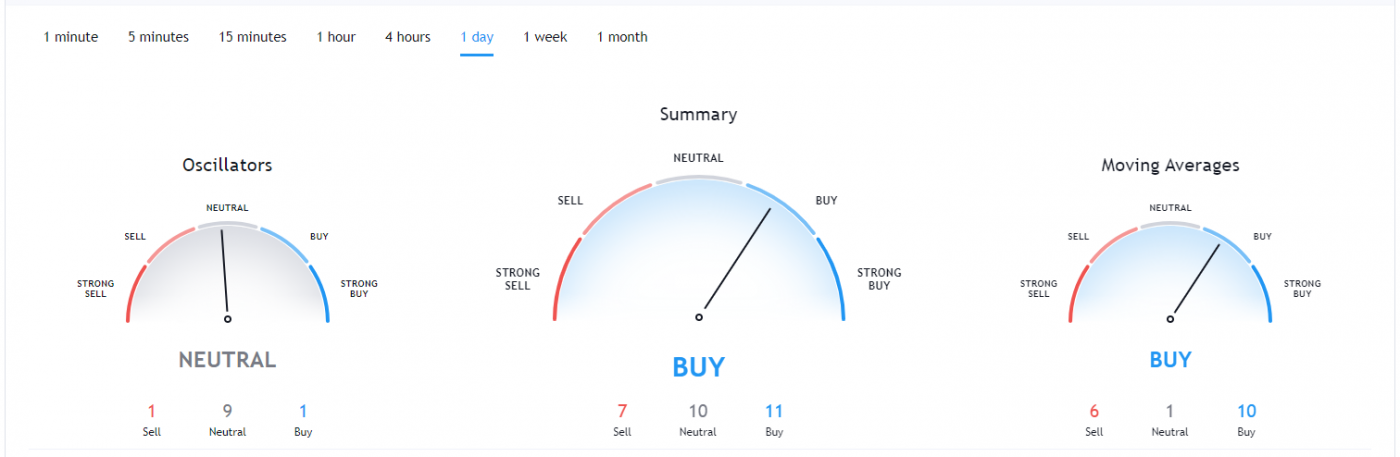

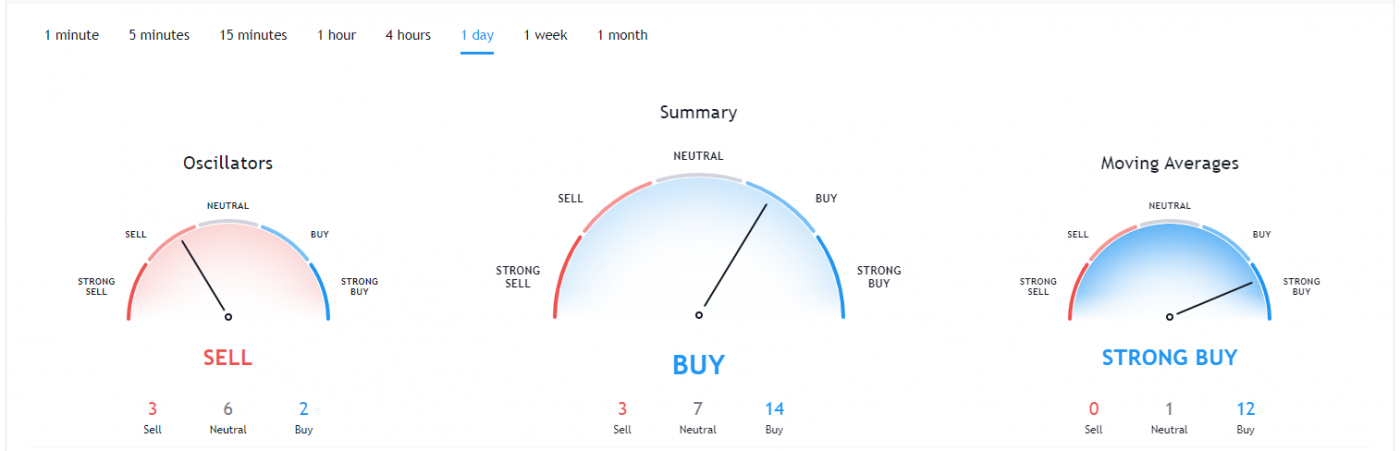

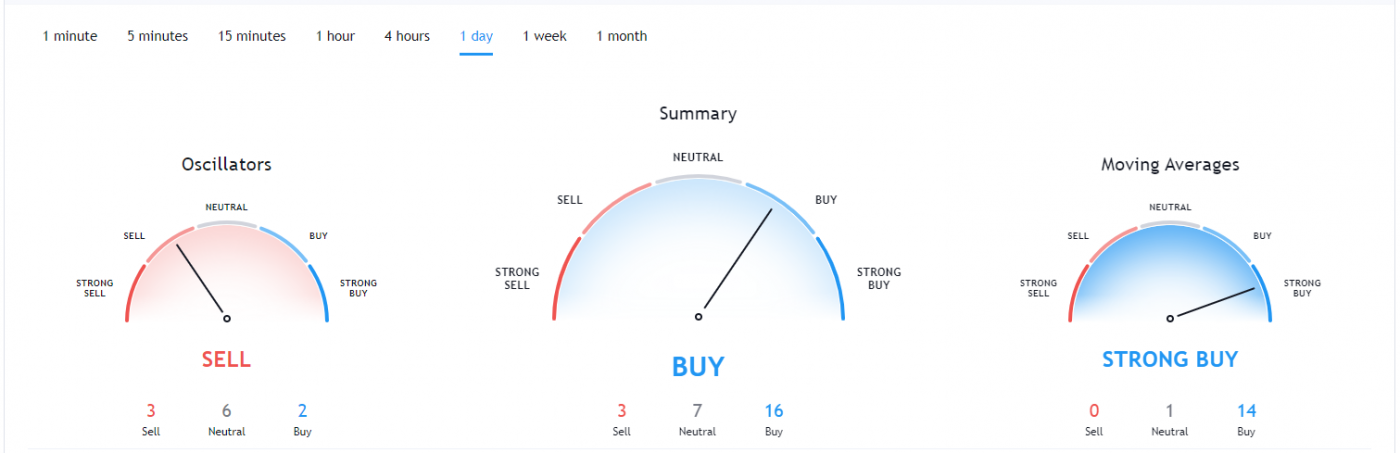

XTZ Price Analysis

At the time of writing, XTZ is ranked 19th cryptocurrency globally and the current price is $2.70 AUD. Let’s take a look at the chart below for price analysis.

Last week, XTZ swept stops below the Q4 support near $1.98 AUD before quickly bouncing into support between $2.25 AUD and $2.17 AUD.

The upward speed of this move back into support shows that buyers are eager to enter, suggesting that more upward movement might be coming.

If the price breaks resistance near $2.93 AUD, just below the monthly open, the equal highs near $3.14 AUD provide an appealing first target. Bullish continuation through the resistance beginning at $3.27 AUD would hint that the next target is the swing high near $3.56 AUD.

Beyond this target, the resistance beginning at $3.98 AUD could be strong enough to halt the bull run. If this resistance breaks, a parabolic rise through the highs might reach the mid-August.

3. Zilliqa (ZIL)

Zilliqa is a public, permissionless Blockchain that is designed to offer high throughput with the ability to complete thousands of transactions per second. It seeks to solve the issue of blockchain scalability and speed by employing sharding as a second-layer scaling solution. The platform is home to many decentralized applications, and as of October 2020, it also allows for staking and yield farming.

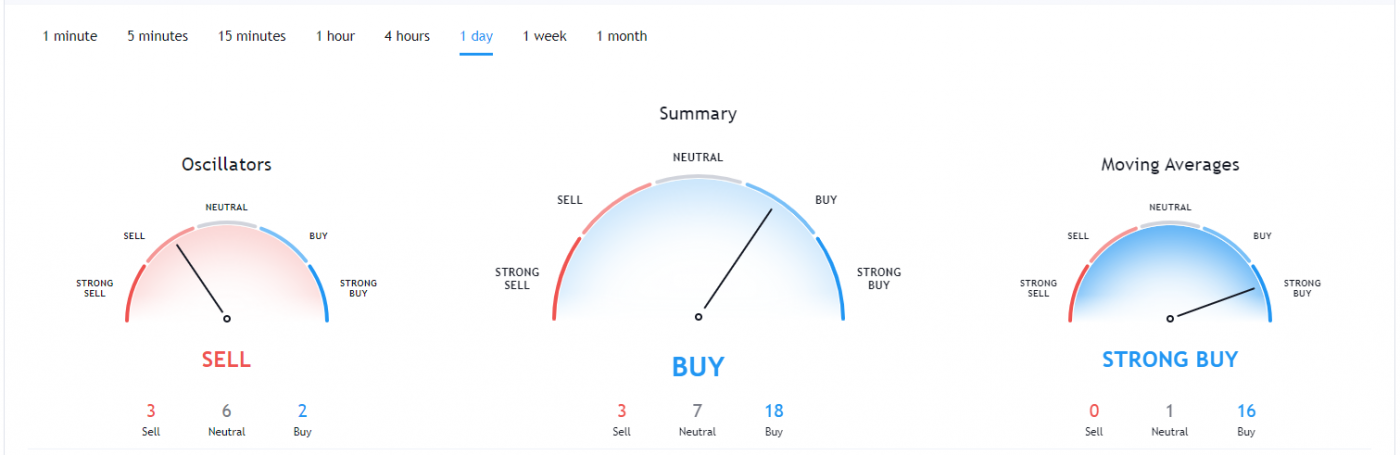

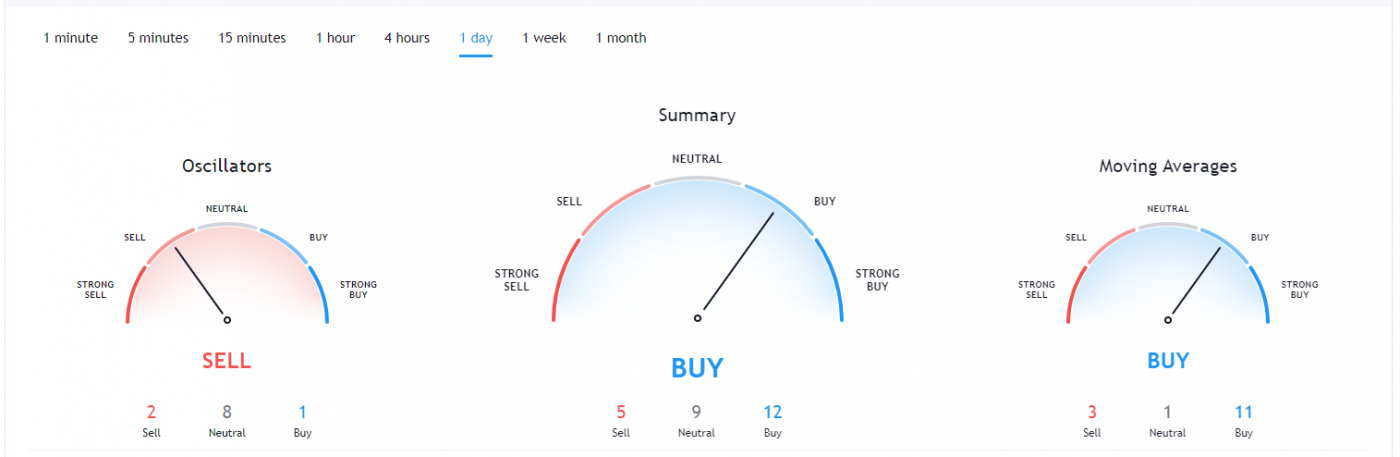

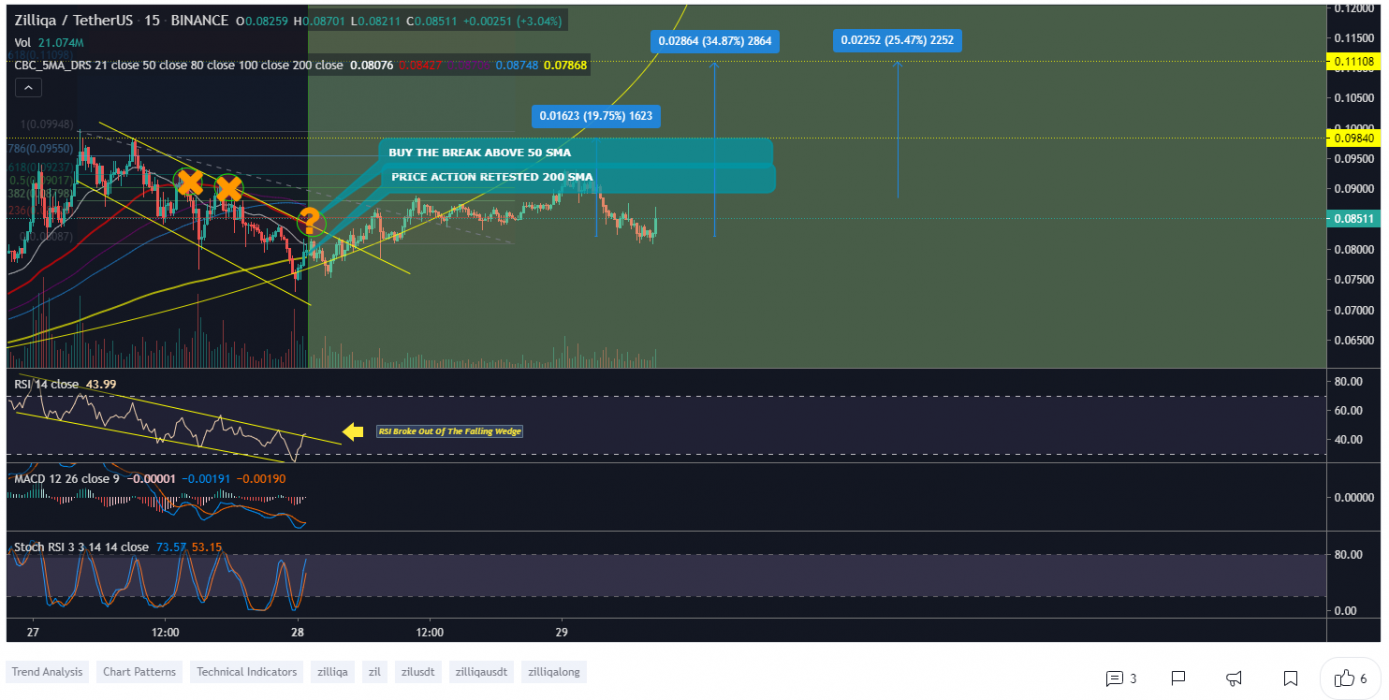

ZIL Price Analysis

At the time of writing, ZIL is ranked 34th cryptocurrency globally and the current price is $0.1286 AUD. Let’s take a look at the chart below for price analysis.

ZIL has already climbed over +275% since its December low, but altcoins sometimes run far beyond what most traders expect.

The price recently retested the 62% retracement of the last swing high and low on the four-hour chart, suggesting that some bulls are still looking for more upside.

If this retest proves to be the local low, overlapping extensions from this pattern and the December move point to the areas around $0.0988 AUD, $0.1421 AUD, $0.1645 AUD, and $0.1935 AUD being the next probable take-profit zones.

If the price instead drops below the weekly open to fill the daily chart gap, the range beginning at $0.0828 AUD could prove as support. More substantial support starts at $0.0621 AUD, while the consolidation preceding this bull run at $0.0543 AUD marks a likely re-accumulation zone.

Where to Buy or Trade Altcoins?

These 3 Altcoins have the highest liquidity on Binance Exchange so that would help for trading on USDT or BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.