Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. DigiByte (DGB)

DigiByte DGB is an open-source blockchain and asset creation platform. A longstanding public blockchain and cryptocurrency, DigiByte uses five different algorithms to improve security, and originally aimed to improve on the Bitcoin blockchain’s security, capacity and transaction speed. DigiByte consists of three layers: a smart contract “App Store”, a public ledger, and the core protocol featuring nodes communicating to relay transactions.

DGB Price Analysis

At the time of writing, DGB is ranked the 144th cryptocurrency globally and the current price is US$0.02628. Let’s take a look at the chart below for price analysis:

After retracing nearly 56% since the beginning of Q2, a 30% range has trapped DGB between $0.03449 and $0.02322 during April.

A consolidation near $0.02192, visible on the weekly chart, provided support on the last touch. This level could provide support again on a stop run under the $0.02015.

A deeper run-on stop at $0.01920 might reach the top of a higher-timeframe gap at the same level. However, a push this low reduces the chance of a new monthly high soon. Below, little significant support exists until $0.01713.

Higher-timeframe levels overlapping with a daily gap beginning at $0.02895 are likely to provide resistance, perhaps on a sweep of the equal highs near $0.03240. Breaking this resistance makes the relatively equal highs near $0.03755 and the monthly high at $0.03947 the next probable targets.

2. Waves (WAVES)

WAVES is a multi-purpose blockchain platform that supports various use cases, including decentralised applications (DApps) and smart contracts. The platform has undergone various changes and added new spin-off features to build on its original design. Waves’ native token is WAVES, an uncapped supply token used for standard payments such as block rewards. Waves initially set out to improve on the first blockchain platforms by increasing speed, utility and user-friendliness.

WAVES Price Analysis

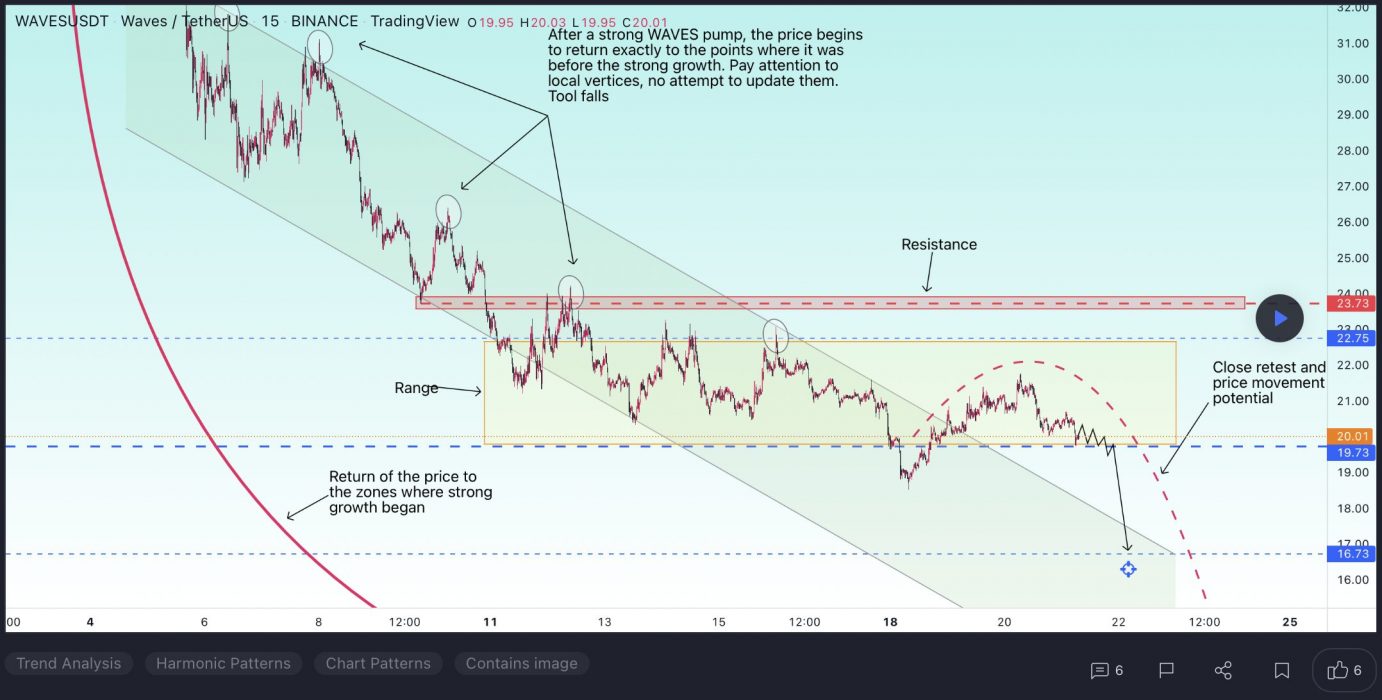

At the time of writing, WAVES is ranked the 52nd cryptocurrency globally and the current price is US$20.27. Let’s take a look at the chart below for price analysis:

During April’s high, WAVES‘ slight drop marks the current range as a reasonable area to expect accumulation.

The recent bearish flip of the 9, 18 and 40 EMAs might cause bulls to be less aggressive in bidding. However, possible support near $20.12 and $18.35 – between the 31.8% and 40.6% retracements – could see at least a short-term bounce.

Long-term consolidation suggests that the areas near $29.45 and $34.61 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $28.77, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $32.42, the start of the bearish move.

3. VeChain (VET)

VeChain VET is a blockchain-powered supply chain platform. VeChain aims to use distributed governance and Internet of Things (IoT) technology to create an ecosystem that solves some of the major problems with supply chain management. The platform uses two in-house tokens, VET and VTHO, to manage and create value based on its VeChainThor public blockchain. The idea is to boost the efficiency, traceability and transparency of supply chains while reducing costs and placing more control in the hands of individual users.

VET Price Analysis

At the time of writing, VET is ranked the 35th cryptocurrency globally and the current price is US$0.06087. Let’s take a look at the chart below for price analysis:

VET‘s 65% move during late March ran into resistance near $0.08120, at the 27% extension of the Q1 swing.

An old high and the 18 EMA have provided support near $0.05833 and may give support again on a retest. This area also has confluence with the 50% and 62.8% retracements of November’s swing.

Just below, near $0.05493, the 55.8% retracement of the current Q1 swing might also mark an area of support.

If the market turns bearish, $0.05072 is unlikely to be revisited but could see interest from bulls during any deeper retracement.

An area near $0.07418, at the 50% extension of the last week swing, could see some profit-taking if bulls break the current resistance near $0.07978. Above, old consolidations near $0.08425 and $0.08872 may also provide some resistance before another round of price discovery.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.