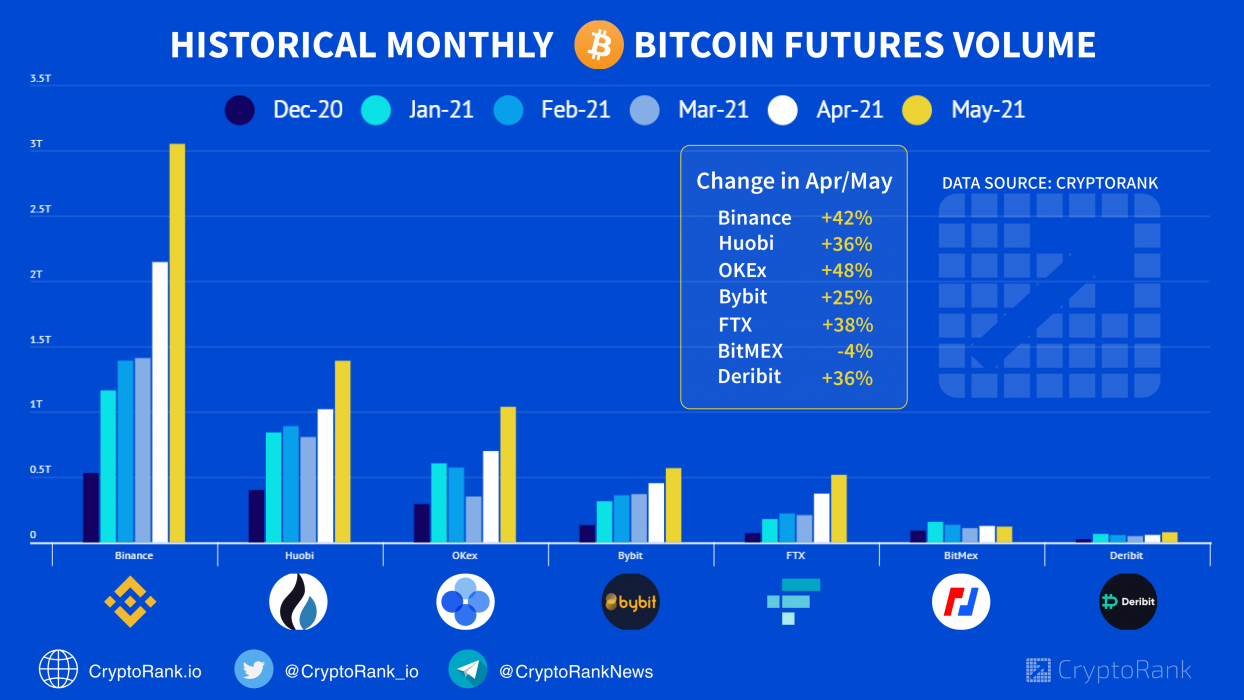

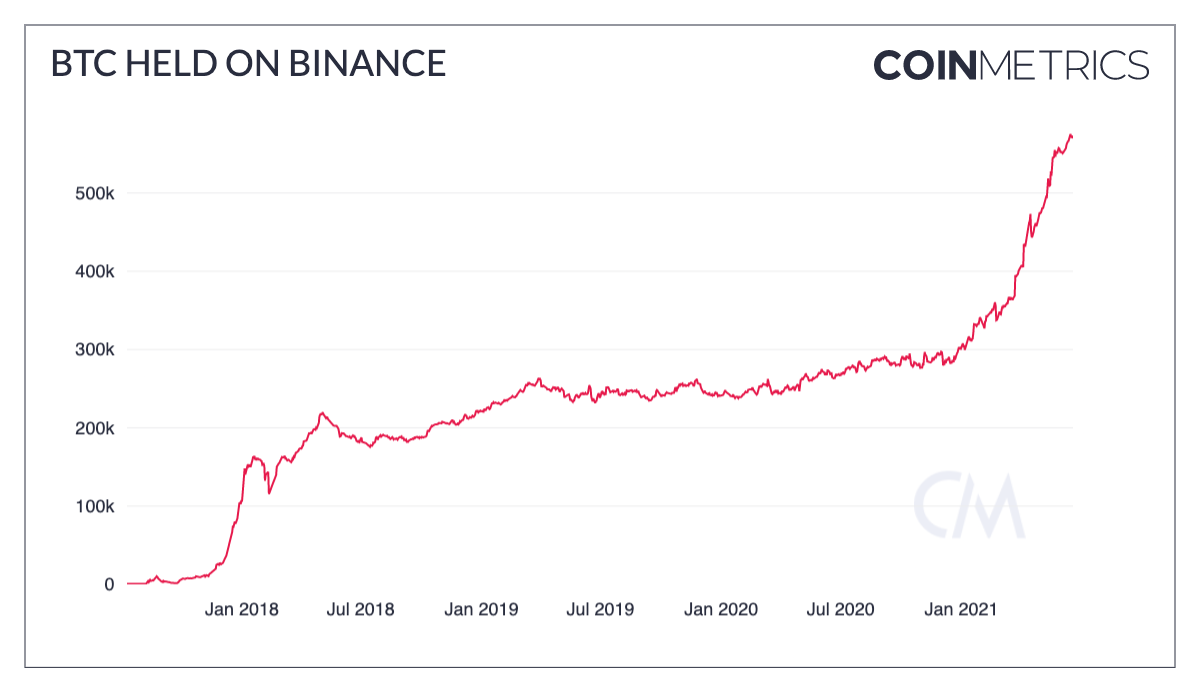

The largest cryptocurrency exchange, Binance, currently holds over 570,000 BTC in reserve. This is considered the highest amount of BTC held by the exchange and far exceeds the balance in other major exchanges, according to data from CoinMetrics.

What’s Behind the Spike in Binance BTC Reserve

It’s worth noting that Binance and some other major exchanges have been seeing an increase in BTC inflows over the past few weeks. There are a lot of factors at play behind the increase in Binance BTC balance. One is the current bearish state of the market, which is causing some investors to deposit Bitcoin to exchanges, probably for selling.

CoinMetrics also opines that the increase in Binance Bitcoin balance is partially caused by Chinese investors moving their BTC holdings off local exchanges.

Recently, the Chinese authorities stepped up their efforts in cracking down on Bitcoin mining activities in the country. The People’s Bank of China also resounded its warnings to financial institutions on providing their services to cryptocurrency-related activities. Such a development would add an extra layer of difficulty for crypto traders in China.

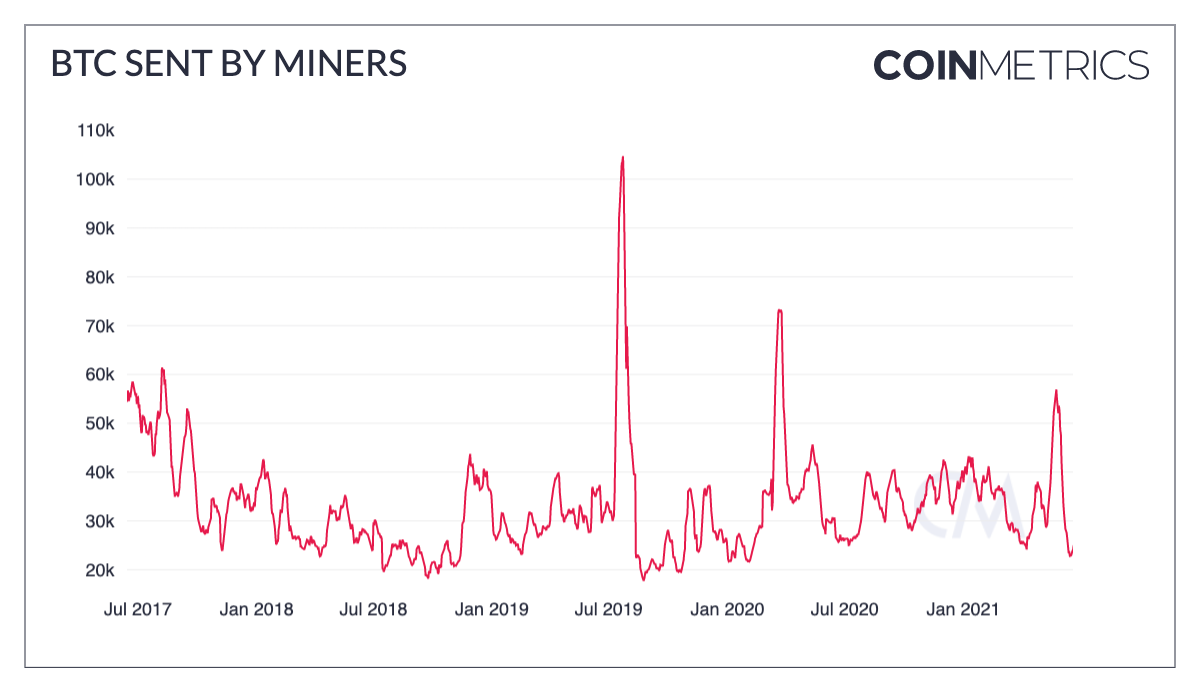

Miners’ Outflows Subside After Initial Flurry

Not minding the regulatory unrest in China concerning digital currencies, there hasn’t been any significant increase in BTC miners’ outflows over the recent days. At first, miners’ outflows to exchanges increased following the announcement that Chinese authorities are planning to clamp down on cryptocurrency mining activities. However, the outflows have since subsided, even as some of the affected miners are relocating.

At the time of writing, Bitcoin’s price was up by over 3% at US$33,664 over the previous 24 hours. BTC dropped below US$29,000 on June 22, amid the bear market. It remains to be seen how soon the market will recover. However, Crypto News Australia recently reported that BTC investors are gradually regaining confidence in the market, following a reserve in exchange flow.