Bitcoin’s market cap hit the US$1 trillion dollar mark last week as BTC’s price surged to US$55,000. Analysts at American investment bank JPMorgan put forward three main reasons behind the recent BTC price surge, and one of them is institutional interest.

Institutions Are Fuelling Bitcoin

It seems institutions are taking the lead again and driving the price this quarter, when it was retail investors that had out-bought institutions in the first quarter of 2021.

According to a Bloomberg report, JPMorgan said that institutional investors were the main driving force behind bitcoin’s recent price surge, mainly because they see it as a “better inflation hedge than gold”.

The re-emergence of inflation concerns among investors has renewed interest in the usage of bitcoin as an inflation hedge. Institutional investors appear to be returning to bitcoin, perhaps seeing it as a better inflation hedge than gold.

JPMorgan statement

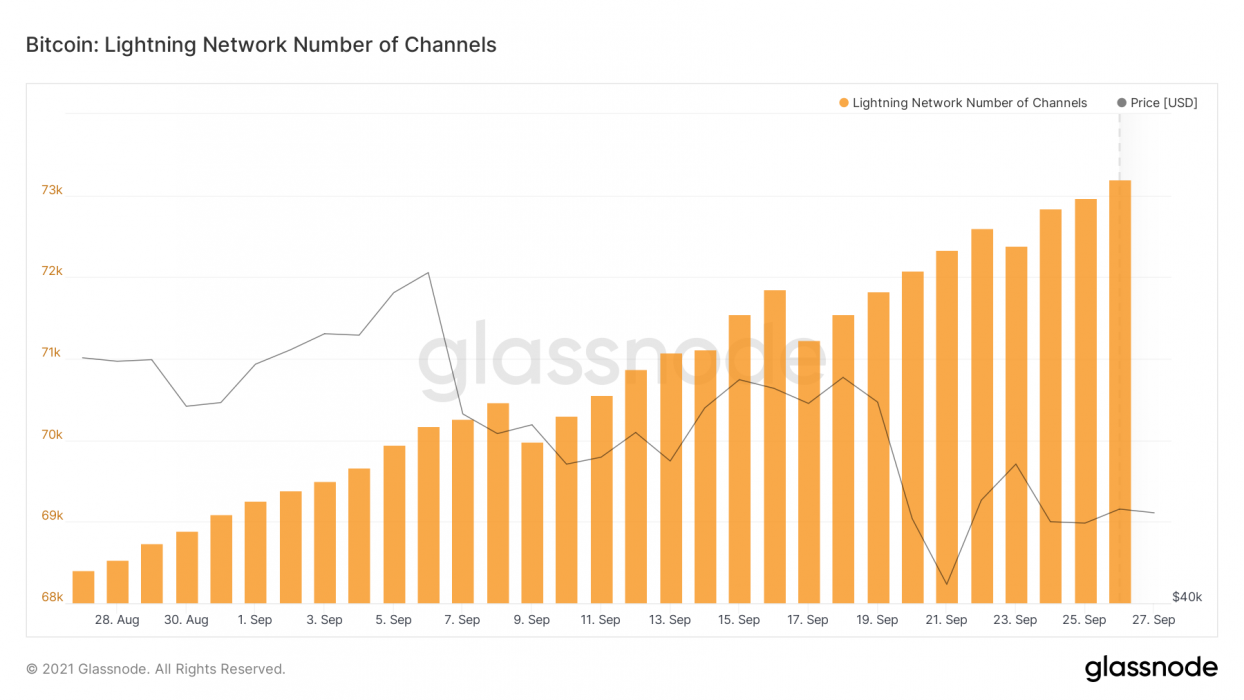

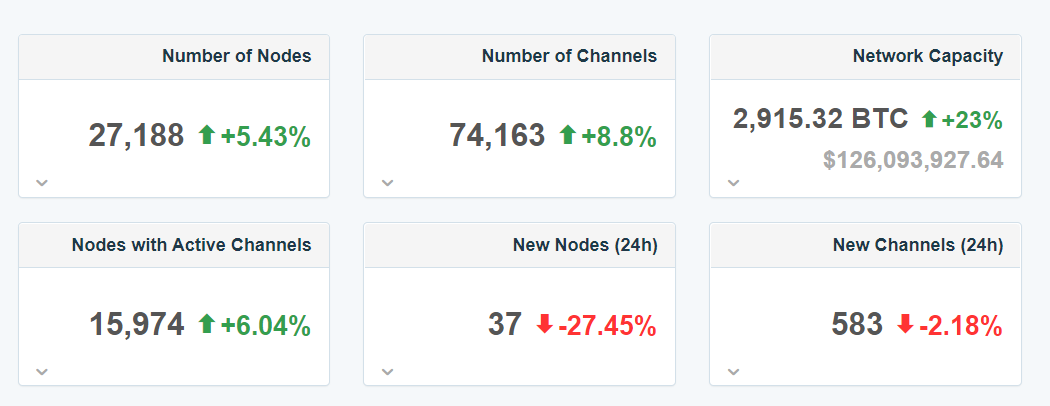

The two other key factors were “recent assurances by US policymakers that there is no intention to follow China’s steps towards banning the usage or mining of cryptocurrencies”, and “the recent rise of the Lightning Network and 2nd layer payments solutions helped by El Salvador’s bitcoin adoption”.

JPMorgan Believes Bitcoin Could Go 10x – But Still Doesn’t Like It

JPMorgan has been one of the most hesitant traditional financial institutions when it comes to bitcoin and cryptocurrencies. But as cryptocurrencies and blockchain technology demonstrate their usefulness especially in times of financial crises, most institutional investors have decided to engage with cryptocurrencies one way or another.

While JPMorgan still doesn’t like Bitcoin – or any crypto, really – its CEO, Jamie Dimon, recently conceded bitcoin could grow by up to 10 times within the next five years, which could be his most positive comment yet about BTC.