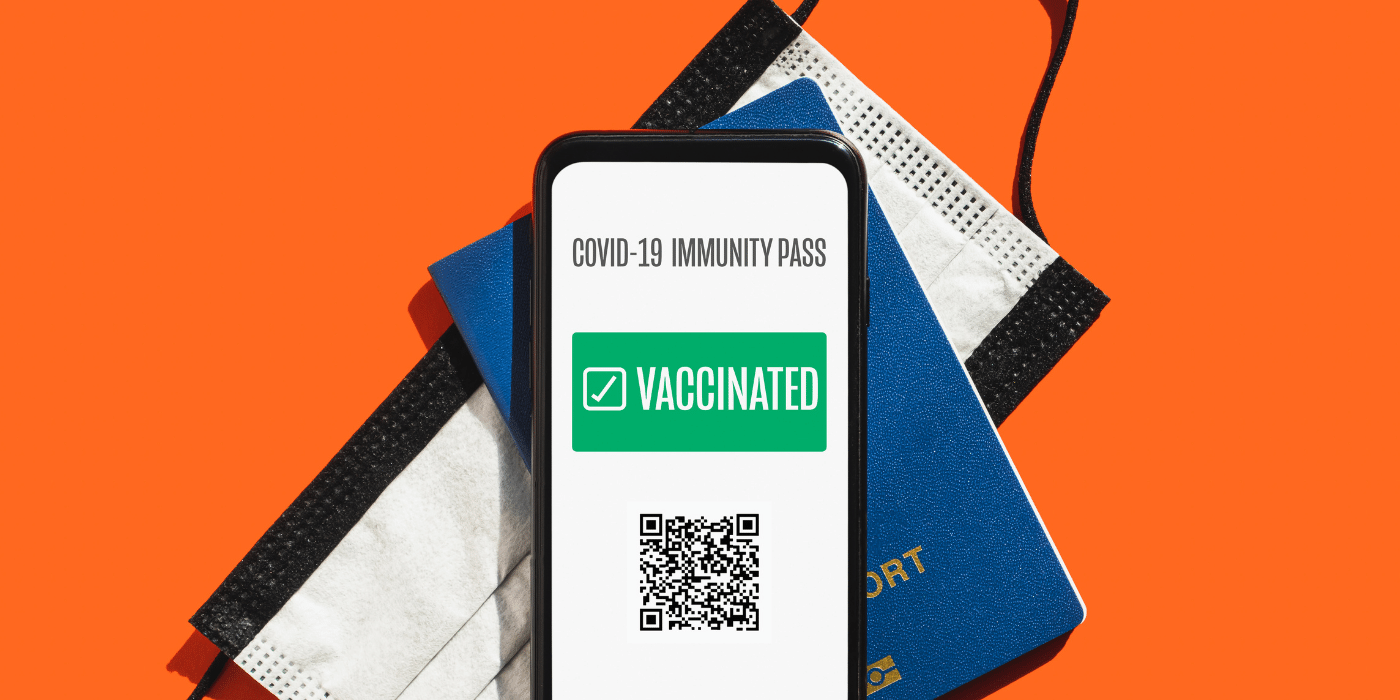

The Republic of San Marino will issue NFT-based digital certificates to enable its citizens to prove their vaccination history and travel more freely across Europe, in partnership with the public blockchain platform VeChain.

The ‘vaccination passport’ will be provided, by request, to anyone vaccinated in the small, landlocked enclave – located in central Italy – to enable verification of green passes outside the European Union.

The passport will hold data about vaccination against SARS-CoV2 (the precursor of COVID-19), past infection or a negative test result.

VeChain’s passport, which it describes as a ‘Digital Covid Certificate’, contains two QR codes. The first code gives access to a certificate that meets EU standards so member states can instantly verify a person’s vaccination status, while scanning the second code opens a certificate that’s verifiable by anyone.

The solution is enabled by linking to a Non-Fungible Token (NFT): a unique and non-repeatable certificate of digital authenticity guaranteeing immutability and accessibility by being registered on VeChainThor public blockchain.

Blockchain Could Be Key to COVID-19 Recovery

Immutable records of vaccination history, enabled by blockchain solutions, could be key to pandemic recovery efforts.

Darknet markets are already openly selling fraudulent certifications of vaccination.

If countries want to validate uptake or tie the vaccination to incentive payments, which has been flagged in Australia, medical records stored on a blockchain could streamline the process.