One of the leading non-fungible token (NFT) scaling platforms, Australian blockchain startup Immutable X, has partnered with retail game giant GameStop to create its new NFT marketplace, as well as a US$100 million fund to support innovation in the NFT space and its creators.

GameStop will be using the Immutable X Layer 2 solution for its speed, zero gas fees, and 100 percent carbon neutral technology to move the company into the nascent NFT sector.

Pursuant to the February 2 announcement, the two companies will also be launching a US$100 million joint fund to empower game developers in the creation of their latest NFT projects. The fund will be used for grants to help creators of NFT content and technology. But individuals who want to build or are building an NFT game project can submit proposals here for a chance to be among the first to build on the new platform.

Gaming Industry Slowly Adopting NFTs

Co-founder of Immutable Robbie Ferguson stated that it wants to change the gaming landscape by “bringing the age of digital ownership to billions of players worldwide […] one that rewards players rather than extract value from them”. GameStop plans to be a catalyst for this by having its marketplace bring “billions of low-cost, in-game assets that can easily be bought and sold” to its 50 million+ users.

Some in the gaming space are of the opinion that the evolution of the industry will be toward players owning their in-game assets. Avid gamers will be able to monetise their time in-game and have more to show than just hundreds of hours and cosmetics that gather virtual dust. On the other side of the coin, many gamers are pushing back against integrating NFTs with games, seeing it as just another cash grab from corporates.

In correspondence with tech website VentureBeat, Ferguson stated that “the best thing to do is to create truly player-first gaming experiences that embrace the benefits, rather than the hype, of NFTs. Most importantly, the games have to be good – it’s play-and-earn, not play-to-earn.”

Immutable X has been busy carving out a name for itself in the gaming industry, having recently signed a deal with ESL Gaming to provide NFTs of its Counter-Strike global tour as well as raising US$60 million in its series B funding round.

NFTs Starting the Year With a Bang

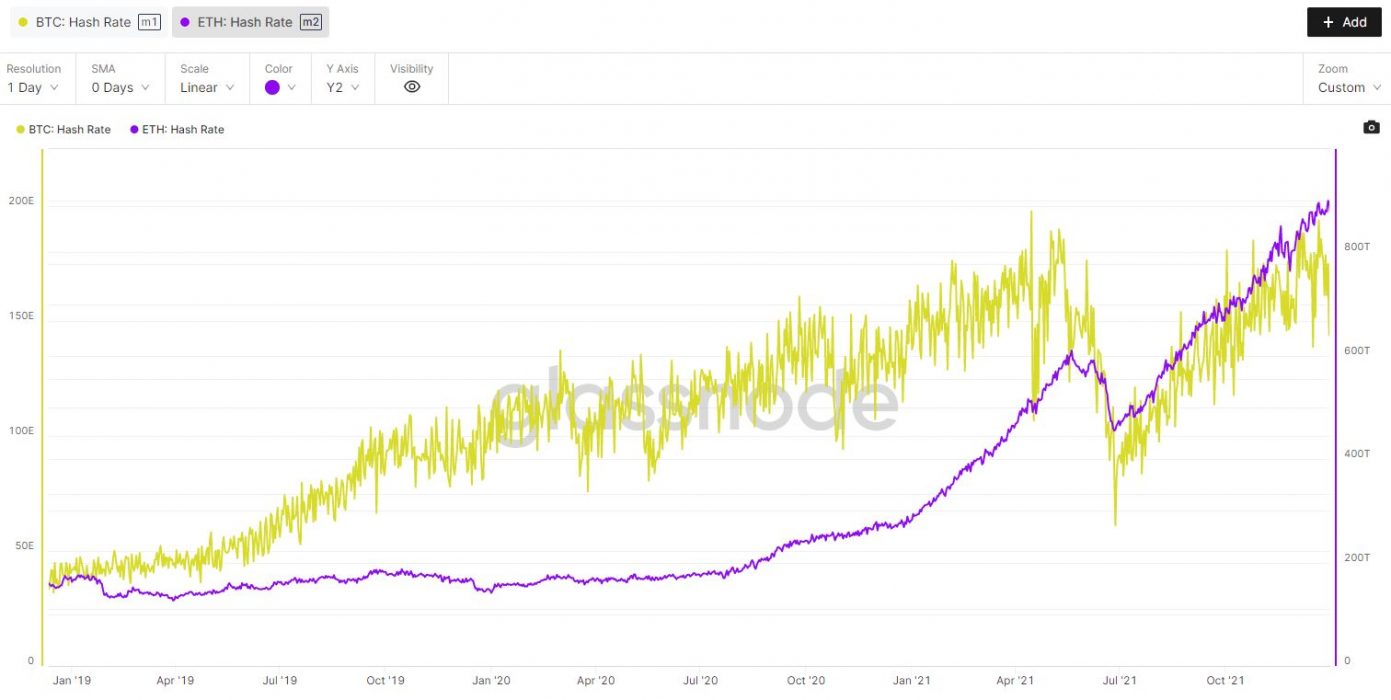

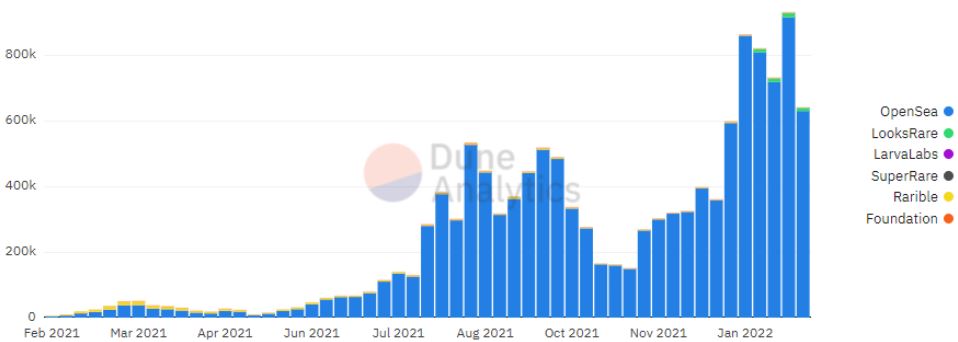

NFTs have performed considerably better than cryptocurrencies this past month, with transaction volume gaining a steady increase.

As more major names start joining the NFT space, it looks quite promising that NFTs will soon become part of gaming culture.