Australian Analyst Matt Harcourt of Apollo Capital, the country’s leading crypto-asset investment firm, recently spoke to DMARGE about crypto trends in 2021. While the discussion focused largely on Bitcoin (BTC), it’s Ethereum (ETH) that’s making headlines today after securing a new all-time high (ATH) above its previous record of AUD$1,850 (US$1,420).

Ethereum was one of the best-performing assets of 2020, gaining over 800% in value throughout the year. After starting the year at the extremely low price of AUD$166, ETH has steadily climbed to its new ATH, only suffering a brief dip during the early days of the COVID-19 outbreak.

In mid-2020, a thriving decentralized finance (DeFi) market emerged that was largely developed on Ethereum’s ERC20 protocol. Although DeFi had a somewhat bumpy start with several projects collapsing or exit-scamming, it nevertheless helped to boost Ethereum’s price and should continue to do so into 2021. 24-hour volume on the Ethereum network has also seen extreme growth this year, peaking at $140 billion on January 4.

Harcourt believes there is room for more growth going into 2021, citing a ‘broken’ financial system that will help boost interest in cryptocurrencies.

“…there is a ‘broken’ (I use that word loosely) financial system that will inevitably be replaced by the more open, fair and efficient system that is Bitcoin and blockchain technology (Ethereum, Decentralised Finance),” he told Australian news outlet DMARGE.

However, he noted that now may not be the best time to buy as prices are very high. “A good time to enter the market may come in 1, 2 or 3 months as I think Bitcoin will end 2021 at a higher price,” he said. It looks like he might be right, as other market indicators are suggesting a possible retrace from the current overbought level.

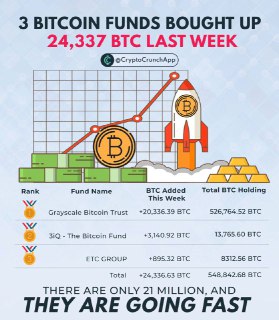

The supply of Bitcoin on exchanges is currently at the highest its been in nine months, suggesting traders are getting ready to sell. With Bitcoin already up by a massive 25 percent just in 2021 alone, buying power must surely start dissipating soon. Even the institutional interest that drove Bitcoin to new highs through late 2020 is beginning to wane, and retail investors appear to be diversifying into altcoins.

Over the past 24 hours, smaller-cap cryptocurrencies like AAVE, ATOM, and MIOTA have all enjoyed gains of between 7 to 12 percent. In the same period, Bitcoin has seen barely any change at all, suggesting that this record-breaking month-long rally that saw it double in price may finally be exhausted.