Mastercard announced Monday that it is extending its partnership with cryptocurrency trading platform Paxos to create a program to make it easier for banks and other financial institutions to offer crypto trading services to their customers.

The program, called Crypto Source, will see Mastercard act as a bridge between Paxos and banks, with Paxos providing cryptocurrency trading and custody services on behalf of the banks.

Partnership Aims to Increase Retail Confidence in Crypto

Mastercard said its role in Crypto Source is largely about creating a secure, trusted bridge between crypto markets and traditional banking. By providing this bridge Mastercard hopes to increase both banks’ adoption of crypto trading services and retail investors’ confidence and willingness to engage with crypto markets. Mastercard’s President of Cyber & Intelligence Ajay Bhalla explained:

“At Mastercard, trust is our business. What we are announcing today is a connected approach to services that will help bring users safely and securely into the crypto ecosystem. Our recent investments in this space, such as the acquisition of CipherTrace and Ekata, are providing us with a unique set of capabilities to help provide our customers and consumers with the most technically advanced solutions available in the market.”

Ajay Bhalla, President, Cyber & Intelligence at Mastercard

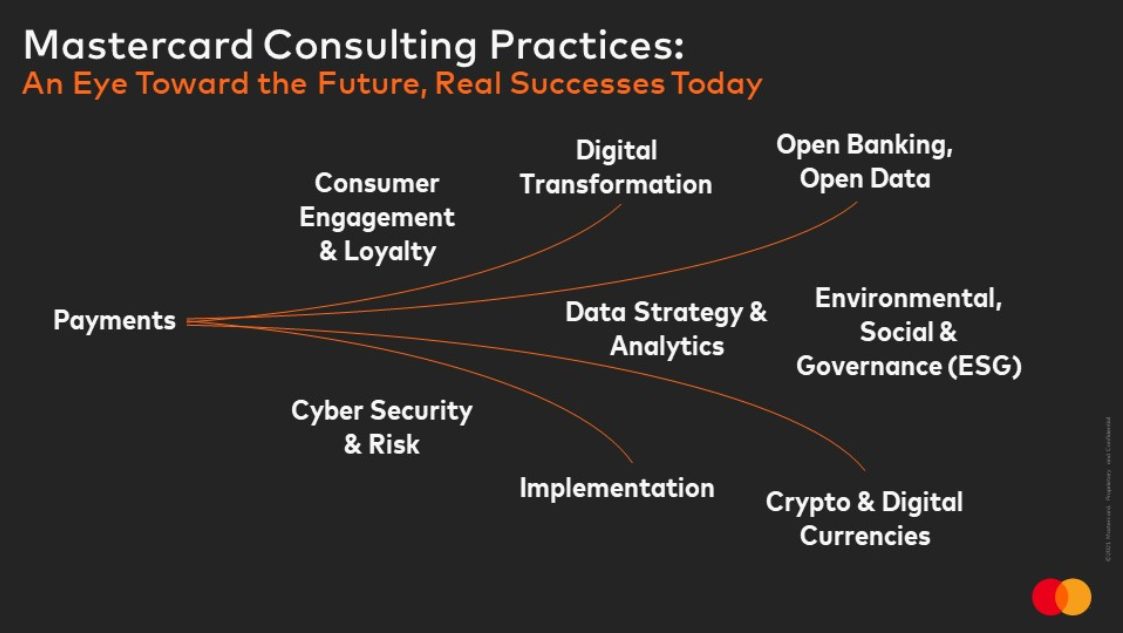

Mastercard’s role centres around verifying transactions, ensuring security and regulatory compliance, and helping banks implement the technology into their existing systems. Mastercard said banks would also be able to offer additional functionality, such as digital receipts and loyalty programs, to augment the core functionality.

Program Deepens Mastercard’s Links With Paxos

Paxos is a blockchain-focussed company perhaps best known for their gold-backed cryptocurrency PAX Gold (PAXG), which has worked with numerous large finance companies, including PayPal, on crypto-related projects.

Last year, Mastercard worked with Paxos to enhance its payment card offerings, making it easier for its partners, such as banks and crypto exchanges, to convert cryptocurrencies into fiat currency.

Crypto Source builds on Mastercard’s pre-existing relationship with Paxos and deepens its involvement in crypto ecosystems. Speaking about the relationship, Mastercard’s Chief Digital Officer, Jorn Lambert said:

“We’re excited to build on our long-term partnership with Paxos – co-innovating to bring safe and secure technology to financial institutions. Our crypto product innovations will provide choice at scale and continue to bring one-of-a-kind opportunities to financial institutions as they seek to offer new, advanced services to their customers”

Jorn Lambert, Chief Digital Officer, Mastercard

According to Mastercard, Crypto Source is currently in a pre-pilot phase, the company has not yet announced a date for a broader rollout of the program.