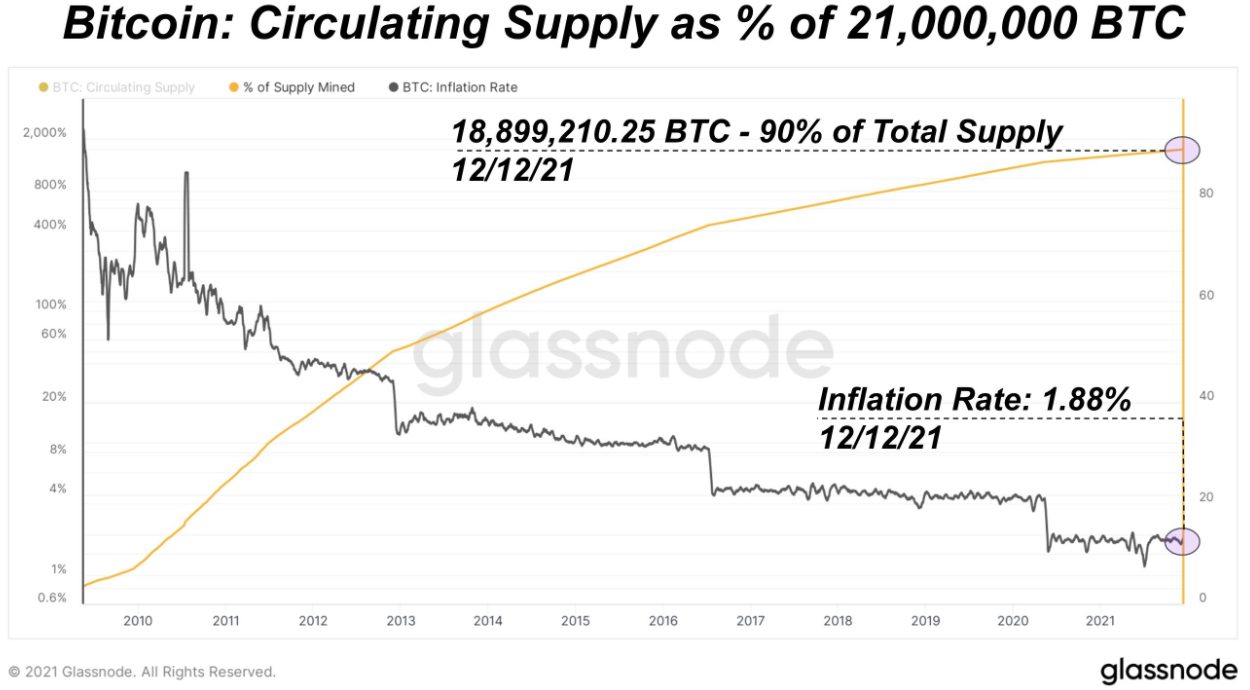

Bitcoin has reached a historic milestone, with 90 percent of the entire 21 million hard cap supply already issued. It took 12 years to mine the first 90 percent and it is estimated that the following five percent will take another four years. Remarkably, the last five percent will take north of 100 years to be issued.

Growing Scarcity

As of the morning of December 13, Bitcoin’s scarcity was highlighted as it eclipsed the 90 percent issuance rate at block 714,000, with 18,899,910.25 Bitcoin mined.

Its scarcity is further amplified considering a 2020 report by Glassnode which established that around 78 percent of Bitcoin was held by illiquid entities – HODLers who have no intention of selling it.

This appears to have continued into 2021, at least according to an October report, also by Glassnode, which found that 70 percent of supply hadn’t moved in five months. Other factors that serve to further entrench Bitcoin’s scarcity in the long run include growing institutional and retail adoption, as well as increased levels of HODLing by miners.

21 Million or Less?

Despite 90 percent of Bitcoin being mined, it is well-known that a material amount has been lost, stolen, or sits in otherwise unrecoverable wallets. Estimates vary, but on all accounts the numbers are significant.

A 2019 report found that at least 1.5 million bitcoins were assumed to be lost or stolen. A 2021 Chainalysis report found that as many as four million bitcoins were owned by accounts that couldn’t access them.

Others, such as this Reddit user, suggest that 3-5 million bitcoins are lost, stolen or otherwise inaccessible:

Estimates of 3-5 million [bitcoin] are out there. You can see onchain metrics showing how much bitcoin hasn’t moved [in the] last decade but that would be the highest possible, and there are some that just haven’t moved even though they possess the keys. I believe it’s around 3 [million], but we will very likely never know and it will continue to slightly go up. We also have a delay factor in the data because people within 10 years may have lost as well. It’s just assumed [for the] first couple of years [the] biggest losses occurred, so we key in on that data.

Fickle_Mix_3847, Reddit user

Whatever the true amount, one thing is for certain, as Satoshi himself said: “Lost coins only make everyone else’s coins worth slightly more. Think of it as a donation to everyone.”