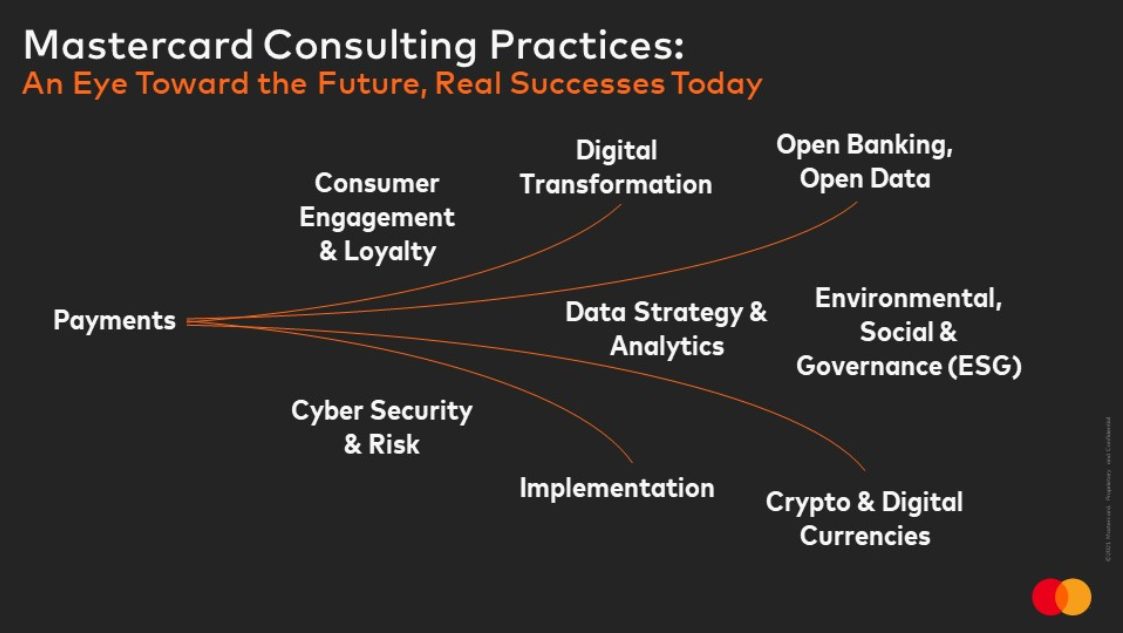

Mastercard has announced plans to cater to open banking, ESGs, open data, and crypto and digital currencies, by expanding its payments-focused consulting service. It is believed the move may help it develop central bank digital currencies (CBDCs), which has been met with contempt from the industry.

Mastercard Sets Eyes on the Future

In a February 15 press release, Mastercard announced new offerings, directed at banks and merchants, intended to cover crypto and NFT strategies, along with loyalty programs and crypto cards.

Mastercard is also exploring the possibility of developing CBDCs, having previously expressed interest in the potential of digital currencies by working on crypto cards for BitPay and Wirex.

Raj Seshadri, Mastercard’s president of data and services, has said that payments are only the beginning, and that the company will continue to help its clients “understand and navigate” the challenges and opportunities thrown their way.

This evolution of consulting is in recognition of the changing world and of our changing business. It’s about helping customers navigate today’s challenges and anticipating what’s next.

Raj Seshadri, Mastercard’s president of data and services

While consulting efforts are set to cover topics from early-stage education to bank-wide crypto and NFT strategies, those within the industry are not so sold on the idea of CBDCs:

Securing its Place in the Industry

In mid-January, Mastercard solidified a partnership with crypto exchange giant Coinbase, which seeks to enable easier NFT purchases for users. And, in late 2021, the company secured a deal that enables consumers to buy, sell and hold assets through the crypto trading platform Bakkt.

By Lauren Claxton, Crypto News Guest Author