Trung Nguyen, co-founder and CEO of Sky Mavis, the studio behind the Axie Infinity blockchain game, reportedly moved around US$3 million in cryptocurrencies before the company disclosed the details of a US$625 million hack.

In March, Axie Infinity weathered one of the all-time largest DeFi hacks when the bridge connecting its Ronin network sidechain to Ethereum was exploited. Now Nguyen has come clean on exactly what took place before the hack was disclosed:

Bloomberg analysed blockchain data to discover that a crypto wallet controlled by Nguyen transferred around US$3 million worth of the game’s AXS governance token from the Ronin sidechain to the Binance crypto exchange. Nguyen’s transfer took place just three hours before Sky Mavis disclosed the hack, almost a week after the attack took place.

Funds Transferred From Nguyen’s Own Wallet

According to Sky Mavis representative Kalie Moore:

At the time, we (Sky Mavis) understood that our position and options would be better the more AXS we had on Binance. This would give us the flexibility to pursue different options for securing the loans/capital required.

Kalie Moore, Sky Mavis

Moore added that the funds were transferred from Nguyen’s own wallet so that AXS short sellers “would not be able to front-run the news”. She also dismissed accusations of other motives regarding the nature of the transfer as “baseless”.

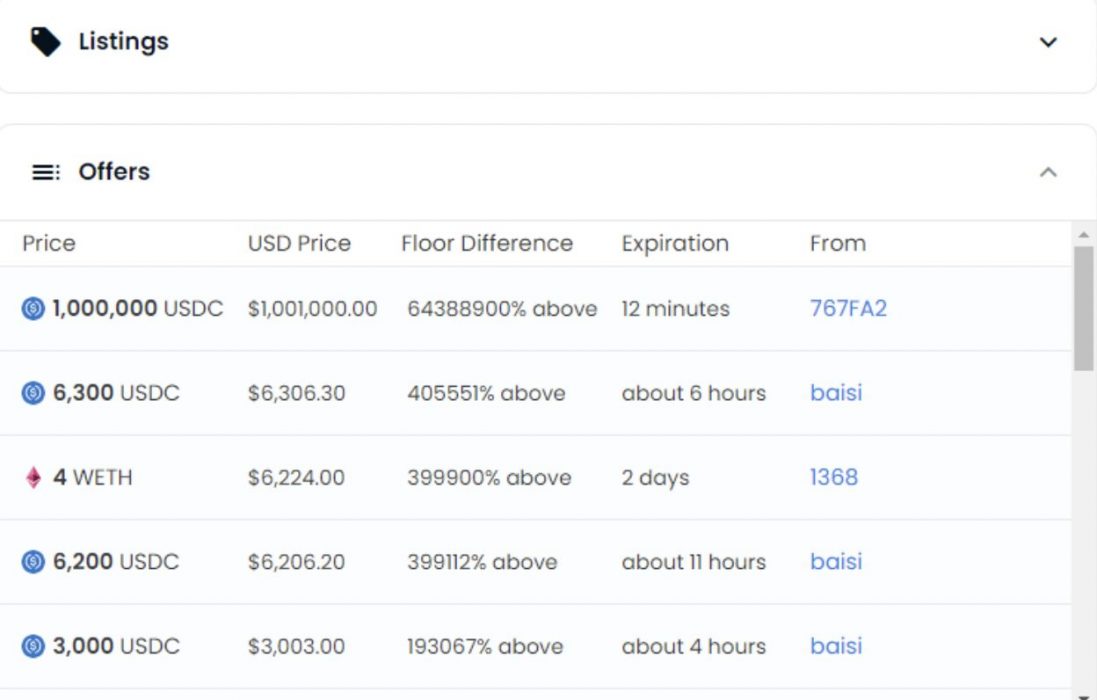

The attack on the Ronin network took place on March 23 but was not discovered until March 29. The attackers stole 173,600 Wrapped Ethereum (WETH) and 25.5 million USDC stablecoins, worth US$625 million at the time of disclosure. They used hacked private keys to gain control of five of the network’s nine validators to sign fraudulent transactions and transfer the funds.

All Users Reimbursed

In the wake of the attack, Sky Mavis announced that it had raised US$150 million to facilitate user refunds. All users were reimbursed after the Ronin bridge was reopened.