Russian government authorities have revealed that the federation owns more than 16.5 trillion rubles, or US$214 billion worth of cryptocurrencies – controlling roughly 12 percent of the crypto market.

Russians Own More Crypto Than Expected

According to sources within the Kremlin, the report was an estimate calculated by analysing IP addresses of some of the biggest crypto exchanges in the country. Russian authorities are using this estimate to form a better overview of the industry and implement proper regulations.

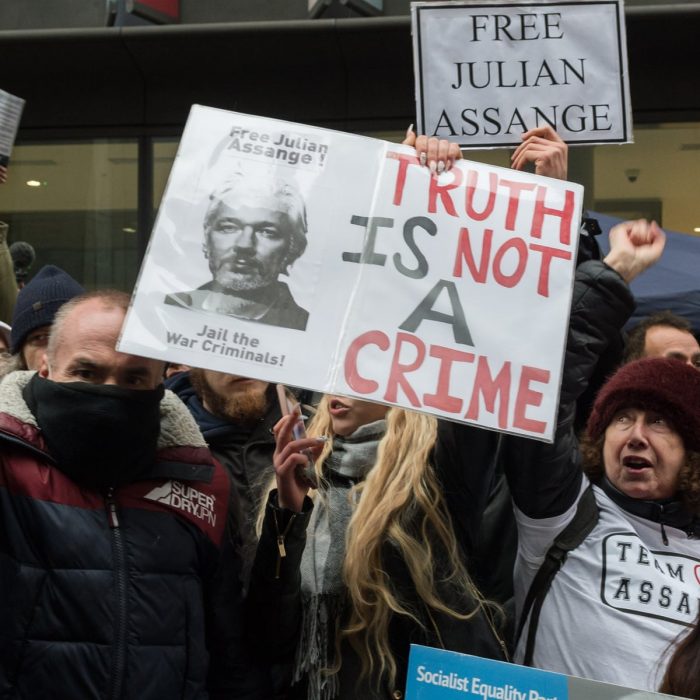

It’s unclear if this estimate is lower than the actual number of crypto users in the Russian federation, since a lot of them use anonymous tools to transact cryptocurrencies:

It is, however, a huge leap from December 2021 when it was reported that Russians held only 5 trillion rubles in crypto, or US$67 billion at that time.

Russia Finally Comes Out in Favour of Proper Crypto Regulation

The regulatory weather in Russia has been a quite confusing environment for crypto users. Two weeks ago, the Russian central bank attempted to ban crypto, only to be countered by the finance ministry with a crypto regulatory framework:

But after a bunch of back and forths between authorities, it seems Russia is finally preparing the roadmap for establishing proper crypto regulation, starting first drafts this month. Dmitry Chernyshenko, deputy chairman of the Russian Federation, last week signed a crypto regulation roadmap valid until the end of the year, as per a report from RBC.

Additionally, finance minister Anton Siluanov suggested that banks and other licensed financial entities should be allowed to provide crypto services, reiterating the ministry’s stance on regulating crypto rather than banning it.