Non-Fungible Tokens (NFT) are providing artists and musicians independency by selling their tokenized artworks or albums in DeFi marketplaces, instead of relying on major record labels.

According to Business Insider, more artists are joining the NFT movement by selling their tokenized work for large sums. A new wave of artists is now considering directly offering their music in the form of tokenized products sold on DeFi marketplaces, rather than having it handled by traditional third parties.

Crypto Art Changing the Music Industry

The implications of this new approach appear to be quite significant, for example from a royalties perspective. Many musicians have complained how the current revenue from streaming platforms like Spotify tends to be quite small after the cut taken by labels and distributors. Experts in the music industry have stated that crypto art could indeed shift the power structure of many companies. Researcher Cherie Hu said that NFTs can potentially change the scenario for record labels and their relationship with musicians.

They could provide more incentive for labels to better serve artists. Artists will likely be asking themselves ‘Is my label doing the best job at maximizing the value of my relationship with fans? Do they deserve a cut of these NFTs?’

Cherie Hu [Business Insider]

Millions of Dollars in NFTs

Some of the first and most popular NFT sales were Kings of Leon and 3LAU. Both artists sold their NFT albums for millions of dollars.

Now it seems that artists can connect directly to fans through NFTs by offering special items, maybe even reserved to NFT holders.

NFTs are built on decentralization, connecting fans directly with creators. The current systems in place are opaque and antiquated. NFTs cut out the middleman.

Matt Colon, Steve Aoki’s manager [Business Insider]

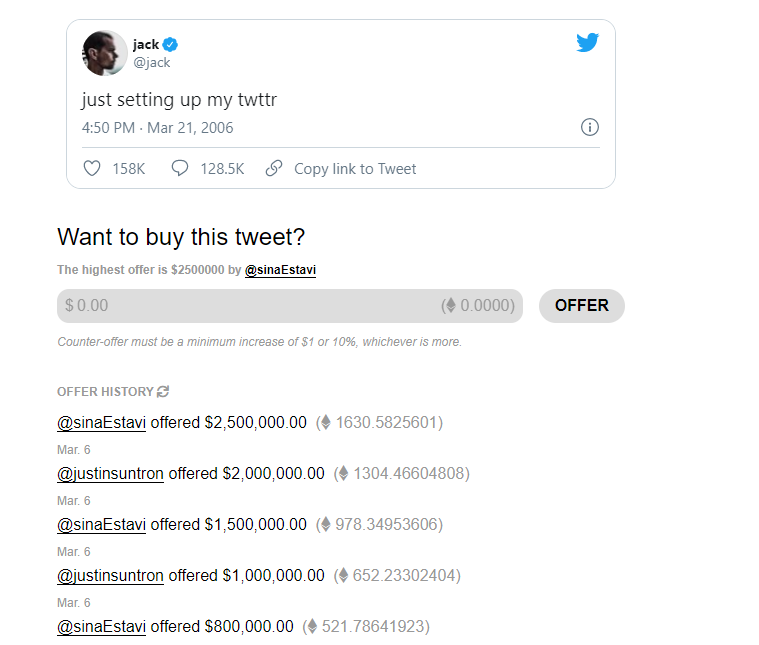

NFTs are currently the hottest trend in the fintech space. From books to a single tweet can be auctioned. Jack Dorsey sold his first tweet, which is also the first tweet ever on the social network. Justin Sun, CEO of Tron, offered two million dollars for it.

Users from Reddit are discussing the NFT craze with DeFi, arguing that record labels will have to adapt to new emerging technologies to stay in business.