Coinflex has filed for restructuring in a Seychelles court, according to a report from Bloomberg:

Coinflex is a derivatives exchange that has been struggling to recover a monumental loss – said to be at least US$84 million – after a counterparty failed to meet a margin call.

The exchange is looking for approval from depositors and the court to issue depositors with rvUSD tokens, equity, and a locked version of the exchange’s native token FLEX coin. Additionally, the firm plans to launch “Locked Balances Markets”, which will be traded against unlocked balances on the platform.

Coinflex on the Edge

In June, the exchange halted user withdrawals due to market conditions, only to resume services in July – the same month it laid off over 50 percent of its staff.

Problems had been brewing since late June when the CEO of Coinflex, Mark Lamb, said Roger Ver – the counterparty in question – owed the exchange US$47 million in USDC:

Coinflex stated it would communicate with its customers as the process continues. Its founders will presumably host a video AMA next week to answer users’ inquiries and doubts.

Bad News Follows Bad

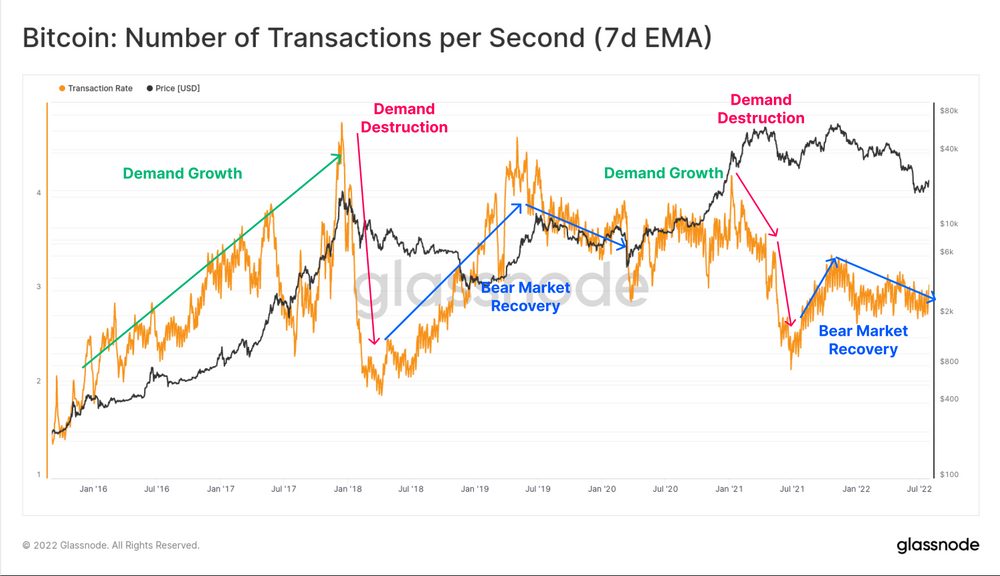

Of course, news of crypto exchanges halting services and preventing users from accessing their accounts no longer comes as a surprise in the ongoing bear market:

Of that list, Celsius has since declared bankruptcy while Zipmex this week announced it would allow partial withdrawals of bitcoin and ethereum.