The British Army is investigating a hack that occurred on its Twitter and YouTube accounts last week, the BBC has reported. It seems the hacker used the accounts to promote NFT collections.

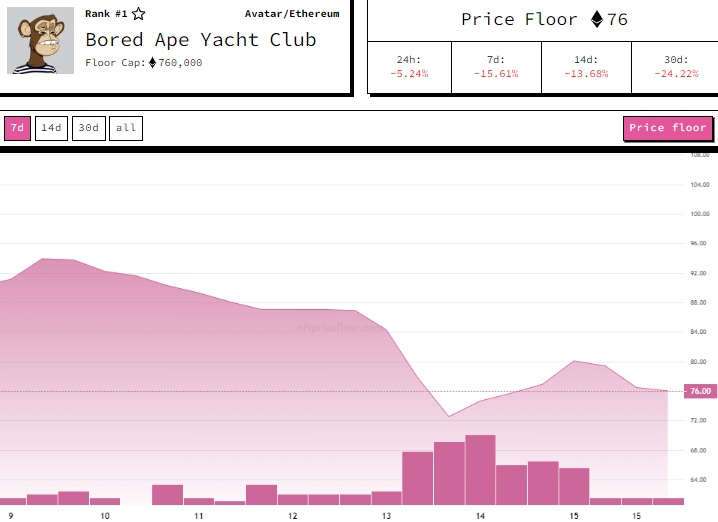

After the attacker gained control of the British Army’s Twitter feed, he or she renamed it to “psssssd” and “Bapesclan”, changed the profile pic to an ape-like joker, and promoted several NFT collections to the Army’s 365,000 followers.

The Twitter feed can be found on web.archive:

On the other hand, the Army’s YouTube channel was plagued with edited videos of billionaires such as Elon Musk, creating a false impression that they were promoting the scam.

Trolling the British Government

The organisation managed to regain full control of both accounts by July 3. While there was no real damage done by the hack, one could see the incident as simply a move to troll people, specifically a UK government organisation.

An Army spokesperson told the BBC: “Whilst we have now resolved the issue an investigation is ongoing and it would be inappropriate to comment further.”

Intercepting YouTube accounts to promote NFT and crypto scams has become a common practice for hackers, according to Google’s Threat Analysis Group. Most recently, Beeple – a popular digital artist and NFT creator – had his Twitter account hacked, resulting in a US$438,000 loss to a phishing scam.