There are many indications that we’re still in a crypto bull market, so let’s take a look at some popular coins and how they have been performing.

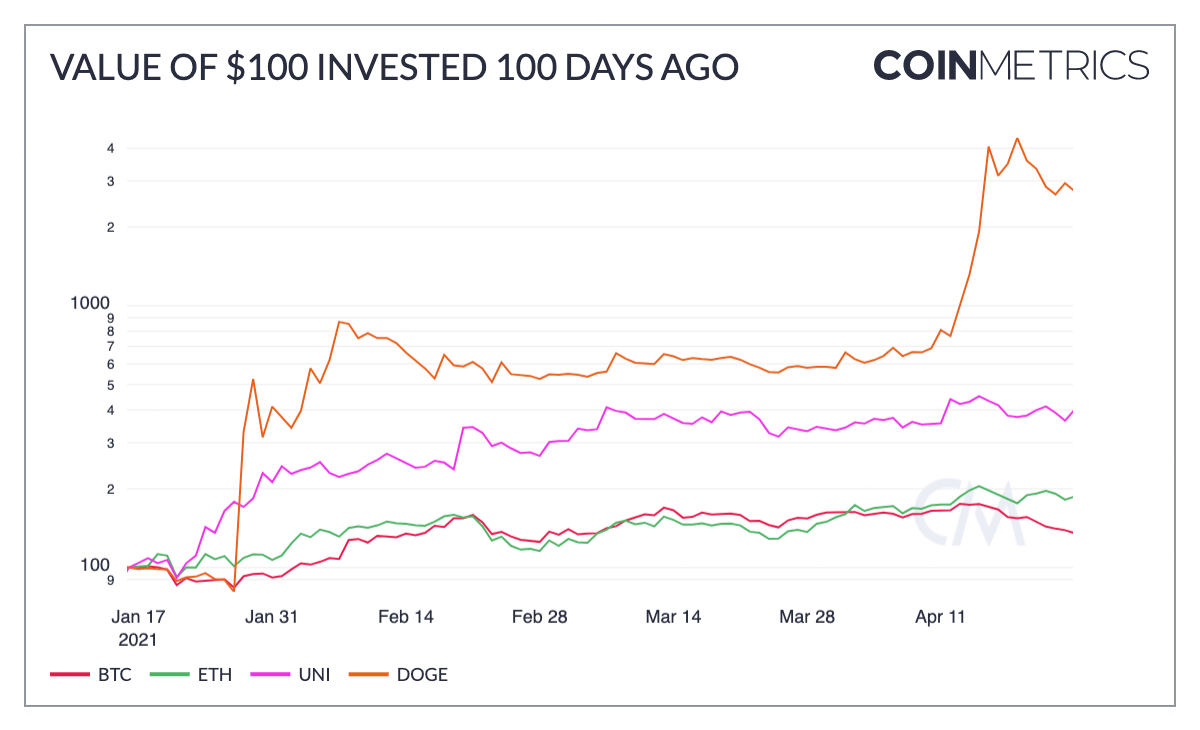

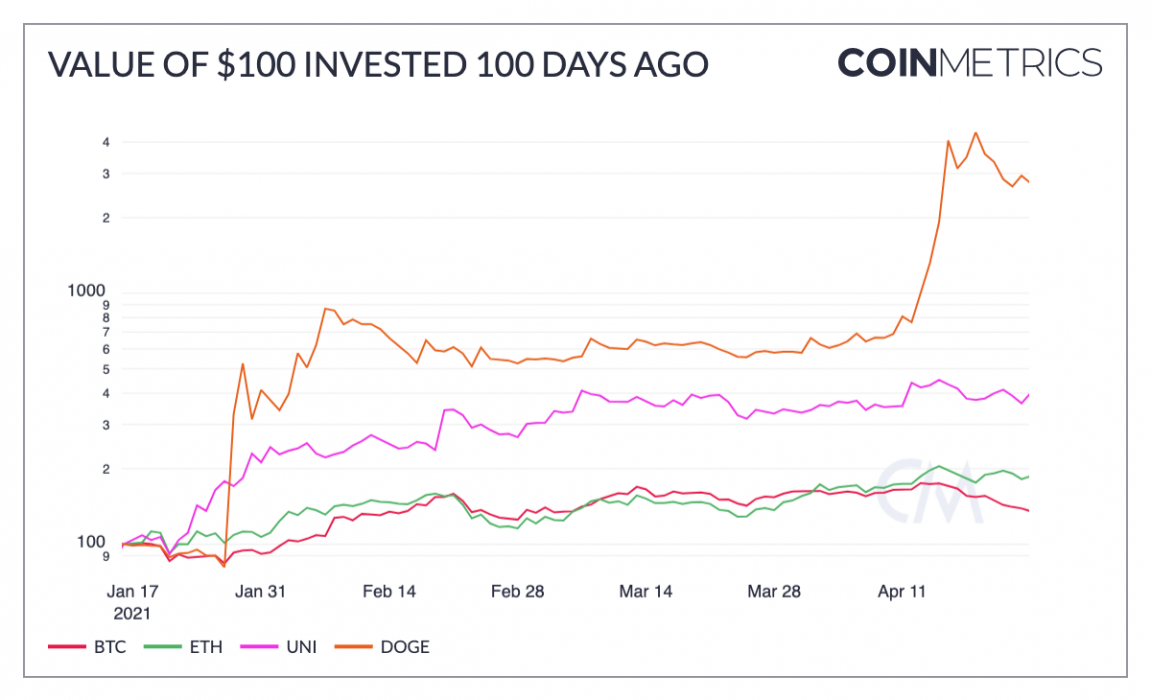

Which Coin Won The Last 100 Days?

The last 100 days have been a turbulent period for crypto enthusiasts. There have been some coins that delivered phenomenal returns, while others have been less impressive. Let’s compare some of the big players.

$100 worth of the relative safety of Bitcoin (BTC) puchased 100 days ago is now worth $135, not too shabby compared to bank interest and government bonds.

$100 worth of Ethereum (ETH) purchased 100 days ago is currently worth a more exciting $186 today driven largely by the explsion in NFTs.

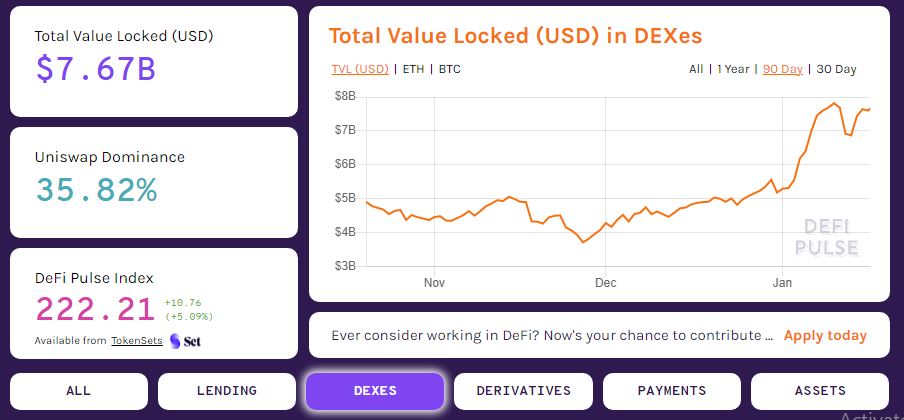

Meanwhile, $100 worth of Uniswap (UNI) has rocketed to $401 in the past 100 days as traffic to the platform continues to grow.

But the real winner of the past 100 days is Dogecoin (DOGE), which would have seen $100 multiplied to a whopping $2,742 during the same timeframe. Such returns are not even considered feasible by those that invest in stocks or other ‘real world’ commodities.

Dogecoin’s Long-term Prospects

For Dogecoin investors there is a significant probability that the coin may retrace its spectacular recent run. Many serious crypto thinkers believe it to be something of a joke that does not deserve its multi-billion dollar market cap. But occasionally markets behave strangely as the past 100 days shows. A single tweet from Elon Musk can send the Dogecoin price vertical. Its value is not based on solid fundamentals or impressive whitepapers, it’s a vehicle for those enjoy memes and don’t take life too seriously.

Jackson Byrne – Crypto News Guest Author