As the first country to make Bitcoin legal tender, El Salvador has become the Bitcoin nation state poster child, inspiring others to consider following suit. Australian Bitcoin Industry Body (ABIB), for one, is looking to engage with El Salvador on its Bitcoin adoption journey in a meeting to be held this week:

Bitcoin Industry Body – a Voice for Australian Bitcoiners

At its foundation, newly launched ABIB seeks to provide a voice for the burgeoning local Bitcoin industry:

ABIB was established primarily for two reasons:

- to provide the local Bitcoin industry with a platform to engage directly with regulators such as AUSTRAC (Australian Transaction Reports and Analysis Centre); and

- to provide a proper understanding of Bitcoin in response to misinformed perspectives in the media.

To get a better overall sense of ABIB’s role and purpose, see the video below in which one of its founding directors, Ethan Timor, provides a little more context:

ABIB Meets with El Salvador

On Wednesday, February 9, at 10am (AEDT), ABIB will hold a video conference with representatives from El Salvador, including its Ambassador to Australia, Werner Matías Romero, as well as its Director of Economic Relations, Eduardo Garcia.

In what is expected to be an exciting exchange of ideas, the topics expected to be discussed are Bitcoin adoption, learnings from the legal tender process, feedback from the citizenry, and how ABIB can collaborate with El Salvador going forward.

Crypto News Australia spoke with ABIB’s Ethan Timor in advance of the meeting, who added:

ABIB’s members and sponsors are thrilled to have the opportunity to meet with El Salvador’s representatives to discuss their historic Bitcoin legal tender adoption. One of our stated objectives is to advance Bitcoin adoption within Australia, and having an opportunity to meet with those at the forefront of Bitcoin innovation is invaluable to our mission. We are excited to learn about their experiences and how we can collaborate with them in the future.

Ethan Timor, ABIB director

For ABIB, the meeting with El Salvador is just the beginning. Local Bitcoiners will be also be pleased to hear that it has some lofty ambitions, including:

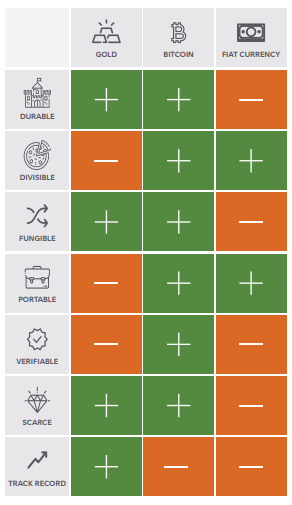

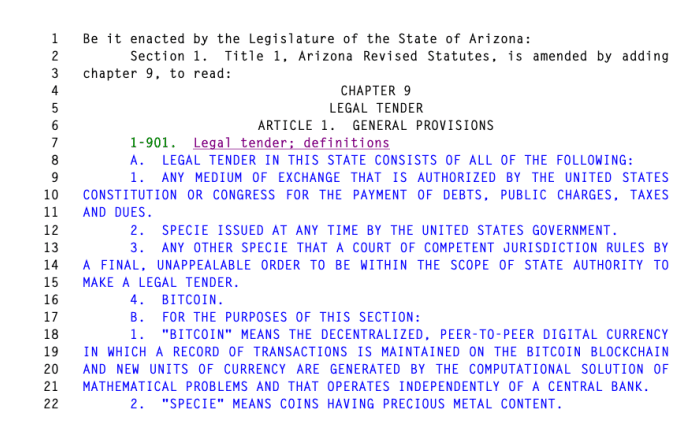

- Bitcoin being classified and treated separately to all other cryptocurrencies;

- Bitcoin being declared a foreign currency, as opposed to personal property;

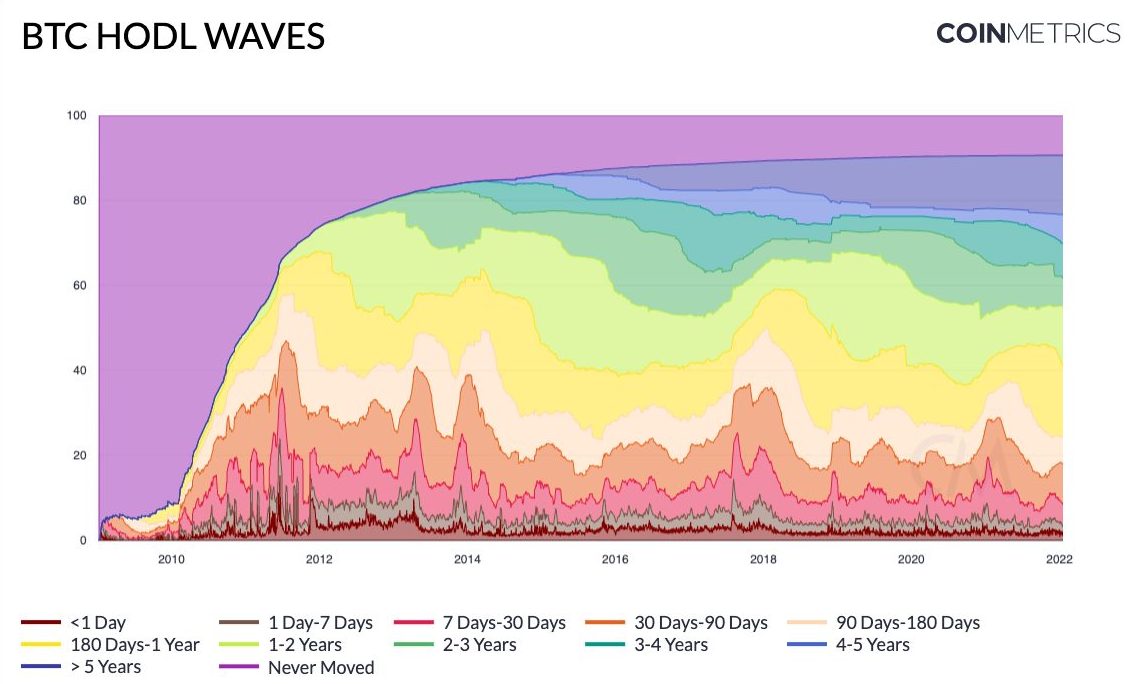

- enactment of the HODL Act, empowering government and the RBA (Reserve Bank of Australia) to hold Bitcoin on its balance sheet to protect against fiat debasement; and

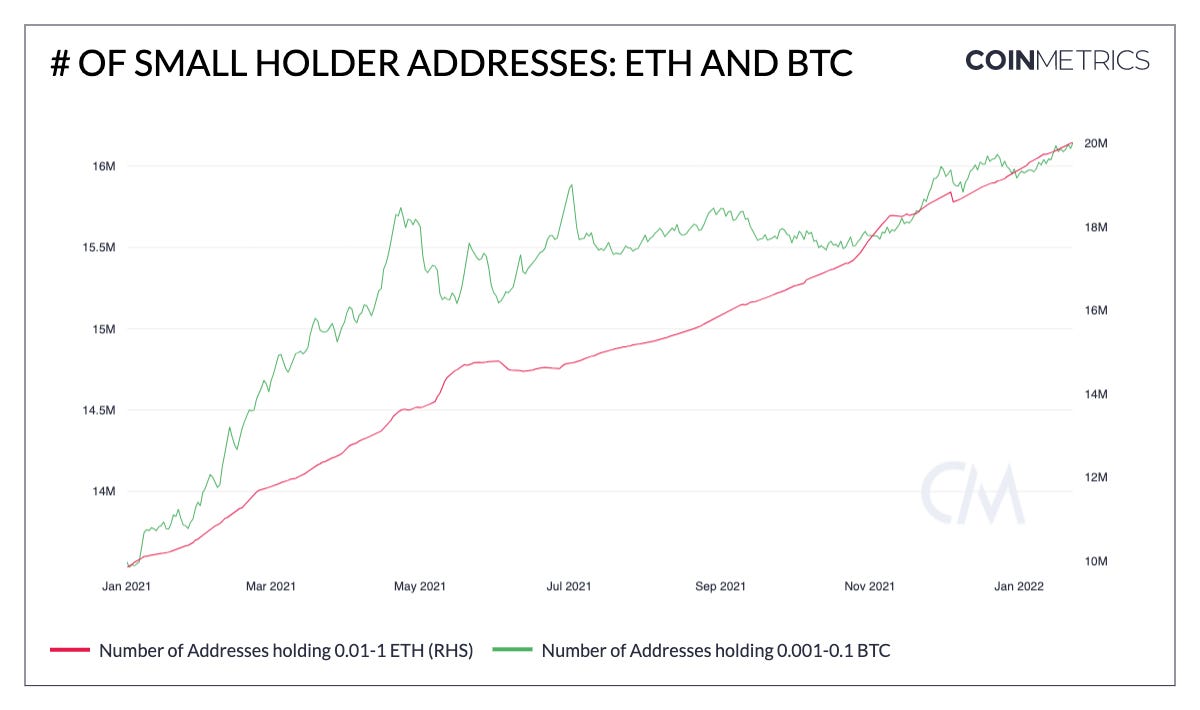

- financial literacy and education, particularly among young Australians.

While the El Salvador meeting is only available to members and sponsors, Australian Bitcoiners can follow developments, as well as other ABIB initiatives, on Twitter.

If you’re a Bitcoiner and keen to get involved, eligible individuals and companies are encouraged to join.