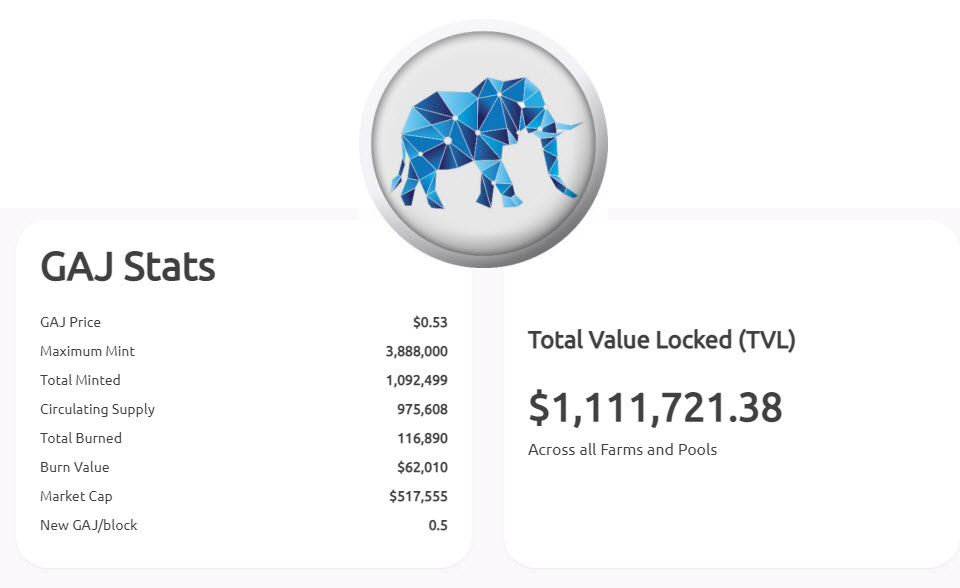

Gajesh Naik designed a Decentralised Finance (DeFi) protocol that now manages around US$1 million in cryptocurrency – and he’s only 13 years old.

Gajesh, a schoolboy from Goa, India, is the chief architect and developer of PolyGaj – a DeFi protocol built on the Polygon blockchain. Last month PolyGaj was actually managing almost US$7 million, all under Gajesh’s entrepreneurial stewardship.

DeFi technology has been growing fast after emerging last year, with US$58 million locked into DeFi protocols. It is also gaining a keen following with billionaire Mark Cuban Calls DeFi The Start Of Personal Banking.

How Gajesh Cracked the DeFi Code

When you entrust your money to a DeFi protocol, you’re diverting it into a series of smart contracts – essentially code that dictates how your funds are invested. So how did Gajesh come up with that code?

I had the basic math skills, like addition, subtraction. Then I started learning all the programming languages.

Gajesh Naik

Those languages – Gajesh knows C, C++, Java, JavaScript and Solidity, the language used to write Ethereum-based smart contracts – were learned at a boot camp he attended five years ago, using a drag-and-drop tutorial program called Scratch. He was eight years old at the time.

Gajesh’s father, Siddhivinayak, a public servant with a degree in computer science, encouraged his son all the way.

Once the COVID threat in India eases, Gajesh hopes to devote “four to five hours” to schoolwork while continuing to work on PolyGaj.

Asked whether someone his age should be handling such large amounts of money, Gajesh has a simple answer: “Age is just a number.”

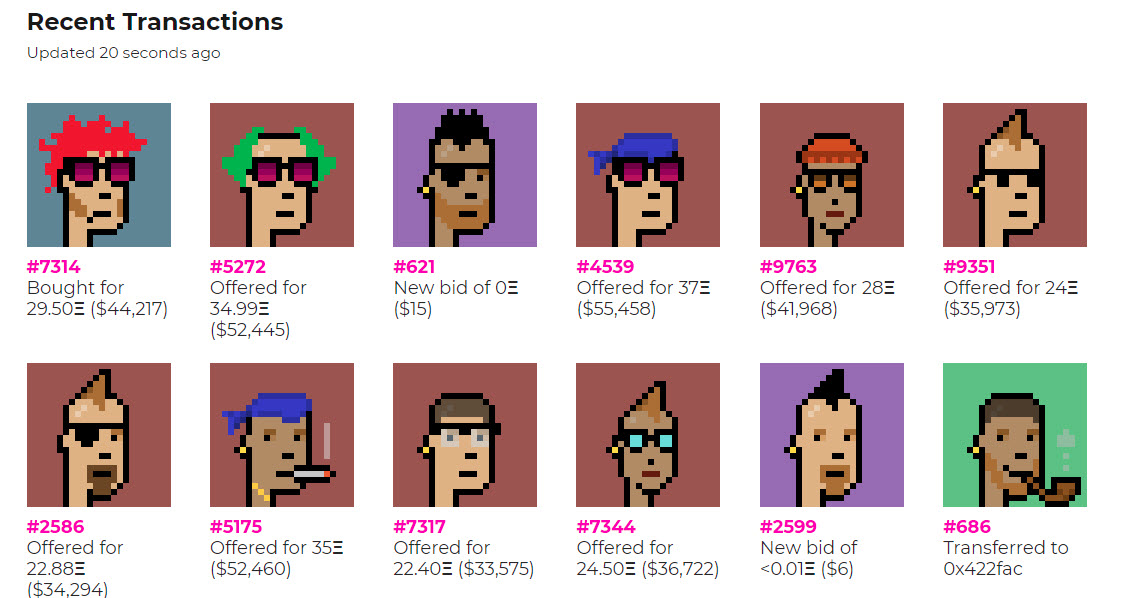

The project has a roadmap with plans to add new features, and has just launched an NFT marketplace. You can view the code on Github.

Other Crypto Superstars

Gajesh isn’t the first to achieve superstar status in the crypto world; earlier this year we saw a hardware hacker modify an old-school Game Boy to mine Bitcoin.

We also saw an Aussie programmer refinance his property using DeFi through crypto loans, which operates outside of the current banking system.