A crypto collateral loan is perhaps one of the newest loan types to hit the peer-to-peer crypto lending scene. Emerging cryptocurrency loans services allow any crypto holders to become either the borrower or the lender, offering you the opportunity to bring utility to dormant funds or wallets.

Crypto loans Australia do not operate identically to bank loans; rather, these loans can be carried out through a blockchain platform. Essentially, the borrower offers their crypto as collateral for a loan, which the lender will then deposit to provide the loan funds.

Many of the available marketplaces for these transactions permit borrowers and lenders to search through each other’s offers for the best deals. Using crypto as collateral allows lenders to offer low loan to value ratios (LTVs); therefore, there will be plenty of collateral in circulation even if the market were to fall.

We have compiled a list of the top 10 crypto collateral loan services in Australia, to help you identify some of the best options in circulation.

1. FiFit

FiFit describes its service as ‘crypto-backed business solutions’. This company is looking to work with businesses that seek access to extra cash without selling off their assets. FiFit’s process involves validating the company profile and cash requirements against their lending criteria and then providing a secure address for your crypto transfer.

To qualify, you will need to be an active Australian registered company with appropriate bitcoin backed assets. If you qualify, applications can be placed online 24/7.

2. Oasis

Oasis is a lending platform that is willing to trade with multiple cryptocurrencies. However, the notable aspect of Oasis is its use of Dai. Dai is described as a ‘smarter digital currency for everyone’. As its value consistently tracks that of the US dollar, Dai claims to be less volatile than other digital currencies on the market.

The Dai wallet operates on the Ethereum blockchain. To complete transactions, you will require ‘gas’, which is an ETH fee – this fee is sent to the miners who maintain the Ethereum blockchain.

3. Compound

There’s no better way to describe Compound than how it describes itself. Compound is an ‘algorithmic, autonomous interest rate protocol’ designed to enable developers to access a plethora of financial applications. Compound is managed by a decentralised community of people in possession of $COMP tokens. It allows you to borrow from many digital currencies, including Ether and Dai.

On the Compound website you can see the market overview, including the top-performing currencies. You can also view the total supply volume and the total borrow volume. When you borrow or lend, you are contributing to the ‘liquidity pool’ rather than borrowing or lending to an individual.

4. Aave

Aave’s liquidity protocol has a similar feel to that of Compound. Described as being open-source and non-custodial, Aave allows its users to earn interest on their deposits and borrowing assets. You can borrow from a handful of digital assets, whether they are stablecoins or altcoins. Putting your assets into the liquidity pool allows users to earn a form of passive income from the repaid interest.

The interest rate on an asset that is in low supply is likely to be higher than that of more readily available assets. To borrow, the collateral you put down in exchange must be of an equivalent loan amount.

5. Alchemix

If you’re looking for a creative take on a crypto collateral loan, Alchemix has a fantasy-type feel to its platform. The trailer for this lender has a very magical vibe, as do the services it is offering. Alchemix is bringing you the opportunity to spend and save simultaneously, as these loans ‘repay themselves’ over time.

Alchemix has big plans for progression, so much so that one of its eventual plans is to create a recipe book for new users. This should outline various yield strategies that vary by risk to ensure a smooth path to generating good returns.

6. Binance

Binance is already a big name in the crypto world, and it is continuing to thrive in the field of crypto loans. Providing you are a registered Binance user, you can start borrowing. The loan terms are measured in days, ranging from a seven-day turnaround to 180 days. However, as interest is calculated on the hours you borrow for, paying in advance could be beneficial.

Binance Loans supports several collateral options; however, what you can borrow and what you can use as collateral may vary, so ensure you check the full list.

7. Nebeus

Nebeus is helping you use your crypto to fund daily expenses for more costly ventures, rather than requiring you to sell your assets for more money. Helping you to ‘bridge your crypto and your cash’, Nebeus lets you go beyond just loans. The platform also offers services such as cryptocurrency insurance, a crypto exchange, and crypto renting.

The crypto you put down for a loan can be insured by a $100 million policy, meaning you can have peace of mind that your deposit is safe. Alternatively, you can rent your crypto to the service and earn passive income from this.

8. Helio

Helio is the lending service boasting the widest array of deposit options and loan structures on the market. Helping you to shop around for the loan that will fit you best, Helio has some unique points of interest. One of these is crypto solutions to home ownership, meaning if you’d like to put crypto down as a house deposit, you can.

Helio is also offering the potential to use real-estate NFTs as loan collateral. There are a variety of options available and, at the end of the day, you will still own any crypto you put down as collateral.

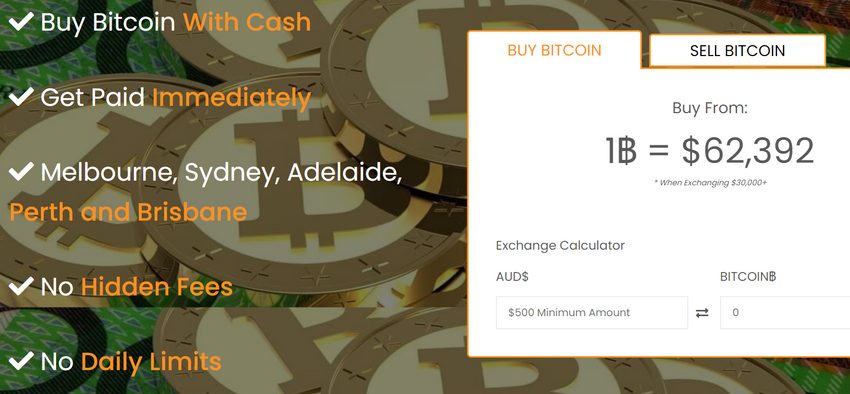

9. Bitcoin Dealers

When it comes to crypto loans Australia, Bitcoin Dealers can help you leverage your crypto for a loan that meets your needs. Despite having Bitcoin in their name, these guys will buy and sell with a handful of the major cryptocurrencies. Another cool aspect of this company is that you get the option to get off the computer and visit them in-branch if you wish.

Bitcoin Dealers will only lend to companies or sole traders. However, if you are an individual looking to sell your crypto, you can bring it to these guys in exchange for cash.

10. Matias Group

For approval within 24 hours and the quick transfer of funds, you may want to investigate Matias Group. Not only are its services claimed to be fast, it also has a particularly handy tool on its site – a loan calculator. To use this tool, you’ll simply need to input the amount you’d like to borrow, your loan term, and the currency you’ll be using as your asset.

From there, the calculator will tell you your LTV and the amount of your digital asset you will need to provide. It will also provide some rough estimates for your monthly and total interest, helping to highlight exactly what you can expect from your loan.

Conclusion

There are several pros and cons when considering a crypto collateral loan you should consider, there are very few strings attached, they often don’t require a credit check, and can grant fast access to cash. However, crypto-backed loans also can be more volatile, some offer poor rates for borrowers compared to traditional finance options, you might get margin called, and there might be a higher risk of encountering a scam.

Crypto loans Australia generally allow you to take the role of the lender as well as borrower. You can then take advantage of placing your crypto into staking liquidity pools to generate yield income.

Engagement with any aspects of the new DeFi industry has risks associated and thorough research must be done before even considering to participate in this space. This list is meant as a starting point down the path of introducing you to options for crypto collateral loans within Australia.