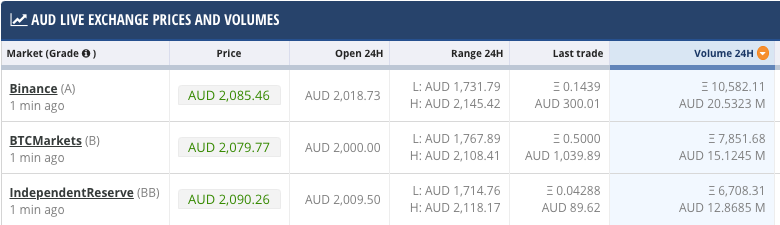

Binance Australia will now allow Aussies to trade three new bullish tokens in its platform: XLM, AVA, and ATOM. Trading will go live on March 10, at 10:00 Sydney time.

These three coins experienced considerable growth in the crypto market since January, up to 10-15% in price, and 24h trading volumes reaching levels of 80%.

Aussies Looking to Hold $AVA

The community seemed excited to trade these three tokens, especially AVA, the native asset of Binance-backed Travala, one of the first blockchain-based travel agencies. The company implemented this blockchain technology along with crypto-payments in 2017.

Since the COVID-19 outbreak started, the travel industry suffered approximately 42% (nearly $500 billion) in losses, according to the U.S. Travel Association. But Travala has provided a blockchain infrastructure and support for crypto-payments for a while, helping the company avoid the effects of the pandemic and attracting crypto enthusiasts.

It’s worth noting that Travala recently allowed support for payments in LINK (Chainlink’s token).

Likewise, XLM, the native token of the open-source DeFi protocol Stellar, also experienced positive growth in January this year. And 24h trading volumes nearly reaching 30%.

On the other hand, ATOM, the native asset from the interoperable blockchain ecosystem Cosmos Network, has also seen positive community support. The platform reached January this year with a market cap of over $4,500,000, and trading volumes are currently 30% up in the last 24 hours.