Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

Since last week, the crypto market has been hectic! We lost another US$200 billion from the TOTAL crypto cap since last week’s analysis article, which is approximately 50% of what we forecast.

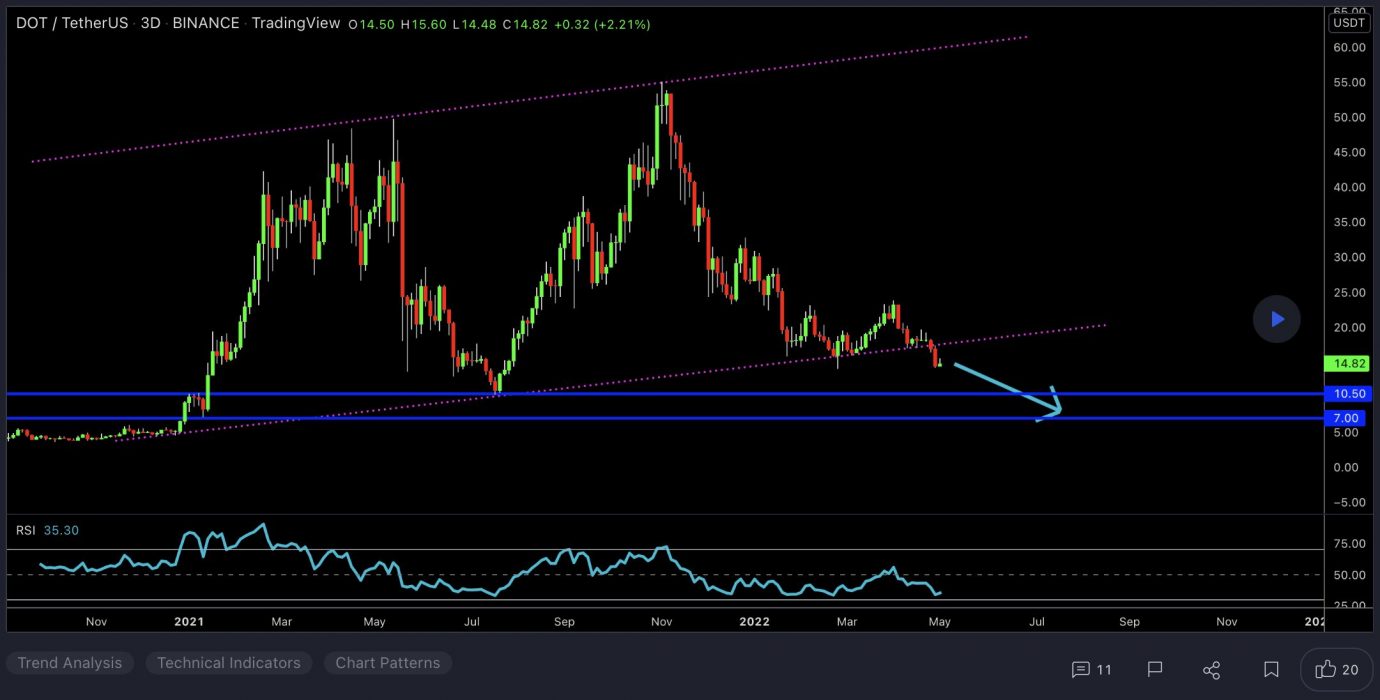

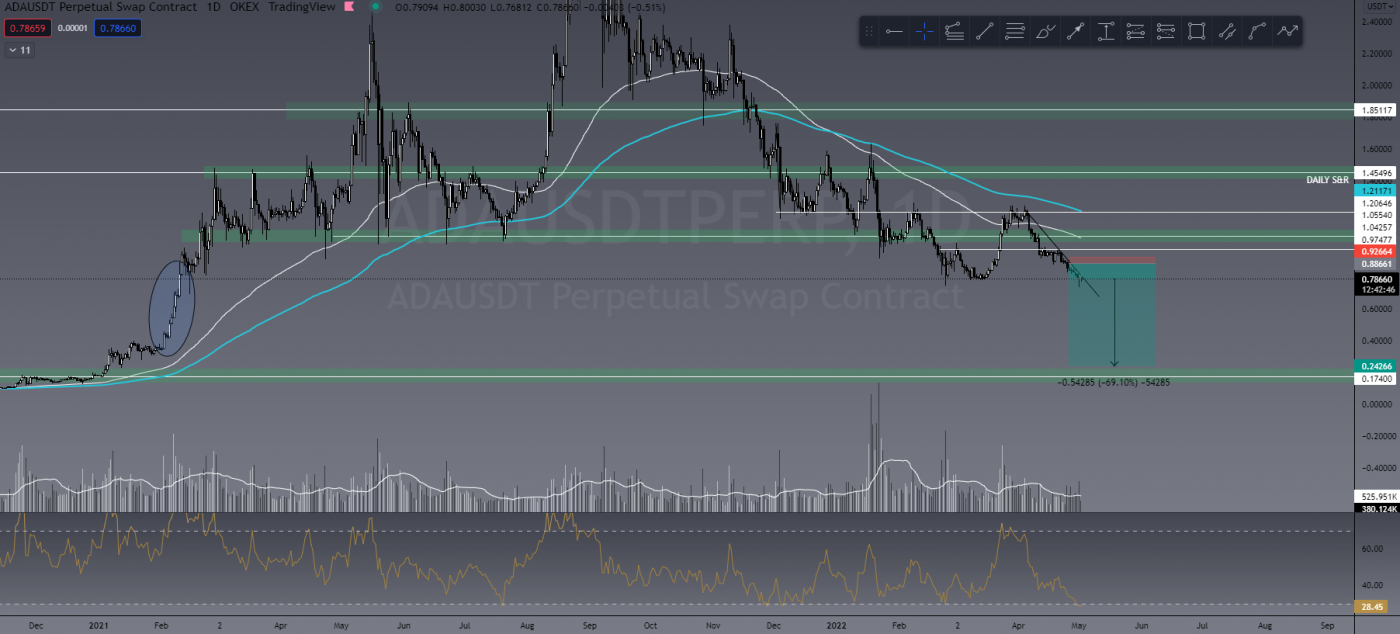

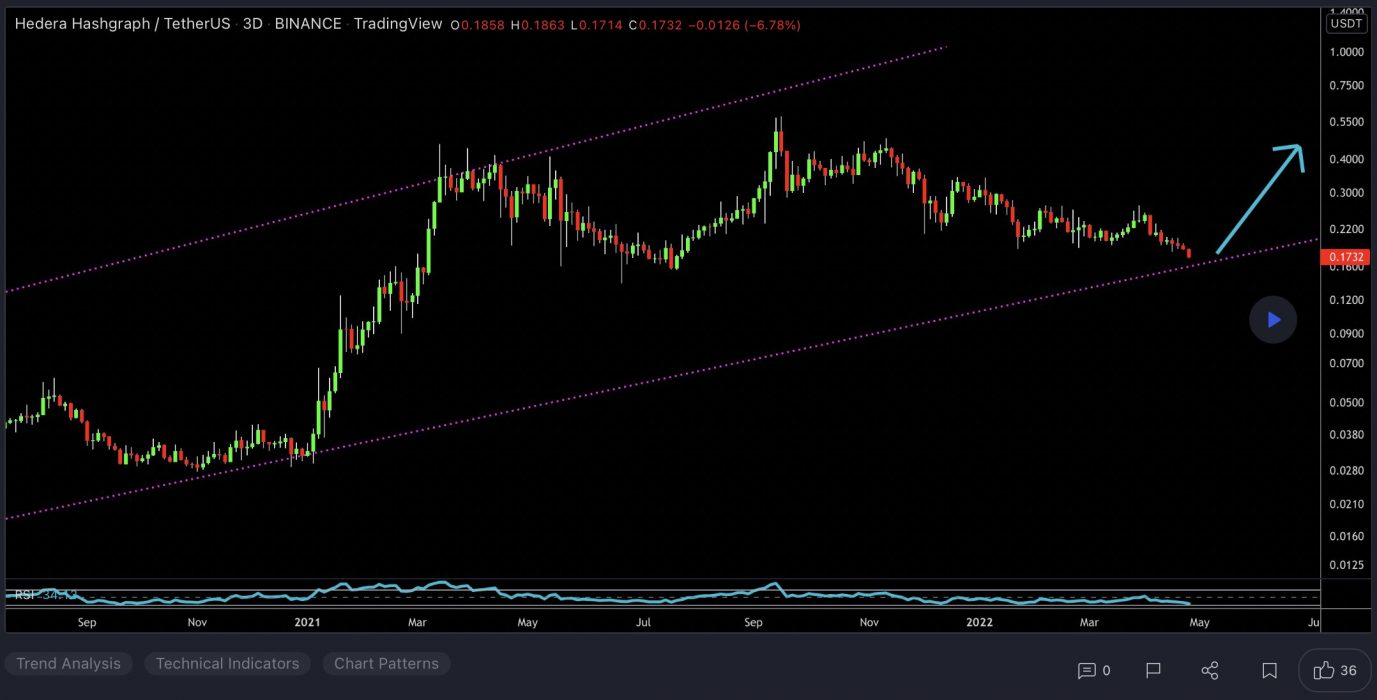

There may be some temporary support and relief but I feel the bloodbath is not over.

Bitcoin has hit target number 1 on the downside with absolute perfection! Take a bow! Now remember folks, I trade in both LONG and SHORT conditions so I’m allowed to be a little excited by this. Not only do we make profits on the way down but we also get to buy cheaper BTC! The bear flag is well and truly under way now. As I said above, we could see a bounce soon with a relief rally but I just don’t feel like the bloodbath is over yet. Nevertheless, I’m scaling in and buying more BTC just in case.

If this US$30,000 region of support breaks to the downside, things will get very scary for those who are yet to weather a crypto winter, with some price objectives seeking out US$23,000, US$20,000 and sub-US$20,000 targets.

If you’re in the red now, stay strong. I have 100% faith that BTC will again make ATH and exceed expectations. This may take some time but I’m confident it will happen if it follows my chart analysis.

Last Week’s Performance

Well, aside from nailing BTC short I’ll share two trades that played well last week. This is the reason we say, “Don’t buy big green candles in a bear market”. We wait for those relief rallies, then short, based on technical analysis alone.

ZIL/USDT

Managed to snag a cheeky short on ZIL in its recent pump. We identified that ZIL was moving against other ALTS, and BTC having seen its little rally, entering short on both daily resistance and 200/100EMAs. This position is still open and on a leverage of 10x, so sitting currently at 213% ROI with a target of 400%+.

DOGE/USDT

One trade I keep going back to is DOGE. I’ve seen the short potential on this for weeks, if not months, and it’s STILL looking good. Last week I was lucky enough to short the “Elon Effect”, positioning me better than I anticipated (thanks Elon!). A 10x trade is currently sitting at 340% ROI.

I still expect further downside to US$0.04 if we don’t bounce here.

This Week’s Trades

No new trades for me this week as my wife and I have just welcomed a beautiful baby girl into the world, but I will quickly share my thoughts on BTC for you.

IF BTC can rally here we could see some green over the next couple weeks, but that still wouldn’t mean the bear moon is over. It could just be yet another relief rally!

Breaking US$30,000 support before any rally occurs, there’s really not much stopping her going to US$20,000.

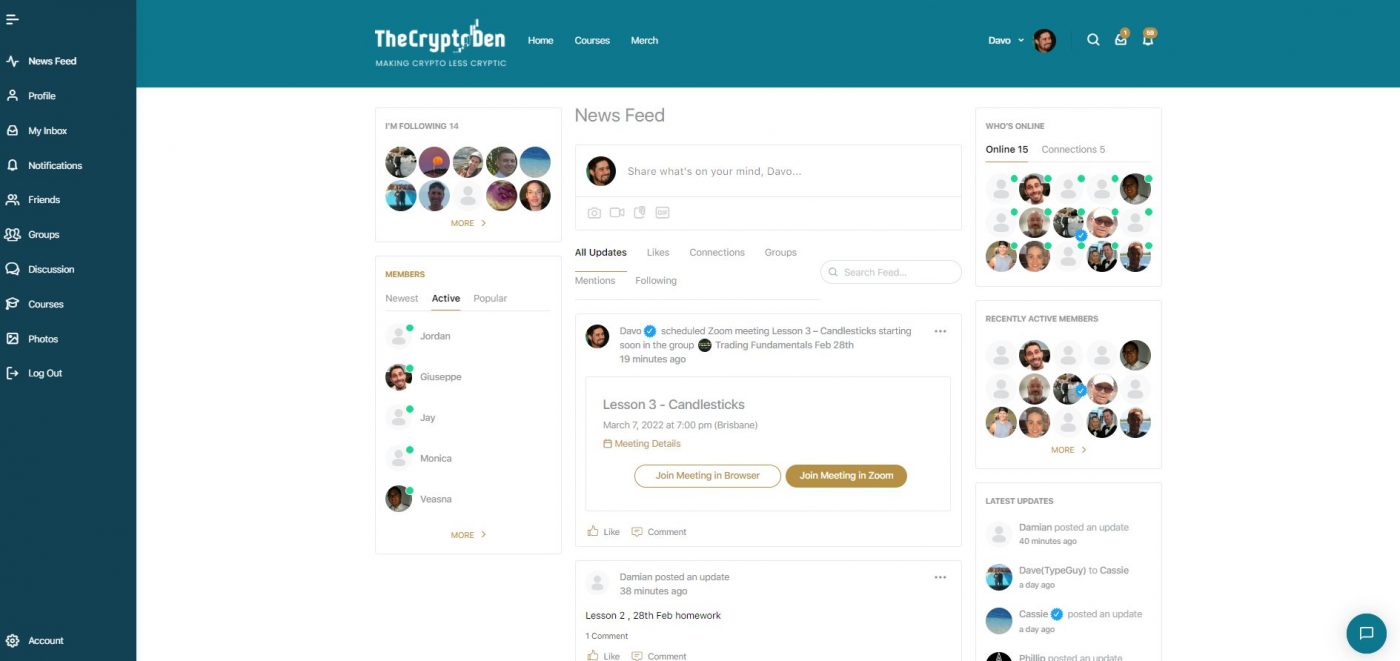

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trade chat, connect with like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

Are You a Trader?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom, you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!