The sudden de-pegging of TerraUSD (UST) and the associated breathtaking decline of Terra (LUNA) over the past few days has triggered huge falls across the wider DeFi market, extending beyond those projects directly linked to the Terra ecosystem.

While projects built on Terra have been hardest hit, the damage has spread widely. DeFi tokens on virtually all blockchains are now seeing sizeable declines, even if they have no direct link to the Terra ecosystem:

Terra-based DeFi Projects See Massive Declines

According to CoinGecko, the native token for Anchor Protocol (ANC), the largest DeFi protocol in the Terra ecosystem, is down over 90 percent since May 7, falling from US$2.14 to US$0.19 at the time of writing.

Other prominent Luna-based DeFi projects have also taken huge hits. Since May 7 the native token of Astroport (ASTRO), an automated market maker protocol, has dropped 89 percent and Mars Protocol (MARS), an on-chain credit protocol, is down almost 65 percent.

At the time of writing the native cryptocurrency of the Terra blockchain itself, LUNA, is down an astonishing 99.6 percent since May 7, trading at a mere US$0.29. Just over a month ago it hit its all-time high of US$119.18.

The Luna Foundation Guard, the group tasked with stabilising UST’s value, is currently seeking an additional US$1 billion capital to attempt to restore the stablecoin’s peg and potentially save the Terra ecosystem from complete collapse – a goal that is, sadly, beginning to look unachievable:

Contagion Spreads to Connected Blockchains and Beyond

Assets from the Cosmos ecosystem have also seen large declines due to their integration with Terra through the Interblockchain Communication Protocol. CoinGecko shows that since May 7, ATOM is down about 47 percent, while DeFi tokens Mirror Protocol (MIR) and Osmosis (OSMO) are down 73 percent and around 50 percent respectively.

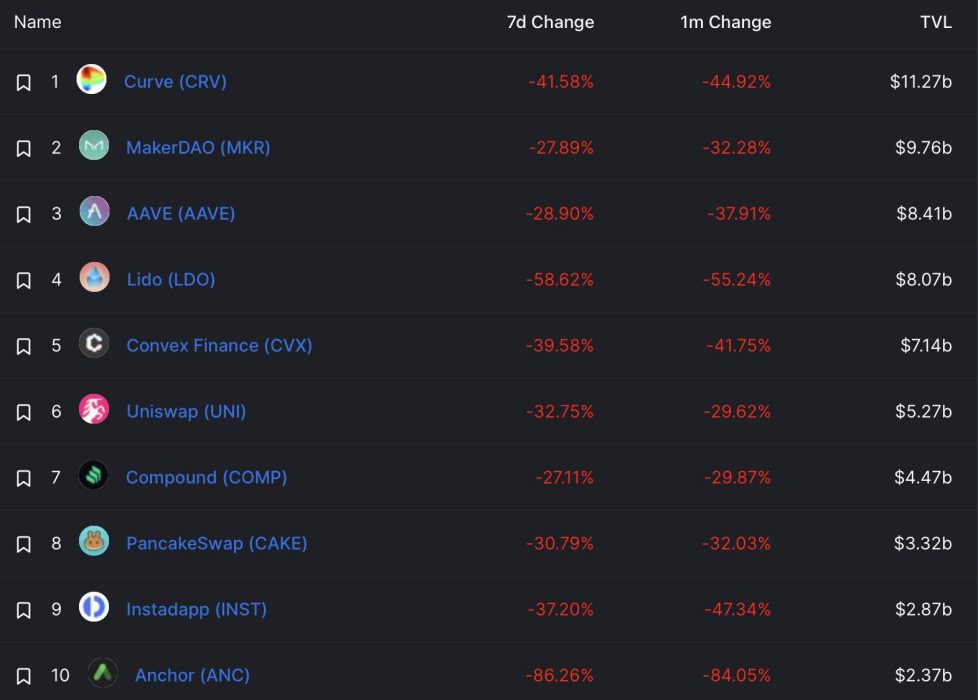

Virtually all DeFi projects across all blockchains have been negatively impacted by this ongoing collapse. According to data from DeFi Llama, total value locked (TVL) across the entire DeFi market has dropped more than 21 percent in the past 24 hours and, since April 4, TVL is down over 48 percent – now sitting at US$120.17 billion, down from US$231.5 billion.

Of the top 10 DeFi projects listed on DeFi Llama, every one has seen seven-day losses of TVL in excess of 27 percent:

In one small piece of positive news for DeFi, earlier in the week Compound Treasury became the first institutional DeFi project to get a credit rating from ratings agency Standard & Poor.