Australian venture capital investor Mark Carnegie has partnered with entrepreneur Sergei Sergienko to launch MHC Digital Finance, a digital assets fund that combines DeFi and Crypto-trading to generate 30% annual returns for large investors.

As reported by the Australian Financial Review, Carnegie believes that DeFi and Crypto-assets have the potential to bring a better, decentralised financial system.

The platform is now live, and it offers institutional clients custody, OTC markets, and fund management, with a minimum investment of $50,000.

Crypto as a hedge Against Inflation

Talking about the declining use of fiat and the consequences of money printing, Carnegie said investors should allocate 1 or 2% of their total net worth into cryptocurrencies as a hedge against inflation.

The money printing is a risk and you’ve got to think what you’re going to do to protect yourself against it,” he said. “Now, with Australia the general solution is buy a house. The problem about that is you forgo a tonne of liquidity if that’s your only solution.

Mark Carnegie [AFR]

Carnegie lamented not seeing the potential of DeFi and cryptocurrencies at first when Ethereum and Bitcoin were barely taking place in investor’s portfolio.

He now believes the ecosystem has grown successfully through time and can bring a new opportunity for large institutions and individual investors. “All the success in DeFi is going to pull bitcoin higher with it”, he claimed.

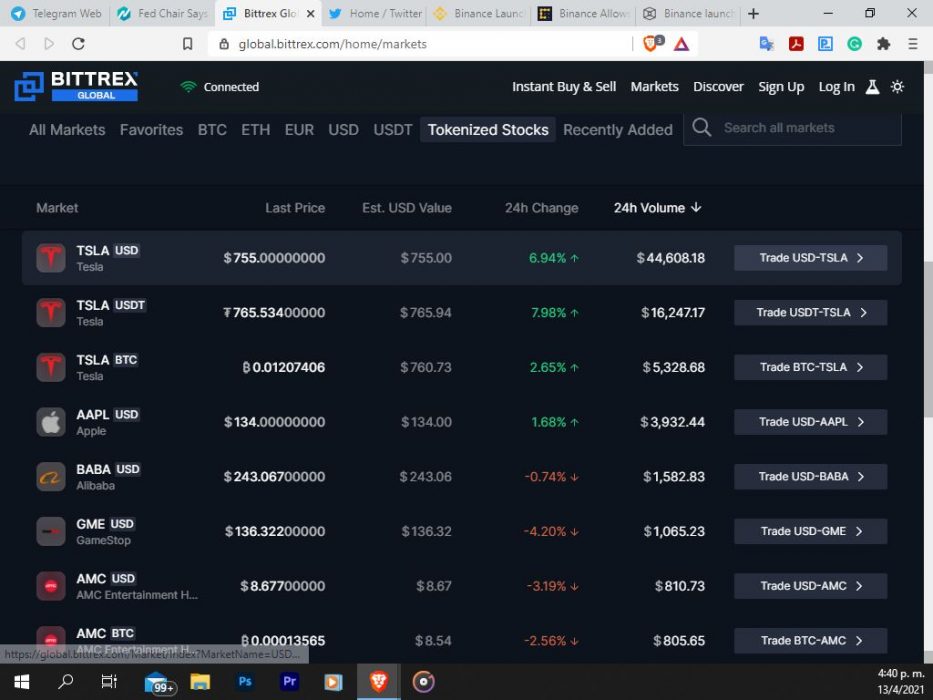

Combining Traditional Market With DeFi

The fund combines the traditional aspect of the market while also combining some popular DeFi strategies like staking, where users lock their funds to receive rewards.

We use automatic market makers and the discrepancies in returns in stable coins to produce a greater return for the fund. Effectively, we’re providing liquidity to automatic market makers on DeFi market protocols and receive commission from the trades executed on those protocols. We do it on different blockchains, thereby also taking advantage of different pricing for commission on different blockchains.

Sergei Sergienko

The fund already saw participation from several private investors. It will invest 45-75% of its assets into high-market cap cryptos such as Bitcoin (BTC) and Ethereum (ETH), and the rest into stablecoins.