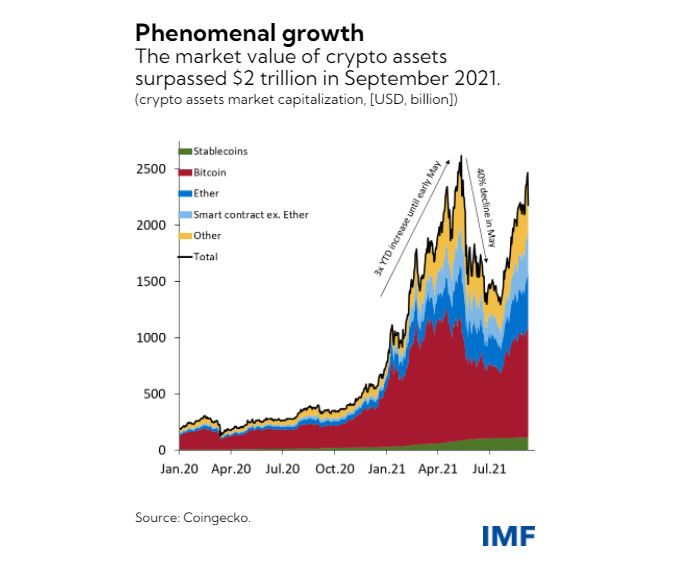

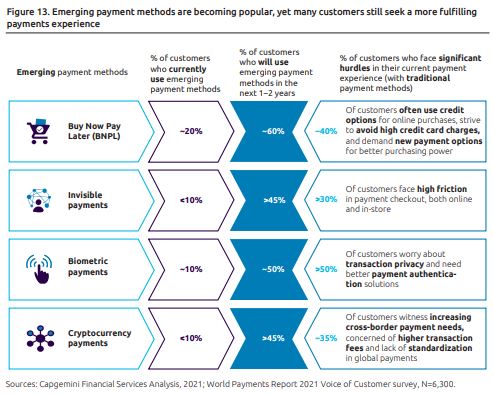

According to a report on worldwide payments by the Capgemini Research Institute, the global leader in independent analysis, the payment industry “faces intensifying, multi-dimensional disruption” with next-gen payment methods like cryptocurrency increasing to 45 percent usage within the next two years.

Capgemini surveyed customers and industry stakeholders to provide an overview of the current global payments landscape. The research team analysed statistics from the Bank of International Settlements, the European Central Bank, the International Monetary Fund, the World Bank, and other central banks.

The report details how payment networks aim to become faster and more cost-effective. Capgemini predicts nearly 45 percent of customers will use the cryptocurrency payment method within the next one to two years due to the growing need for cross-border payments in addition to concerns about high transaction fees.

Newfound Payment Technology Drives Regulators to Mitigate Risk

The study states that the outlook for cryptocurrencies and stablecoins is “hazy”, citing the mixed reactions to crypto assets by governments and regulators around the world.

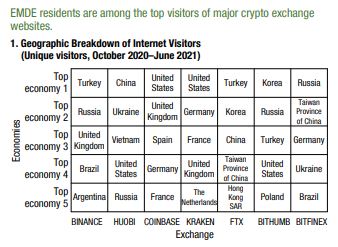

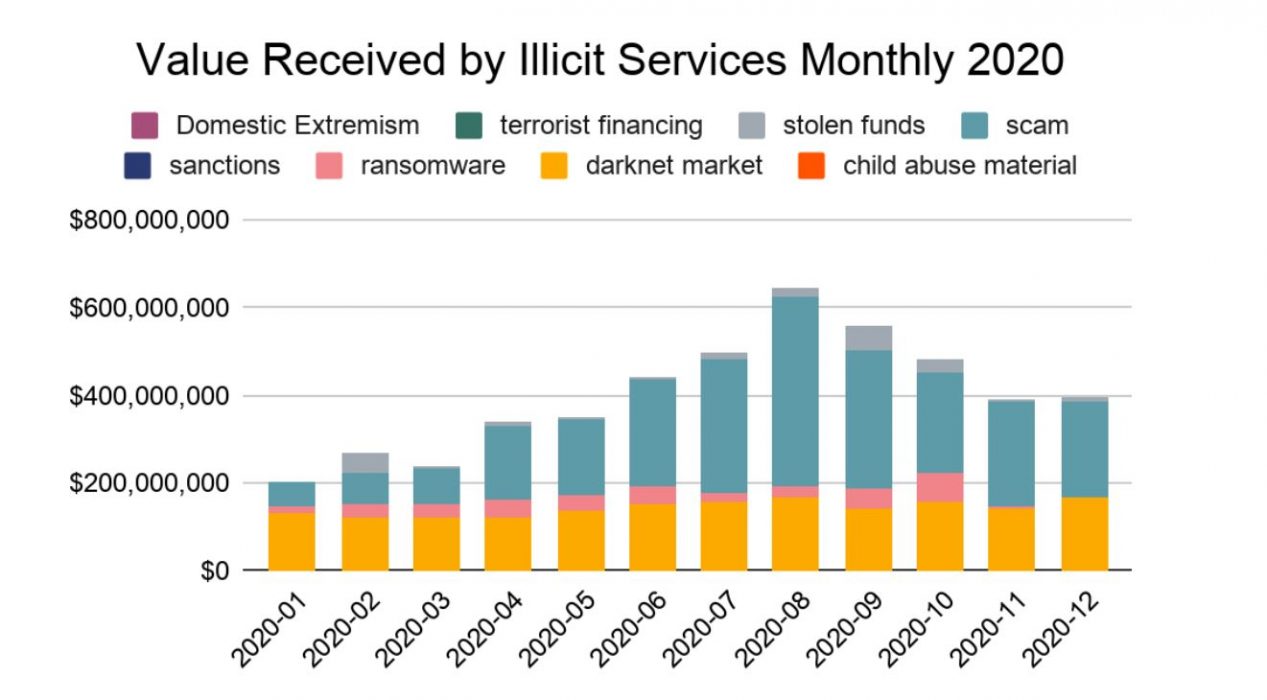

According to the report, regulators are focused on Key Regulatory and Industry Initiatives (KRIIs), which recently have been centred on customer protection and risk mitigation for new payment methods. The nature of cryptocurrency means there are very low barriers to entry – anyone, knowledgeable or not, can use the technology, creating a potential financial risk to novices as well as exposure to illicit financial activity.

Capgemini reported that Russia, India and the United Arab Emirates see potential in the adoption and regulation of crypto assets and stablecoins. Meanwhile, the study also noted other countries such as China and Egypt have moved to ban crypto assets due to the rising risk of illicit transactions.

CBDCs as an Alternative to Private Cryptocurrencies

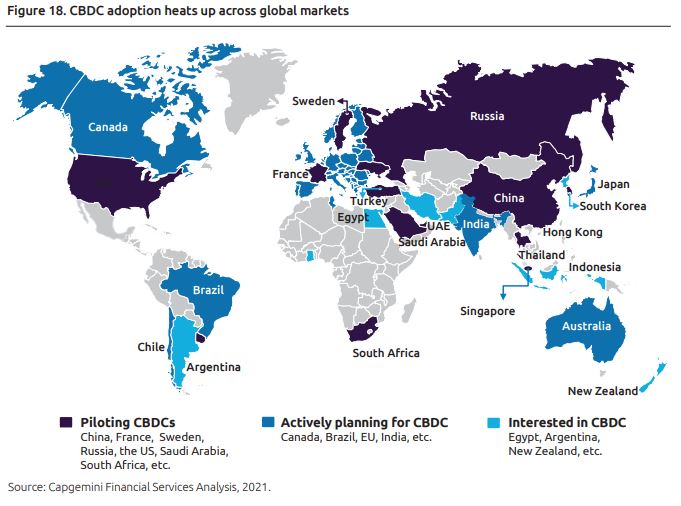

Central banks want to leverage blockchain technology such as smart contracts in order to better manage monetary policy functions like money supply, interest rates, and direct stimulus payments to individuals. Therefore CBDCs have become a trending topic for banks and regulators alike.

CBDCs aim to facilitate frictionless payments and create a gateway for the unbanked to join the digital economy as the payments landscape evolves. Considering the potential benefits of CBDCs, several central banks have started experimenting with the technology.

Currently, the main challenges for CBDCs are that the ecosystem requires collaboration with payment infrastructure companies and various other entities. With the current hype and speculation, it’s important that the necessary action is taken with regards to “implementation, migration, tax structures, settlement speed, governing regulation, integration of players, and checks and controls”.

If introduced, retail CBDCs should be developed and implemented through public/private sector collaboration from the start to ensure that deployment complements other payment methods and leverages payment service providers’ expertise, market knowledge, and customer relationships.

Etienne Goosse, director general, European Payments Council, Belgium

It may yet take years for the CBDC concept to transition to reality, according to the Capgemini study:

It’s too soon to count on nascent central bank digital currency (CBDC) as an alternative to unregulated cryptocurrencies or an additional pathway to financial inclusion.

Capgemini Research Institute

Crypto Credit Cards Spurring Adoption

Currently, major names including PayPal, Yum brands and Coca-Cola accept payments in crypto, but a major driving factor is crypto-linked cards “fuelled by global card player initiatives to create a fertile crypto-payment ecosystem”.

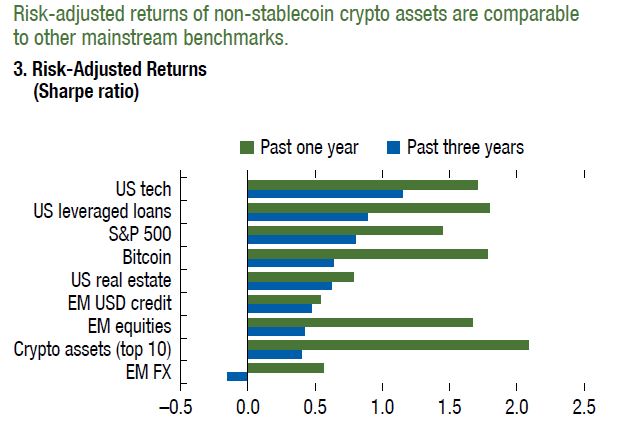

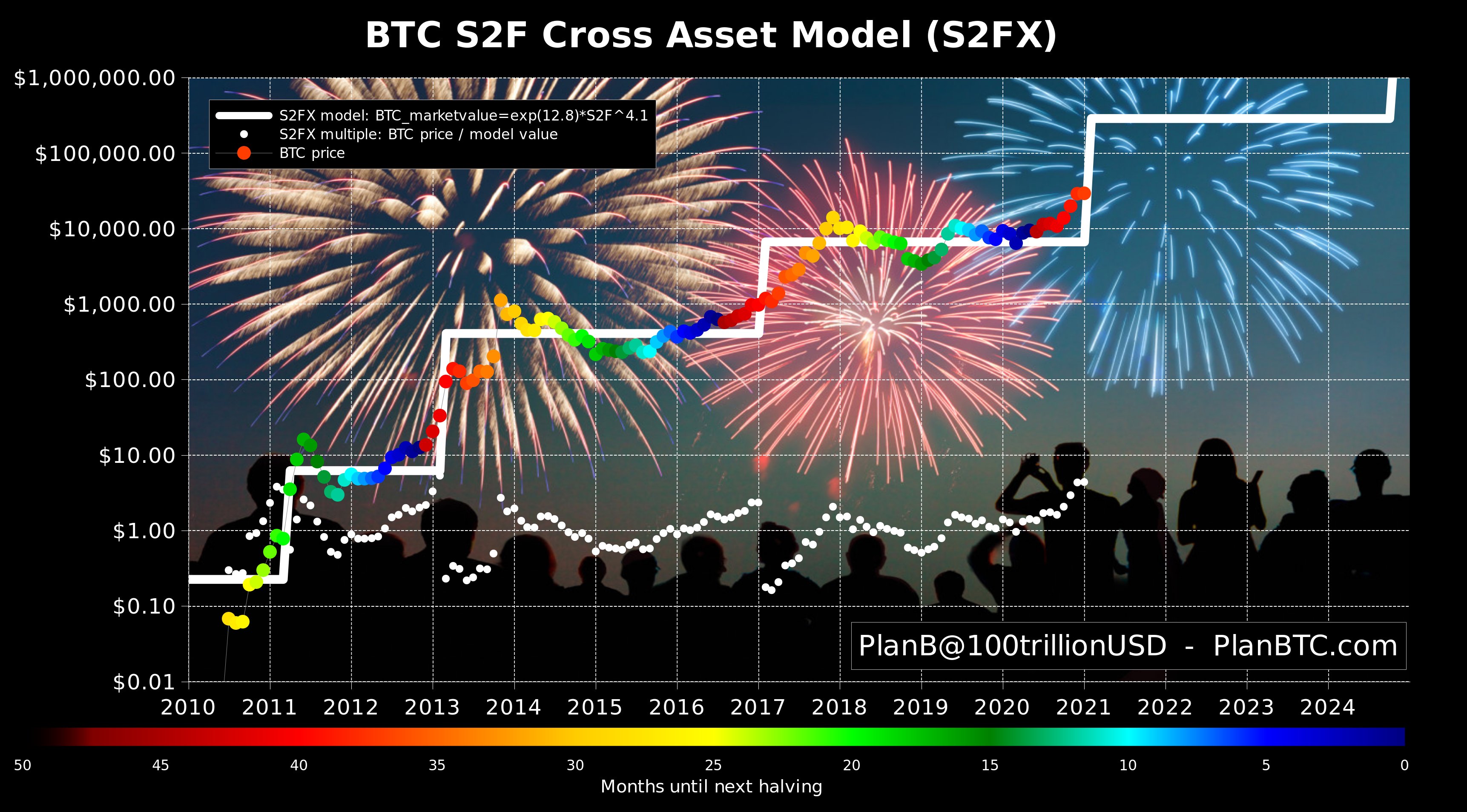

Cryptocurrency market volatility indicates a lack of maturity. Still, crypto-linked cards are taking the lead in the crypto-payments space.

Capgemini Research Institute