The publishers of Rolling Stone Australia will release the magazine’s first non-fungible token (NFT) cover this week, with homegrown Australian pop superstar Tones and I as its subject.

Timed to coincide with the release of the No 1-selling artist’s debut album, Welcome To The Madhouse, the NFT cover is a limited release priced at A$230 each and available from 12 noon AEST on Friday, July 16, closing 24 hours later.

The first 350 bundles sold will also include a physical copy of Rolling Stone Australia’s debut (and sold out) issue signed and numbered by Tones And I, and an exclusive cassette copy of Welcome To The Madhouse.

It’s an absolute honour to be the first artist in the world to have a Rolling Stone Australia magazine cover released as an NFT.

Tones and I (aka Toni Watson)

Tones and I’s breakout single, Dance Monkey, was released in May 2019 and reached No 1 in more than 30 countries.

On a Mission to Support Australian Artists

Luke Girgis, CEO of Rolling Stone Australia‘s publishing company, Brag Media, said the NFT release presents a groundbreaking opportunity to further the company’s mission in supporting Australian artists.

By minting an exclusive NFT of this cover to celebrate the issue and create a one-of-a-kind collectible for the NFT community, we also have an opportunity to – hopefully – help Tones And I achieve the first-ever No 1 ARIA album sold as a NFT on our new store.

Luke Girgis, CEO, Brag Media

Brag Media chose Origin, an NFT platform using Ethereum blockchain technology, to power its new store. Co-founder Matthew Liu said of the partnership:

NFTs enable creators to engage and interact with fans and collectors at a new, deeper level. This launch is another example of traditional media and music converging with the best of blockchain technology.

Matthew Liu, Origin co-founder

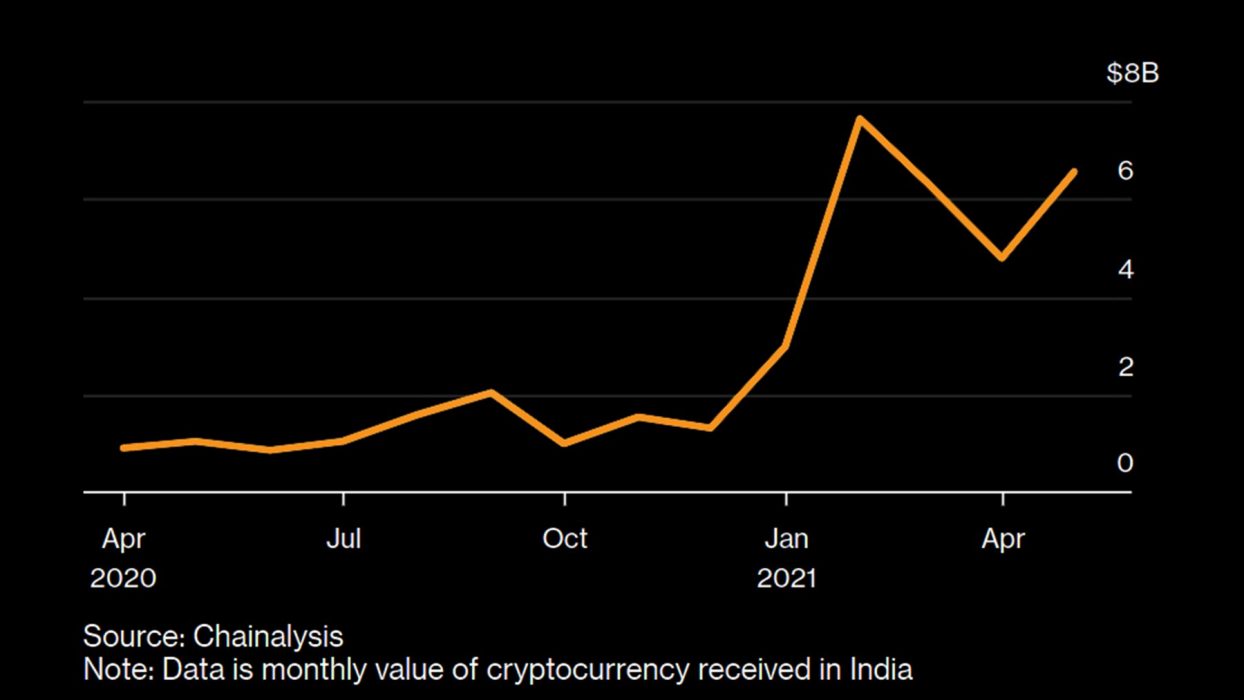

Australia Becoming an NFT Innovator

Last month, Binance NFT Marketplace announced its ‘100 Creators’ campaign, which aims to support and promote innovative creators from around the world and spotlight NFT collectibles from different cultural backgrounds.

Also last month, Australian multimedia artist Dave Court became the first in his field to stage a physical NFT exhibition, and one of the first in the southern hemisphere.