Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Coti (COTI)

COTI markets itself as the first enterprise-grade fintech platform that empowers organisations to build their own payment solutions as well as digitise any currency to save time as well as money. COTI is one of the world’s first blockchain protocols that is optimised for decentralised payments and designed for use by merchants, governments, payment DApps, and stablecoin issuers. The ecosystem has a DAG-based blockchain, proof-of-trust consensus algorithm, multiDAG, GTS (Global Trust System), a universal payment solution, and a payment gateway.

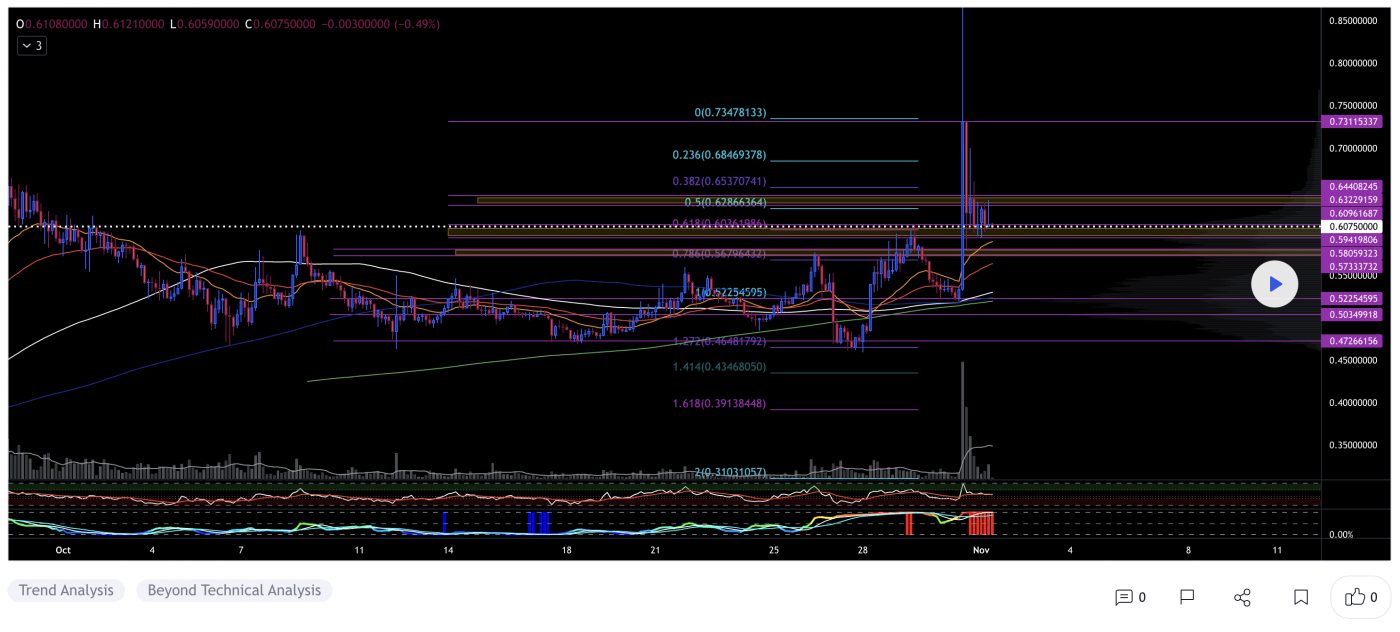

COTI Price Analysis

At the time of writing, COTI is ranked the 140th cryptocurrency globally and the current price is A$0.8359. Let’s take a look at the chart below for price analysis:

COTI‘s 189% rally from its September lows spiked through March’s high before going into a minor retracement and consolidation.

Last week’s rapid climb before Tuesday’s mainnet release could be setting up a “sell the news” scenario. However, the price is on possible support beginning near A$0.7955, which has confluence with the 9 EMA.

If this level holds, bulls may be ready to push COTI to its next target. Possible support around the current range low, near A$0.7232, and the 40 EMA might see a stronger reaction from bulls and provide a better risk-to-reward entry.

A sharper downturn in the market – perhaps from a steep BTC retrace – could reach near the 61.8% retracement of September’s move. This area had a strong reaction on October 27. A level near the 79% retracement, around A$0.5085, could also provide support. However, if the price reaches this far, it might signal a longer-term bearish shift.

Final targets are impossible to predict, but extensions from 2021’s significant move and the current leg suggest bulls might take profits near A$1.08, A$1.20, and A$1.58.

2. ICON (ICX)

ICON is a decentralised blockchain network focused on interoperability. With ICON’s “blockchain transmission protocol”, independent blockchains like Bitcoin and Ethereum can connect and transact with each other. This opens up cross-chain use cases that are impossible without an interoperability layer like ICON. The ICON blockchain is powered by loopchain, a blockchain engine designed by ICONLOOP.

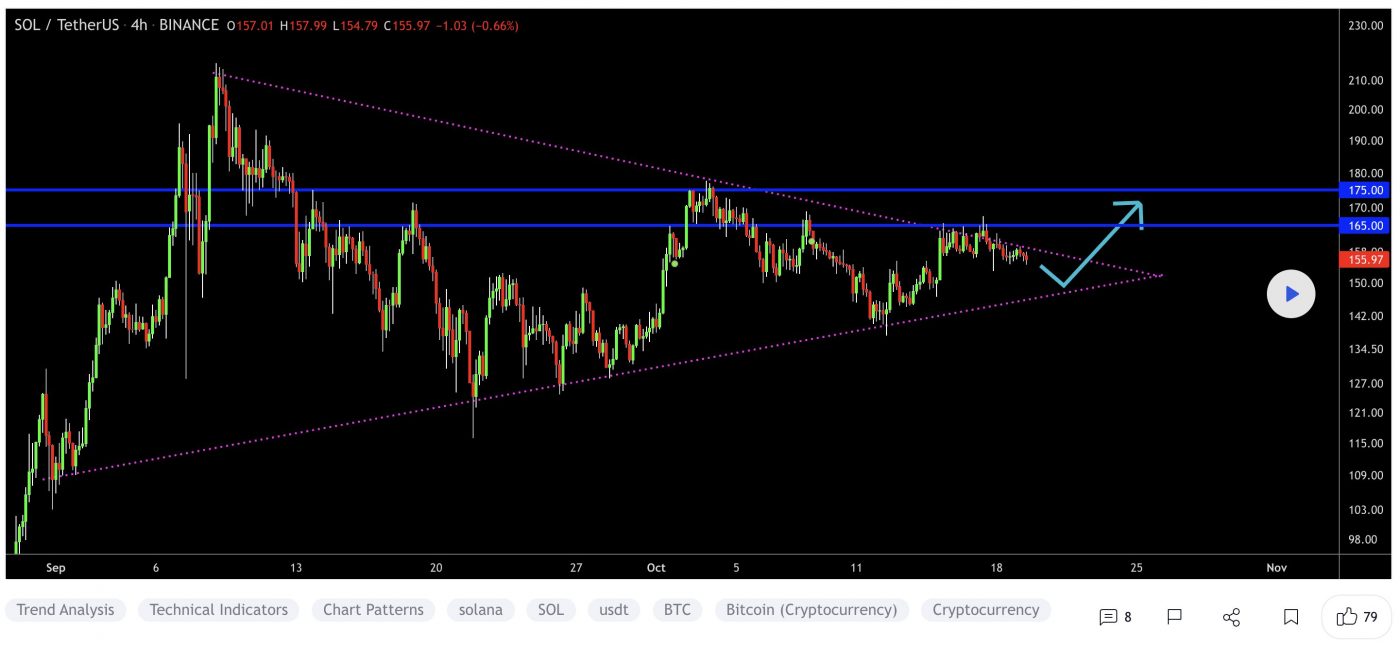

ICX Price Analysis

At the time of writing, ICX is ranked the 80th cryptocurrency globally and the current price is A$3.04. Let’s take a look at the chart below for price analysis:

ICX‘s 300% climb from its June low has continued grinding upward at a steady pace.

At the current price, near the local range’s high, A$3.05 could support a move toward all-time highs. If the price dips, an area near the range low and 9, 18, and 40 EMAs could provide a better risk-to-reward entry for bulls. The Mainnet 2.0 Launch on Thursday could be the catalyst by causing some investors to take profits, prompting a retracement.

Like COTI, a more significant bearish shift in BTC could send the price down to a larger range’s lows near A$2.34 and possibly as far as A$2.07. This area saw a strong reaction in October 27’s retracement.

Bulls will likely take some profits near the highs at A$3.98, but the price could continue well beyond the highs. The final target is impossible to predict, but extensions from early 2021’s significant move and the current range suggest that bulls might take more profits near A$5.31 and A$5.98.

3. Secret (SCRT)

Secret SCRT is the native coin of the Secret Network, a decentralised network for private/secure computation. Nodes on the network (known as secret nodes) can perform generalisable computations over encrypted data, which allows smart contracts (known as secret contracts) to use private and sensitive data as inputs. Our focus is on computational privacy, not just transactional privacy. Developers can build decentralised, privacy-preserving “Secret Apps” on the network. The privacy functionality of the Secret Network is critical for many fields, including decentralised finance, Web3, machine learning, access control, and many more.

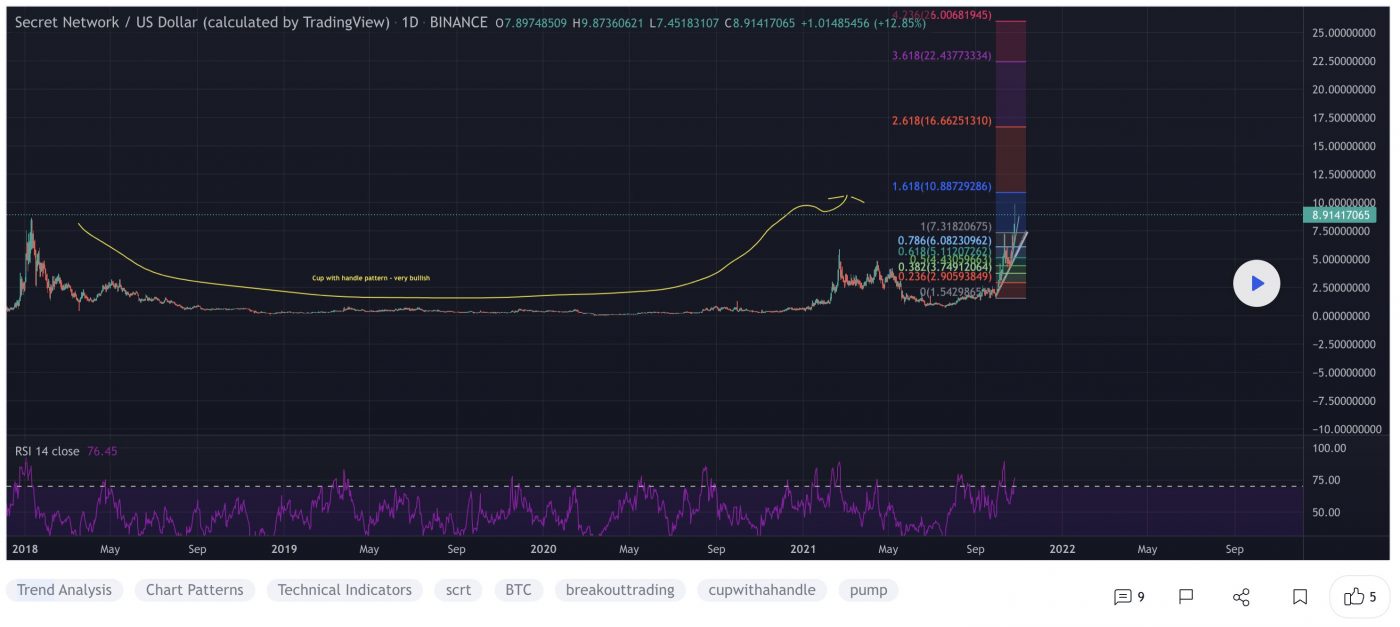

SCRT Price Analysis

At the time of writing, SCR is ranked the 86th cryptocurrency globally and the current price is A$12.05. Let’s take a look at the chart below for price analysis:

SCRT‘s stunning 1,344% move from its July low could have more room to run. However, the price is distancing itself from quality higher-timeframe support.

Near the current price, A$12.03 could give resistance before any next leg up as bulls bid near the 9 EMA. However, the consolidation under the last swing high near A$9.29 and the 61.8% retracement is a better candidate for robust support. The Shade Protocol snapshots, which start this Sunday, could help support the price hold this range by encouraging investors not to sell.

Closer to the 78.6% retracement, just under the 40 EMA, and near the last impulse’s range low, A$7.80 could provide more substantial support for another significant swing.

Price is currently finding resistance near an extension from 2018’s bull run. If the bulls flip this level, extensions on 2021’s move suggest that they might take their next profits near A$15.67 and A$17.27.

Where to Buy or Trade Altcoins?

These 3 Altcoins have the highest liquidity on Binance Exchange so that would help for trading on USDT or BTC pairs. However, if you’re just looking at buying some quick and HODLing, then Swyftx Exchange is a popular choice in Australia.