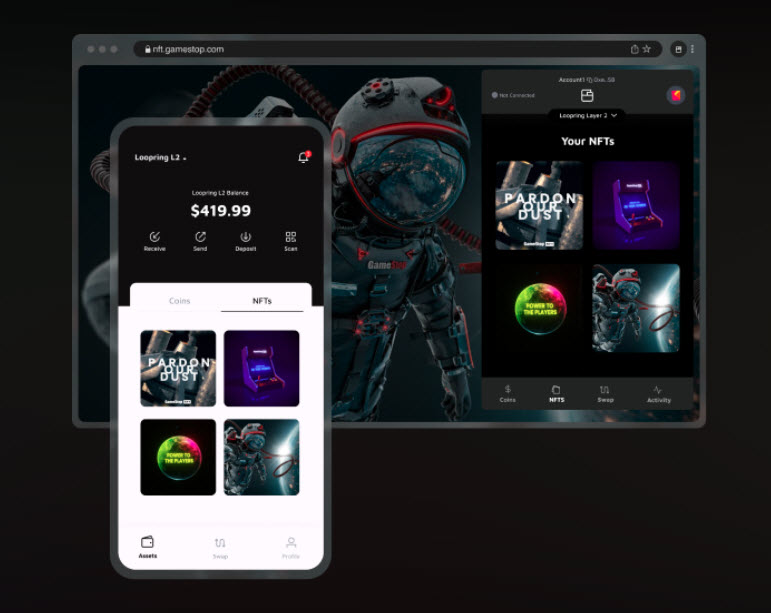

Electronics retail giant GameStop has launched a cryptocurrency and NFT wallet to pivot into the digital assets world. The wallet is an Ethereum-based browser extension – similar to MetaMask – and is available for download at the Chrome Web Store.

NFT Marketplace to Launch in July

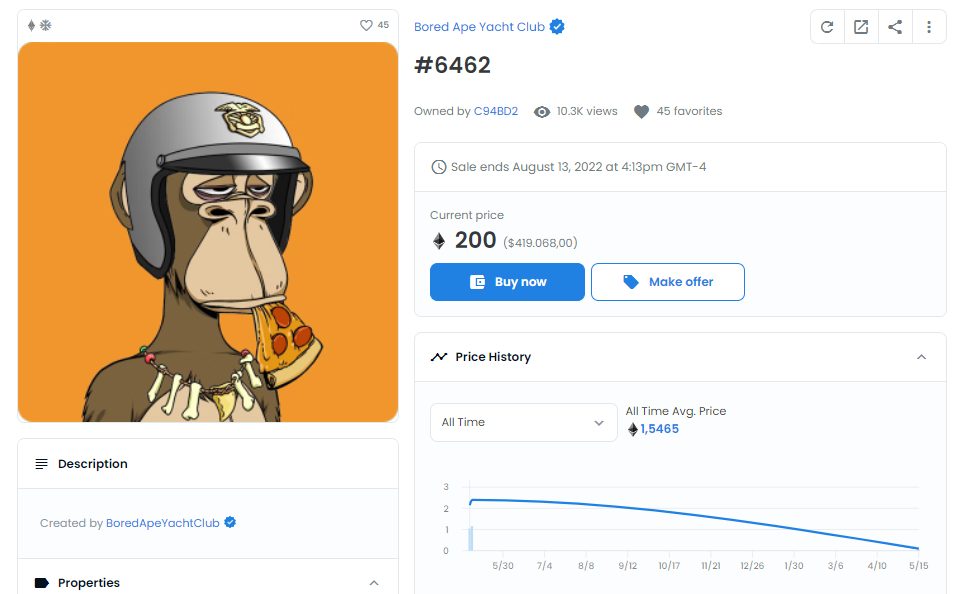

The wallet is self-custodial, allowing users to store and transfer several cryptocurrencies. It will also support NFT trading on GameStop’s upcoming NFT marketplace, expected to launch in early July.

As Ethereum transactions are synonymous with expensive gas fees, GameStop has opted to integrate an ETH layer-2 protocol called Loopring, which leverages ZK (zero-knowledge) technology to make transactions cheaper and faster:

Crypto News Australia reported in March that Loopring had surged over 50 percent after GameStop launched a beta version of its Loopring-powered NFT marketplace.

GameStop Sales Improve Year-on-Year

Despite the overall bearish sentiment in the crypto market, GameStop is still planning to offer crypto products for its gamers. The company’s Q4 financial results revealed it had generated net sales of just over US$6 billion for the fiscal year, compared to $5.090 billion for fiscal year 2020.